Market Statistics

| Study Period | 2019 - 2030 |

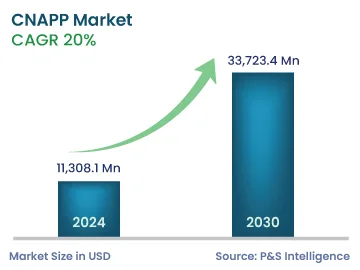

| 2024 Market Size | 11,308.1 Million |

| 2030 Forecast | 33,723.4 Million |

| Growth Rate(CAGR) | 20% |

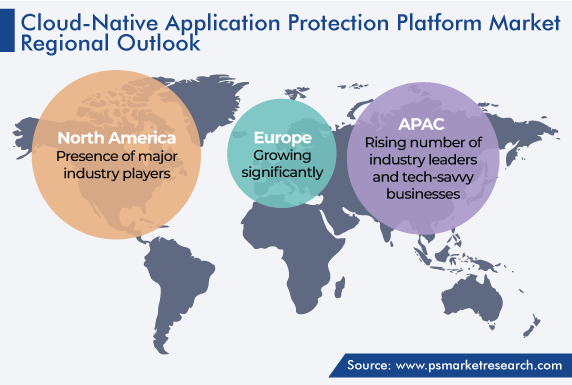

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12765

Get a Comprehensive Overview of the CNAPP Market Report Prepared by P&S Intelligence, Segmented by Offering (Platforms, Professional Services), Cloud Type (Public, Private), Vertical (Retail and Ecommerce, BFSI, IT and Telecommunications, Healthcare and Life Sciences, Energy and Utilities), Enterprise Size (Large Enterprises, SMEs), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 11,308.1 Million |

| 2030 Forecast | 33,723.4 Million |

| Growth Rate(CAGR) | 20% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global cloud-native application protection platform market size stood at USD 11,308.1 million in 2024, and it is projected to reach USD 33,723.4 million by 2030, advancing at a growth rate of 20.0% during 2024–2030. This is attributed to the increasing usage of cloud-based servers and the rising number of cyberattacks across industries, which have influenced organizations to take proactive measures and provide protection to their data and infrastructure in public, private, and hybrid cloud environments.

Cloud-native application protection platform (CNAPP) is a developing cloud security platform that streamlines cloud security by integrating the capabilities of tools, such as cloud security posture management (CSPM), cloud service network security (CSNS), and cloud workload protection platform (CWPP), in a single holistic platform. These platforms allow enterprises leveraging multi-cloud to subscribe to third-party security vendors, which would provide a consolidated view into cloud environments.

Adoption of BYOD and Rising Security Threats Drive the Industry

Unmanaged devices brought by company employees to workplaces are typically associated with BYOD. As per reports, over 80% of corporations have actively enabled BYOD, to a certain extent. With the growing remote work environments, challenges associated with managing these mobile devices have grown significantly, concerning their safety. Common risks faced by an enterprise are cloud workloads, containers, Kubernetes (K8s) clusters, and misconfigurations of secrets. The adoption of CNAPP will have incredible benefits to counter these threats. The system allows organizations to provide tighter controls and proactively scan, detect, and quickly remediate vulnerable systems and compliance risks due to misconfigurations.

Traditional security measures adopted by companies are intended for “castle-and-moat” networks and are not ideal for modern corporations. Despite well-defined features, the requirement for safety and protection across private and public clouds has become essential. By integrating CI/CD pipelines, CNAPP has been built with an up-to-date “cloud-native” structure, containing serverless security and containers as per business demands.

The capability to contextualize data and create end-to-end visibility across an organization’s application infrastructure sets CNAPP apart from the others. It can prioritize alerts that potentially could pose a risk to an enterprise with an encrypted system for visibility and granular detail on technology stacks, configurations, and identities. Thus, this factor boosts the cloud-native application protection platform market demand.

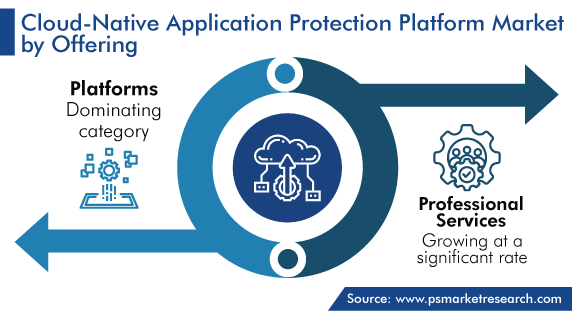

The platform category dominates the market. This is ascribed to the surging demand for all-in-one native systems working across applications to simplify monitoring, detecting, and acting for cloud environments and workloads; accelerate threat hunting; and check for vulnerabilities. Applications for reducing mean time to respond, helping development, security, and operation (DevSecOp) teams, addressing runtime threats, escalating major safety issues, and enabling threat hunting further help in propagating the demand for CNAPP.

Moreover, the platform provides a simplified protection and compliance tool, to reduce misconfigurations, mismanagement, and vulnerabilities of cloud-native applications. It can provide a bi-directional link and operation visibility and insight into risk analysis to improve the overall enterprise security posture. The CNAPP allows the requisite department to understand paths based on relationships concerning dangers, vulnerabilities, and misconfigurations, which would enable an attacker to target an application. It also helps reduce the number of vendors and tools involved in the continuous integration and continuous deployment (CI/CD) pipeline.

The professional services category is projected to have a modest share in the form of storage in the market. This is because, apart from the platform, an additional benefit of the professional services is that agent-based solutions enable pre-runtime and runtime protection, as compared to agent-less solutions that only offer partial visibility and lack remediation capabilities. Also, these services provide organizations with comprehensive visibility, detection, and remediation proficiencies to secure their cloud infrastructure.

The BFSI category accounted for the largest revenue share, of 35%, in the CNAPP market in 2023, and it is projected to maintain its dominance in the coming years as well. This is because cloud computing and its native architecture and models infuse BFSI business agility.

Moreover, cloud computing provides a competitive edge, facilitates innovation, and reduces costs for enterprises, and it is a critical element of the digital revolution, transforming the BFSI industry. In addition, the ease of adopting open banking, the ability to provide personalized products, and leveraging of cloud cognitive services make it the stellar choice for replacing various independent tools with a single holistic security solution. The automated disaster recovery capability will further drive the demand for the technology in the industry.

The BFSI industry faces multiple safety concerns with regard to country-specific regulations, legacy architecture, and complex transitions for enterprises moving from on-premise to adopting cloud migration technologies. Also, financial institutions are focused on improving the scalability and quick provisioning of their operations. Fintech embraces the cloud and its pioneering capabilities as its related services are way more affordable than traditional on-premise systems. It not only allows organizations to store data but also provides multiple other features such as pay-per-use pricing, measuring cloud service, broad network access, and resource pooling.

Furthermore, the deployment of CNAPP provides increased flexibility in the industry. The financial institutions need to be compliant with several data protection laws and regulations, such as the Payment Card Industry Data Security Standard (PCI DSS) and The Personal Information Protection and Electronic Documents Act (PIPEDA), to operate efficiently in their respective areas and get benefits of the system in saving infrastructure and license costs. Thus, these factors are expected to proliferate the adoption of CNAPP in the BFSI sector.

In 2023, the large enterprise category accounted for the largest market share. The rising number of data theft and cyber fraud cases post-COVID-19 has increased. This has led to the rise in the adoption of CNAPP by large enterprises and also among SMEs to enhance safety measures and combat future attacks. The accelerated trend in the adoption of work-from-home and BYOD is further expected to propagate the demand for cloud-based solutions in the forecast period.

Data is a crucial resource for the success of modern businesses and helps them improve their operations. With more businesses moving online and incorporating the e-commerce model, commercial data consisting of customer requirements, complaints, and business operations becomes an integral part to help reform businesses and leverage the insights gathered. Multiple benefits of the cloud such as storing capabilities, low maintenance, and high flexibility and other benefits make it an obvious choice for big companies to shift their capabilities online

Drive strategic growth with comprehensive market analysis

In 2023, the North American market accounted for the largest revenue, of USD 5.2 billion, and it is also likely to witness high growth in the coming years. This is ascribed to the presence of major industry players and strict regulations, the surging innovations in this field, and the world's dominant tech epicenter. Also, it is home to some of the biggest tech firms containing the sensitive information of millions, which are at the forefront of using CNAPP.

Some other major factors fueling the CNAPP market growth are the rising cases of payment security concerns and data breaches and the increasing payment regulatory compliances in the region. For instance, in 2021, the most reported incidents and complaints were for ransomware, business email compromise, and cases involving cryptocurrency, which rose to an unprecedented level. As per a report, over 800,000 cybercrime cases were reported in 2021 by the American public, with an increase of around 7% from the year 2020, causing a loss exceeding USD 6.5 billion.

Moreover, the increasing business and technology strategy for enterprises and the rising demand for security, scalability, and multiple performance features play a critical role in cloud model selection. Thus, these factors are expected to drive the demand for CNAPP in North America in the coming years.

On the other hand, the APAC market is expected to have a decent market share during the forecast period. This can be because countries like China, India, Japan, and South Korea are at the forefront of tech innovations. In the rapidly evolving and vibrant business scenario with companies capturing new business opportunities, the reliance on cloud computing, data & analytics, and the internet of things is growing heavily in the region. Also, companies are focusing on cost benefits, business efficiencies, and competitive advantages by using new technologies.

Moreover, the rising number of industry leaders and tech-savvy businesses in APAC are adopting cloud computing, which helps them not only better serve their customers, but also run their organizations more efficiently and increase overall profit margins. All these factors drive the demand for CNAPP in the region.

The study uncovers the biggest trends and opportunities in the cloud-native application protection platform industry, along with offering segmentation analysis at the granular level for the period 2019 to 2030.

Based on Offering

Based on Cloud Type

Based on Vertical

Based on Enterprise Size

Geographical Analysis

The cloud-native application protection platform market size stood at USD 11,308.1 million in 2024.

During 2024–2030, the growth rate of the CNAPP market will be around 20.0%.

BFSI is the largest industry vertical in the CNAPP market.

The major drivers of the cloud-native application protection platform market include the rising usage of cloud-based servers and the increasing number of cyberattacks across industries, which have influenced companies to take active measures for the protection of their data.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages