Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 5,345.7 Million |

| 2030 Forecast | USD 7,439.6 Million |

| Growth Rate (CAGR) | 5.7% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Report Code: 12697

Get a Comprehensive Overview of the Compressor Rental Market Report Prepared by P&S Intelligence, Segmented by Type (Rotatory Screw, Reciprocating), Drive Type (Engine-Driven, Gas-Driven, Hydraulically Driven, Electrically Driven), Industry (Construction, Mining, Oil & Gas, Power, Manufacturing, Chemical), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 5,345.7 Million |

| 2030 Forecast | USD 7,439.6 Million |

| Growth Rate (CAGR) | 5.7% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global compressor rental market revenue was USD 5,345.7 million in 2024, which is expected to reach USD 7,439.6 million by 2030, growing at a CAGR of 5.7% during 2024–2030.

This growth is due to the widespread application of compressors in multiple industries, such as aerospace, automotive, manufacturing, and construction. There has also been an increasing demand for energy-efficient compressors, which rental companies are trying hard to leverage.

A compressor is a piece of equipment used to compress and supply air in an enclosed unit at the required pressure levels. This machine is used in various industries, such as refrigeration & air conditioning, power generation, food & beverage, medical devices & healthcare, and automotive. The demand for compressor rental services is increasing as requirement from these industries is rising to perform processes and operations seamlessly.

There has been an increasing demand specifically from the refrigeration & air conditioning industry as a result of the surging population and heat levels globally. Moreover, with the rising disposable incomes, people are leaning toward more-comfortable ways of living, which, in turn, add up to the demand for ACs and refrigerators, thus leading to a rising sale of compressors.

Moreover, the surging demand for new-generation rental air service is likely to propel the growth of the compressor rental industry during the prediction period. Compressors are utilized to a large extent in multiple industries to supply high-pressure air to jackhammers and pneumatic tools. For instance, oil & gas demand is surging globally, thus creating strong pressure on producers to augment extraction and refining outputs. This industry heavily employs compressors in gas processing, natural gas transmission, and oil refining operations.

The mining sector also has a significant demand for rental compressors as they are used in hydraulic shovels, continuous machines, and cable shovels. The demand for gold, silver, platinum, iron, copper, aluminum, and coal will be forever on the rise, thus leading to a strong need for compressors all around the world.

Further, construction activities are on the rise due to the increasing population and ongoing infrastructure development projects, especially in emerging economies. Compressor are used to a wide extent here for powering equipment such as jackhammers and pneumatic drills. In addition, pressurized air is important in spraying paints and coatings in multiple industries.

Thus, many users are renting customized compressors as a result of their reduced operational costs and advantages. Renting compressors ensures flexibility in choosing the perfect one for the desired applications. It also helps in optimizing the maintenance costs of the existing compressors, by lowering the seasonal peak demand. In this regard, the significant investments in refineries and construction & infrastructure activities will aid the growth of the market for rental compressors.

Customization of Rental Services and Innovations in Compressors Drive Growth

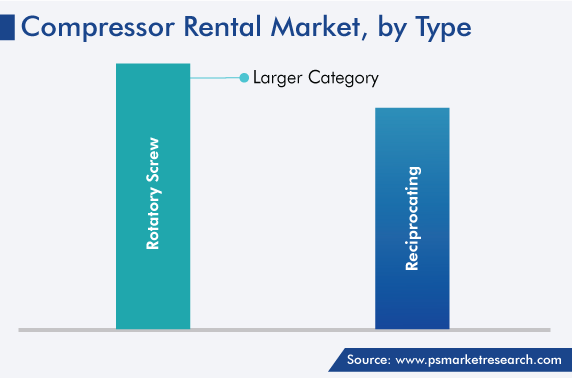

The rotary screw category leads the type segment of the compressor rental market with a 2023 share of 60%, and it is set to continue on the same path during the prediction period.

This domination is due to these variants’ higher efficiency, as they have a more-continuous flow of compressed air, which results in a reduced energy loss. They also have a longer service life owing to the presence of fewer moving parts, which results in less wear and tear. Additionally, these variants have quieter operations than other variants, thus making them ideal for sensitive environments. Another among their major advantages is oil-free operation, which makes them perfect for applications where oil-free air is needed, such as in the food & beverage industry.

Moreover, the reciprocating category held a significant share as these alternatives are widely used in small enterprises and are compatible with single-phase or three-phase AC. They are particularly used where air is either not needed continuously or needed in not-too-high volumes. They also have lower maintenance costs than their rotary screw counterpart, as well as the potential to offer high pressure and high power. Moreover, they can be operated near the point of use, thus eliminating the need for lengthy piping. Further, they are durable, affordable, efficient, and long-lasting.

The construction category accounted for the largest market share in the end user segment, of 25%, in 2023, and it is predicted to maintain its position during the forecast period.

The forever-growing construction industry uses compressed air to a great extent for powering pneumatic tools, such as jackhammers, nail guns, impact wrenches, and air drills. These tools are dependent on compressed air to provide the apt force and perform tasks efficiently. Compressors also play an important role in concrete spraying equipment by providing pressurized air to propel the concrete mix on to surfaces. This helps in a uniform concrete application for building walls, lining tunnels, or repairing structures.

Moreover, the industrial sector holds a significant share in the market for rental compressors, because these machines are extensively used in a variety of industrial processes. Most important, they provide compressed refrigerant for air conditioners and ventilation systems, thus keeping industrial facilities cool and comfortable, while removing dust and pollutants as well.

Additionally, a variety of tools used in industrial production are powered by air compressors, such as pneumatic tools, air welders, and paint sprayers. Further, oil & gas demand is forever rising as a result of the population expansion and increasing automobile sales. This, in turn, boosts the demand for compressors as they are used to pressurize natural gas and oil in order to facilitate transportation and storage.

Drive strategic growth with comprehensive market analysis

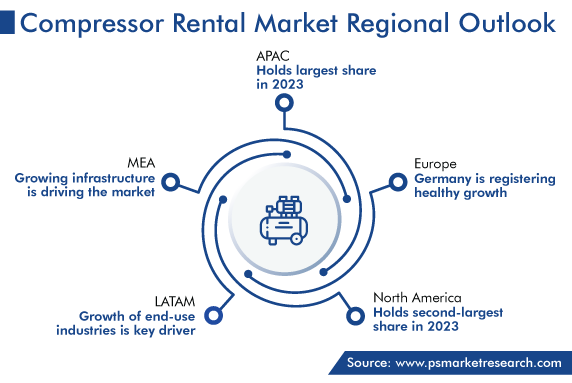

In 2023, the APAC region held the largest market share in the compressor rental market, of 55%, and it is expected to continue being dominant during the prediction period.

This is due to the presence of many growing economies in the region, as well as of rental companies providing advanced models with features such as remote monitoring, predictive maintenance, and real-time data analytics. Additionally, corporations are going for compressor rentals because of the enhanced performance, reduced downtime, and higher energy efficiency of the newer models.

Further, governments of many nations have implemented initiatives and regulations to hasten the expansion of industry, achieve environmental sustainability, and boost the rate of infrastructure development. This creates a high demand for next-generation compressors, which are energy-efficient and quieter, thus reducing energy wastage and noise pollution, respectively.

Moreover, Germany, in the European region, is registering a healthy market growth rate, owing to its growing automotive industry, characterized by the presence of a large number of plants and assembly lines. This sector employs compressors in a variety of applications, such as powering pneumatic tools, operating production machinery, and facilitating compressed air for testing, painting, and cleaning processes. With the continuous expansion of the automotive industry, the need for air compressors will rise dramatically, thus leading to the need for rentals to a great extent.

This report offers deep insights into the compressor rental industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Type

Based on Drive Type

Based on Industry

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages