Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 24.9 Billion |

| 2030 Forecast | USD 50.8 Billion |

| Growth Rate(CAGR) | 12.5% |

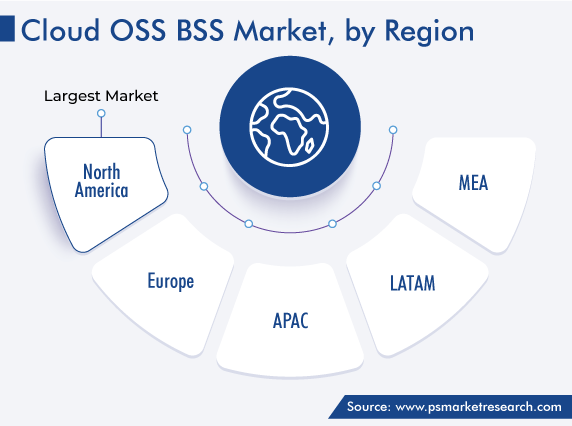

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12600

Get a Comprehensive Overview of the Cloud OSS BSS Market Report Prepared by P&S Intelligence, Segmented by Component (Solution, Service), Enterprise (Large, SME), Cloud (Public, Private, Hybrid), Industry Vertical (IT and Telecom, BFSI, Healthcare and Life science, Consumer Good and Retail, Manufacturing, Media and Entertainment), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 24.9 Billion |

| 2030 Forecast | USD 50.8 Billion |

| Growth Rate(CAGR) | 12.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

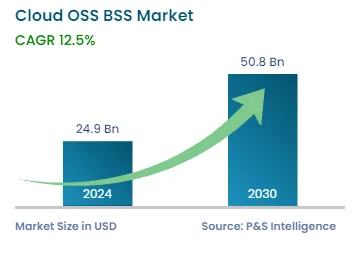

The cloud OSS BSS market size stood at USD 24.9 billion in 2024, and it is expected to grow at a compound annual growth rate of 12.5% during 2024–2030, to reach USD 50.8 billion by 2030. This is due to the rising need to reduce CAPEX, the increasing demand for convergent billing systems, the mounting deployment of revenue management systems (RMSs), and the surging adoption of 5G technology.

Moreover, these solutions help organizations to create different and personalized customer experiences, as these are important for increasing revenues, profitability, and customer retention. BSS solutions include telecommunications billing and client relationship management; whereas, OSS solutions include order management, network operations, and network inventory management. Additionally, the OSS solutions that are deployed over the cloud in a software-as-a-service (SaaS) model provide different service providers with a blend of business flexibility and technology at a low cost.

During the COVID-19 pandemic, the cloud OSS BSS industry saw growth in investments related to technological advancements and expansion of operations. This opened the door to new opportunities and made it easier for new players to enter the market. In addition, the integration of service charges into a single invoice increased the demand for convergent billing tools, which, in turn, contributed to the demand for such solutions during the pandemic situation.

The IT and telecom category is predicted to expand at the highest rate, of around 13%, over the forecast period. Telecom service providers can monetize their businesses with the help of cloud OSS BSS solutions. The end-to-end business and operational functions such as management of network performance, inventory, fault and billing issues, new product delivery, and customer experience can be optimized and monitored using end-to-end cloud solutions.

With the application of new technology advancements such as IP-based multimedia systems, cloud OSS BSS have emerged as key elements of an operator’s network, which will make the market grow in the coming years.

The increasing demand for cloud and M2M technologies for supporting services is driving the growth of the industry. The rise in the number of mobile customers leads to high demand for such technologies, which makes the network more flexible and diversifiable. To increase the level of customer satisfaction and assuring high-quality services, the telecom sector generates high demand for cloud OSS BSS solutions.

In addition, these solutions are being used by telecom operators for managing companies’ operations to improve customer satisfaction. An increase in the deployment of remote working norms and distant learning policies that have made a high need to install more internet connections, which are dependent on the telecom sector. Moreover, the increasing foreign direct investment (FDI) in the telecom sector drives the cloud OSS BSS market growth. For instance, the FDI cap in the industry had increased from 74% to 100% in India. In October 2021, the Indian government informed about 100% FDI via the automatic route in the sector.

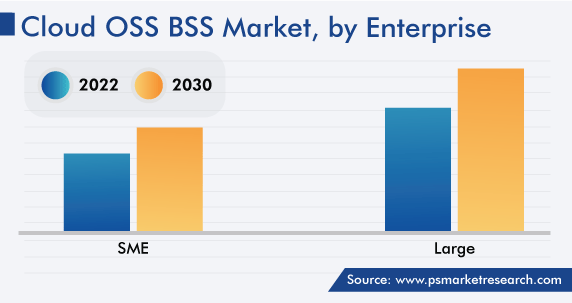

The small and medium enterprise category is predicted to expand at the highest rate, of around 12.3%, over the projection timeframe. Small and medium-sized enterprises (SMEs) play very important roles in every community. According to a research article, around 400 million SMEs are operating across the globe, which have accounted for 99% of global organizations. SMEs are creating a lot of job opportunities, making up 60–85% of employment. According to the International Labor Organization, SMEs contribute up to 70% of the world’s GDP.

SMEs widely adopted cloud OSS BSS solutions to increase the skills and knowledge of entrepreneurs and improve operational productivity. Also, more than two-thirds of SMEs have planned to increase their IT budgets and prioritize investments in the upcoming years.

The public cloud category is predicted to expand at the highest rate, of around 12.6%, in the coming years. This can be because the public cloud has the property of scalability, and it is infinitely scalable according to the needs of individual enterprises, telecom operators, and government organizations. For this, companies need to pay for the server capacity, which is needed currently, and if the future needs for services increase or decrease, application hosting costs will rise or fall accordingly.

Whereas, requests for server infrastructure are needed in advance for an on-premises deployment of OSS solutions. Using the public cloud, the resources can be made instantly available for smooth operations. This also makes faster deployments of new IT solutions, which enables new services to be applied more quickly. For operators, the public cloud is also cheaper than hosting OSS solutions in their private systems.

Moreover, factors such as flexibility, high speed, and low cost have strengthened the demand for the public cloud. Also, the huge CAPEX involved in setting up infrastructure increases the usage of the public cloud, which makes operators look for a lower total cost of ownership.

Drive strategic growth with comprehensive market analysis

North America accounts for the largest market share. This is ascribed to the presence of major industry players and the rise in digital businesses and systems in the region. Moreover, with the surging need to achieve operational efficiency and huge competition among service providers, telecom operators are more focused on the monetization of mobile broadband data services. This factor drives the demand for cloud OSS BSS solutions in the U.S. and Canada.

Whereas, APAC is seeing an exponential demand for these solutions, with the rise in the number of telecom service users, especially in densely populated countries such as India and China, which are also the major markets for mobile phones. Moreover, cloud-based OSS BSS solutions help operators to provide a better customer experience and to look beyond connectivity, as they provide significant customer benefits such as increased conductivity, reduced costs, and automated business processes.

In addition, the growing trend of rapid economic development, network ecosystem, development, FDI, and adoption of smartphones is expected to contribute to the growth of the regional cloud OSS BSS market.

The other important reasons for the high growth rate in the APAC market include the increased spending on IT infrastructure and the growing population, which have resulted in a large customer base for telecom companies. Also, the new mandatory government regulations and the emergence of a wide range of affordable cloud services are together helping in expanding the demand for cloud OSS BSS solutions in the region.

Based on Component

Based on Enterprise

Based on Cloud

Based on Industry Vertical

Geographical Analysis

The cloud OSS BSS market size stood at USD 24.9 billion in 2024.

During 2024–2030, the growth rate of the cloud OSS BSS market will be around 12.5%.

IT and Telecom is the largest industry vertical in the cloud OSS BSS market.

The major drivers of the cloud OSS BSS market include the rising adoption of cloud solutions across different sectors, the increasing deployment of 5G networks, and the surging need for convergent billing systems.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages