Report Code: 10946 | Available Format: Excel

Closed Loop Stepper Motor Market Size and Share Analysis - Global Trends, Strategic Developments, and Forecast Report, 2024-2030

- Report Code: 10946

- Available Format: Excel

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

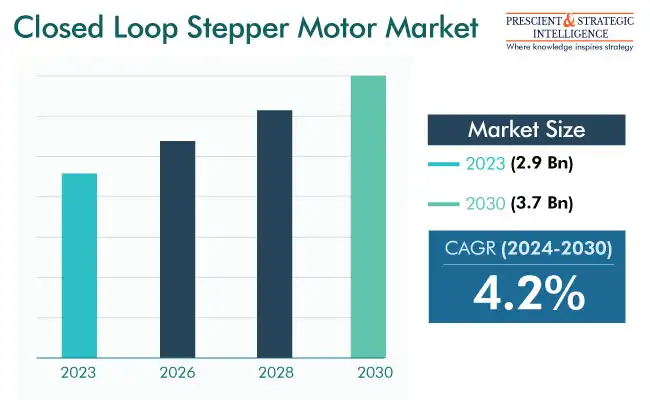

The global closed-loop stepper motor market was valued at USD 2.9 Billion (E) in 2023, and it is expected to grow at a rate of 4.2% during 2024–2030, reaching USD 3.7 Billion in 2030.

The rapid development of the robotics and automation sector has heightened the demand for stepper motors that can fit into narrower spaces. Motor manufacturers have, thus, been impelled to increasingly focus on enhancing design and industrial processes, to provide improved products with advanced efficiency.

In turn, the better design and efficient manufacturing processes of small motors result in their acceptance in various applications, such as semiconductors, automobile, and robotics, which require high accuracy, high torque, and better efficiency. The increasing emphasis on energy-efficient technologies in various industries is propelling the need for closed-loop stepper motors.

Furthermore, the industry is experiencing incredible growth attributed to the surge in vehicle production, especially EVs. These motors also play an essential role in medical devices, with an increasing requirement in blood analyzers and X-ray machines projected to drive the industry in the future. The improvements in healthcare, such as the utilization of motors in oxygen concentrators for cooling purposes, contribute to this trend. The small size and negligible noise of such devices make them a better choice for numerous medical applications.

Moreover, technical innovations have resulted in the development of waterproof stepper motors, which are highly favored in the packaging sector to facilitate corrosion-free processes. Additionally, the stable operation, fast startup response, low noise, and lower machine costs drive the popularity of these energy conversion devices across industries. For instance, in April 2023, Nanotec introduced the GP42-N series low-noise planetary gearbox for BLDC and stepper motors, featuring a NEMA 17 flange (42 mm). Gear options include seven distinct reductions, available in both single- and two-stage variants, providing a torque ranging from 0.8 to 4.9 Nm.

The market in advanced economies is approaching maturity and is projected to experience moderate growth during the projection period. Further, the detent torque, high torque density, and the ability to handle high inertia loads of these devices are projected to make them popular over servo motors.

Growing Adoption across Industries Is Biggest Driving Factor

The automation trend in several industries, such as packaging and manufacturing, is fueling the adoption of closed-loop stepper motors for accurate control. Further, in computerized numerical control (CNC) machines, these components play an essential role in precisely positioning the axes and rotating the lathes and mills. In all modern objects, such as consumer electronics, machines tools, and automobiles, people now desire complex designs and shapes, which are impossible to create with traditional cutting machines.

This has driven the demand for CNC machines in industries to precisely cut metallic, wooden, and plastic parts to create the intended designs. Further, stepper motors have applications in consumer electronics, such as camera systems, printers, and scanners.

Hybrid Motors Lead Market

On the basis of type, hybrid motors dominate the market, credited to the amalgamation of permanent magnet and variable reluctance features, which aids in attaining the desired output power despite their small size.

Moreover, the hybrid technology provides a low stepping rate, high torque, and high precision at low speeds, which make them popular among industries. These variants are mainly utilized in medical tools and manufacturing machinery. In the context of medicinal devices, they are used in surgical hand tools, medical pumps, and ventilation equipment. Additionally, the high accuracy and control offered by hybrid closed-loop stepper motors has fueled their acceptance in industrial machinery.

The permanent magnet type holds a significant industry share too, propelled by the higher detent torque offered by these variants compared to variable-reluctance motors and low electricity needs due to the absence of a physical commutator and brushes. This type also reduces manufacturing costs as its rotor does not require external current and generates greater torque for each Ampere of stator current.

In many applications, permanent-magnet motors provide augmented power density, decreased weight, and fewer emissions. Such motors find applications in computer peripherals, solar array monitoring systems, robots, motion control systems, and various other fields.

| Report Attribute | Details |

Market Size in 2023 |

USD 2.9 Billion (E) |

Revenue Forecast in 2030 |

USD 3.7 Billion |

Growth Rate |

4.2% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Automotive Application Is Significant Revenue Contributor

On the basis of application, the automotive category has a significant share because closed-loop stepper motors are utilized in electric, hybrid, and even ICE vehicles. The high efficiency and minimal cooling requirements make stepper motors suited for hybrid and electric vehicles. Moreover, in ICE vehicles, they find applications in power windows, power steering, and engine cooling fans.

The industrial machinery category is the leader of the industry, attributed to the increasing utilization of these motors in sophisticated tools, including extruders, feeder drives, and robots. Stepper motors also find usage in retrofit kits and CNC systems, both single and multi-axis controllers. Therefore, with the increasing adoption of Industry 4.0 approaches, the demand for robots, CNC machines, and other automation equipment is growing, thus driving the adoption of closed-loop stepper motors.

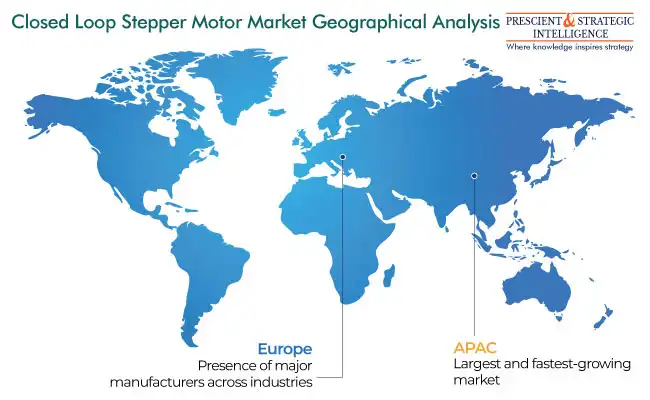

APAC Region Dominates Market

The Asia-Pacific region is dominating the market, and the region is also expected to witness the fastest growth during the projection period. This can be credited to the augmenting utilization of such motors in motion control systems in Japan and China. Moreover, several government guidelines have instructed safety features in cars, such as start/stop systems, anti-lock braking systems, and airbags. These safety features require motors for precise operations.

In the same way, the region has the largest industrial base in the world, led by China, Japan, South Korea, and India. As per reports, these four countries accounted for over 40% of the world’s manufacturing output in 2023. With further investments in augmenting manufacturing output, factories are being made smart, by integrating CNC machines, robots, and other automation technologies. Made in China 2025 and Make in India are the two most-prominent government initiatives aimed at enhancing their respective manufacturing industries around the world.

Key Players in Closed-Loop Stepper Motor Market

- Nippon Pulse Motor Co. Ltd.

- Schneider Electric SE

- ABB Ltd.

- Applied Motion Products Inc.

- Delta Electronics Inc.

- Sanyo Denki Co. Ltd.

- National Instruments Corporation

- Nidec Corporation

- Lin Engineering LLC

- Faulhaber Group

- Oriental Motor Co.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws