Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2,671.9 Million |

| 2030 Forecast | USD 4,974 Million |

| Growth Rate(CAGR) | 10.9% |

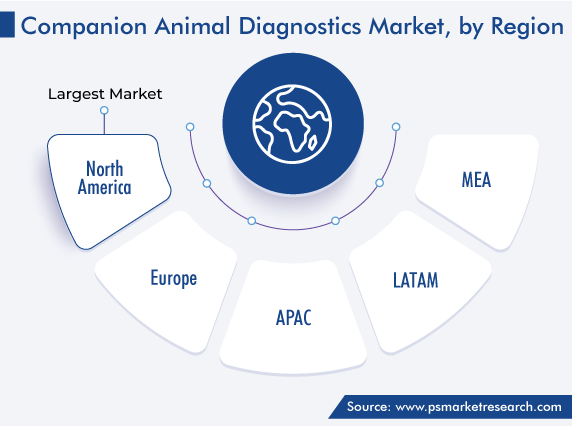

| Largest Region | North America |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Report Code: 12550

Get a Comprehensive Overview of the Companion Animal Diagnostics Market Report Prepared by P&S Intelligence, Segmented by Technology (Immunodiagnostics, Clinical Biochemistry, Hematology, Urinalysis, Molecular Diagnostics), Animal Type (Dog, Cat), Application (Clinical Pathology, Bacteriology, Virology, Parasitology), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2,671.9 Million |

| 2030 Forecast | USD 4,974 Million |

| Growth Rate(CAGR) | 10.9% |

| Largest Region | North America |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The companion animal diagnostics market size stood at USD 2,671.9 million in 2024, and it is expected to grow at a compound annual growth rate of 10.9% during 2024–2030, to reach USD 4,974 million by 2030. This is due to the increasing number of animals being adopted as pets globally and the surging appeal of pet owners to consider pets as family members leading to the global trend of pet parenting. In regions like North America and Europe, pets are being adopted as a companion for older people. Moreover, with the rising awareness of pets’ health and the improving quality of treatments and therapies for animals, the demand for pet diagnostics is expanding at a significant rate.

In addition, the longer lifespan of companion animals is also one of the key factors driving the market. According to the Federation of European Companion Animal Veterinary Associations, the life expectancy of pets is changing and they are living longer and healthier lives than a decade before. With aging, there is an increase in new and unique health needs. Risks of health problems like liver disease, cancer, senility, and joint disease increase with age. To counter these risks, the need for animal diagnostics is rising.

Furthermore, with the surge in the adoption of advanced technologies like big data and machine learning, and portable instruments for point-of-care (POC) services, the diagnostic records of millions of animals can be analyzed to identify the beginning of chronic illnesses and animal diagnostics is improving. Also, the rising awareness among pet owners toward their pet health has resulted in a regular diagnosis of glucose levels, thus increasing the demand for glucose monitors.

There are various organizations around the world that are working toward animal health and welfare. They are promoting and setting health standards for animals, which are to be followed. For instance, the World Organization for Animal Health (WOAH) provides guidance on a wide range of aspects related to disease prevention and control, animal welfare, and veterinary public health. It also aims to make animal health services better to deal with the existing challenges. Additionally, there are various tools that are being used by these organizations to evaluate the performance of veterinary services against the WOAH international standards. With increasing standards for animal healthcare, the demand for diagnostics is rising as well.

“One health” is also one of the approaches, which summarizes that human, animal, and plant health is interdependent and bound to improve the health of the ecosystems in which they exist. This approach guarantees control of priority zoonotic diseases such as rabies, avian flu, viral hemorrhagic fevers such as Ebola, and numerous cross-cutting issues such as antimicrobial resistance, food safety, climate change, and weak healthcare infrastructure. These can only be done with the support of proper diagnostic systems in the world. Therefore, investments in diagnostics will increase in the coming future.

Drive strategic growth with comprehensive market analysis

North America is the largest market for animal diagnostics, accounting for a revenue share of 41% in 2022, and it is also projected to witness the fastest growth in the forecasted period. This is due to the growing population of companion animals, especially in the U.S.; the surging pet insurance; and the rising health expenditure on pets in the region. For instance, according to the American Pet Products Association (APPA), in the U.S., around 70% of households owned a pet, as of 2021.

In addition, the APAC companion animal diagnostics market will also grow significantly in the coming years and provide opportunities for players, due to the rising prevalence of various zoonotic diseases, the increasing awareness about animal health, and the surging income levels. Many initiatives are being taken by governments of developing countries for fighting disease outbreaks in animals. Also, players expanding in the region are going to witness profitable gains and will strengthen their position in the industry in the long run.

Based on Technology

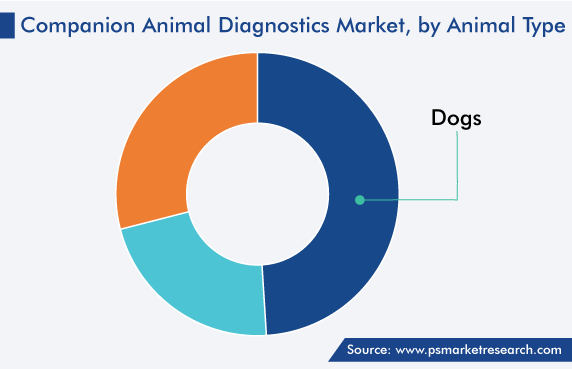

Based on Animal Type

Based on Application

Geographical Analysis

The companion animal diagnostics market size stood at USD 2,671.9 million in 2024.

During 2024–2030, the growth rate of the companion animal diagnostics market will be around 10.9%.

Dog is the largest animal type in the companion animal diagnostics market.

The major drivers of the companion animal diagnostics market include the increasing population of pet animals, the rising awareness of pets’ health, and the improving quality of treatments and therapies for animals.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages