Report Code: 10802 | Available Format: PDF | Pages: 100

Global Start-Stop Technology Market Size, Share, Development, Growth and Demand Forecast to 2022 - Industry Insights by Product (Enhanced Starter, Belt-Driven Alternator Starter, Direct Starter, Integrated Starter Generator)

- Report Code: 10802

- Available Format: PDF

- Pages: 100

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

Start-stop technology automatically shuts down and restarts the internal combustion engine of vehicles to cut down the amount of time the engine spends idling. Additionally, the technology helps in reducing fuel consumption and emissions. The growth in start-stop technology market is driven by continuous improvement in vehicle performance and fuel efficiency levels. Strict regulations regarding exhaust gases set by various government and legislative bodies are serving as an advantage to this market. Major suppliers of these systems and automotive manufacturers adopting these systems are in the Asia-Oceania and European regions, that enables these regions to become the largest markets for start-stop technology.

The key factors supporting growth in the global start-stop technology market include increasing production of start-stop vehicles in North America. The start-stop systems is expected to be integrated in about 35% of vehicles sold in North America by 2020. In the U.S., automakers are integrating the start-stop technology to meet the target of 54.5 mpg corporate average fuel economy (CAFE) by the 2025.

Market Dynamics

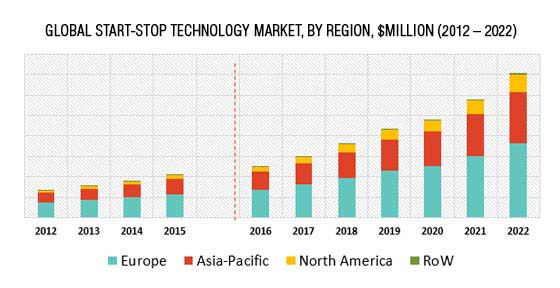

The global start-stop technology market is expected to witness a CAGR of 18.8% during the forecast period to reach $7,058.0 million by 2022. The key drivers supporting the growth in the market include the growing demand for fuel efficient vehicles and stringent emission control norms. Based on product, the enhanced starter segment is expected to be the largest segment of the global start-stop technology market during the forecast period; however, the integrated starter generator is expected to witness the highest growth during the forecast period in terms of volume and value.

Trends

The key trend observed in the global start-stop technology market is the adoption of clean energy across the globe. Start-stop technology is more efficient in reducing industrial and automotive emissions of toxic gases such as carbon monoxide and sulfur dioxide as compared with other technologies. Growing demand for vehicles with better fuel efficiency and lower emission is expected to support further growth in start-stop technology on account of increasing enhancement in the fuel performance for petroleum products. There is an increasing demand for vehicles with better fuel efficiency and lower emission. In several countries, the government has imposed stringent emission control norms to reduce the greenhouse gases emission from the vehicles. In 2011, global CO2 emission stood at 31.6 gigatons, with 23% of these emissions coming from the transportation sector across the globe. As per the European government’s CO2 emission regulation, the total CO2 emission from new passenger cars should be decreased from 130 grams (g) per kilometer (km) travel in 2013 to 95g per km travel by 2020. This, in turn, is expected to increase the demand for fuel-efficient vehicles and consequently, drive the growth of the start-stop technology market.

Growth Drivers

The factors driving the growth of the start-stop technology market are increasing need for fuel efficient vehicles and stringent emission control norms globally. In North America, Environmental Protection Agency (EPA) introduced emission standards for cars and light trucks. According to the target set by EPA, the permissible emission from a passenger car should not exceed 225 grams per mile (g/mi) in 2016. The planned permissible emission limits for passenger cars is 143 g/mi for 2025 in North America. Additionally, the permissible combined fuel economy for cars and trucks was 35.5 miles per gallon (mpg) for 2016, which is expected to increase up to 54.5 mpg by 2025 in North America. According to the government regulation in Europe, the average emission level from new cars reduced by 160 grams per kilometer (g/km) during 2006 - 2012. The regulation requires reducing the emission levels from new cars to 95 g/km by 2020. Such stringent regulations have resulted in increasing use of start-stop technology by automobile manufacturers.

Competitive Landscape

Some of the key players in the global market include Robert Bosch GmbH, Continental AG, Denso Corporation, Delphi Automotive PLC, Johnson Controls, Inc, Hitachi, Ltd., Mitsubishi Electric Corporation, Valeo SA, and BorgWarner Inc.

Scope for Customization

P&S Intelligence offers customization as per specific business requirements of clients. Illustrative customization within the scope of this report includes:

- Period of Analysis – Increase in the study period, including historic and forecast years

- Geographical Analysis – Increase in country coverage

- Segment Analysis – More granular coverage related to:

- Country level market breakdown by product

- Company Profiles – Wider company coverage in terms of detailed analysis or additional company profiles

- New custom report – A completely customized report can be provided on the market, specific to a region/ country/ segment

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws