Report Code: 12470 | Available Format: PDF

Clinical Trials Outsourcing Market Outlook by Phase (Phase-I, Phase-2, Phase-3, Phase-4), End User (Small & Mid-Size Companies, Large Companies), Application (Cancer, Cardiovascular Diseases, Infectious Diseases, Nervous System Disorder, Musculoskeletal Diseases, Gastroenterology Disease) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12470

- Available Format: PDF

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

The global clinical trials outsourcing market was valued at $40,428.4 million in 2021, and it will grow at a CAGR of 7.2% during the forecast period, to reach $75,573.4 million by 2030. This growth can be majorly attributed to the rising need to improve efficiency and reduce R&D costs. Moreover, the increasing number of communicable and non-communicable diseases, the growing pharmaceutical and biopharmaceutical industries, and surging R&D activities to develop new drugs are also driving the market.

In addition, governments in several countries are focusing more on the healthcare sector than before, due to the rising number of people with chronic diseases, such as diabetes, CVDs, and lung cancer. Apart from this, government and non-government organizations are increasingly focusing on drug safety and efficacy. Thus, these factors are also responsible for the market growth.

Increasing Number of Communicable and Non-Communicable Diseases Are Driving the Industry

The increasing prevalence of different diseases around the world and the rising demand for new medications to treat them are promoting market expansion. The major cause of death worldwide is non-communicable diseases (NCDs), which include mostly cardiovascular illnesses, diabetes, malignancies, and chronic respiratory diseases. They cause the death of seven out of ten, or 74% of all fatalities, majorly in low- and middle-income countries. The industry is also progressing due to the increasing government regulation, research, and innovation; improving primary healthcare; surging production of new drugs; and rising technical assistance.

Additionally, communicable diseases, including neglected tropical diseases (NTDs), such as HIV/AIDS, tuberculosis (TB), malaria, and viral hepatitis, are among the common causes of death and disability in low-income countries and marginalized groups. As a result, the market is being driven by the increased prevalence of these diseases and the rising drug demand. Also, the global COVID-19 pandemic and the expanding need for effective treatments are increasing the demand for clinical trials outsourcing services.

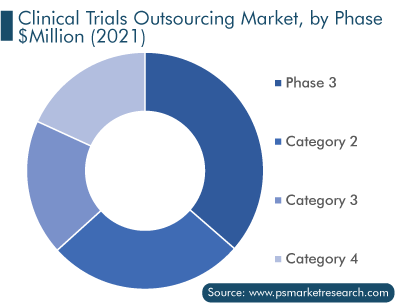

Outsourcing of Phase 3 Clinical Trials Is Increasing

In 2021, phase 3 clinical trials accounted for the largest revenue share, of more than 36%, in the market. Due to a huge number of clinical trials in the phase 3 stage and the high chance of failure in clearing this phase, pharmaceutical companies look forward to partnering with outsourcing partners, which, in turn, contributes to the clinical trials outsourcing market expansion.

Furthermore, the phase 3 category is likely to grow significantly in the coming years because it provides information on potential drug interactions as well as drug safety and efficacy. Phase 3 clinical research enables medical professionals and researchers to gain a deeper understanding of drugs and their side effects. With this knowledge, they can find new and improved methods for disease detection, diagnosis, treatment, and prevention, all of which benefit disease sufferers.

Demand for AI-Based Clinical Trial Solutions To Rise Significantly in Future

One of the main trends in the industry is the substantial investments that pharmaceutical companies are making to use AI to replenish their different pipelines. The market is also being driven by the increasing number of public and private initiatives to encourage the implementation of AI-powered solutions in new medication efficacy trials, in order to hasten drug discovery. Due to the rising use of AI-based tools and supportive government initiatives for their adoption in various healthcare domains, the demand for AI-based clinical trial solutions is projected to grow significantly in the coming years.

Moreover, to increase the use of AI-based clinical trial solutions for the development of drugs, healthcare players have collaborated with technology companies. For instance, Bristol-Myers Squibb announced in March 2019 that it had reached a strategic agreement with Concerto HealthAI, to use Concerto's AI-based solution for drug research.

North America Captured Majority of Revenue Share

Geographically, North America generated the highest revenue in 2021 in the market. This is due to the presence of developed healthcare infrastructure, high healthcare expenditure, the rise in the number of advanced drug research studies, high investment in clinical trials, and the presence of key players in the region.

In addition, Europe holds the second position in the market, due to the lower cost of clinical trials and well-established infrastructure for clinical trials. Furthermore, a dense network of healthcare facilities, clinical research universities, and high R&D expenditure of pharmaceutical companies will propel the demand for clinical trials outsourcing services in the coming years. Moreover, the rapidly increasing percentage of the aging population, which is being caused by a low fertility rate, emigration of young people, and rising life expectancy in Central and Eastern European countries, is leading to the rising healthcare investment. Thus, the increasing expenditure on the healthcare sector drives the regional market growth.

On the other hand, the APAC market is expected to witness the fastest growth, advancing at a CAGR of over 7.5%, during the forecast period. This can be mainly ascribed to the improving healthcare infrastructure, increasing drug research activities, and rising prevalence of diseases in the region. Additionally, low costs of clinical trials, a high patient population, and the rise in the number of CROs in APAC are also boosting the regional market growth.

Small & Mid-Sized Companies To Show Faster Growth

The small & mid-sized companies category is expected to witness faster growth during the forecast period. Contract outsourcing transfers the execution of drug safety functions and processes to a third party. A lot of companies outsource to reduce high initial investments and fixed overhead costs, improve resource flexibility, and secure additional capacity. For small and medium-sized businesses, outsourcing is a cost-effective option. Outsourcing can make it possible for small & mid-sized players to conduct clinical trials in the therapeutic area where they may not have the expertise and/or resources to independently develop drugs.

| Report Attribute | Details |

Historical Years |

2017-2021 |

Forecast Years |

2022-2030 |

Market Size in 2021 |

$40,428.4 Million |

Revenue Forecast in 2030 |

$75,573.4 Million |

Growth Rate |

7.2% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Phase; By End User; By Application; By Region |

Explore more about this report - Request free sample

Cancer Application Dominates Market

In 2021, the cancer category accounted for the highest revenue share, of around 34%, in the market. Because of their side effects, cancer medications must be evaluated for safety. The rise in cancer prevalence has hastened the demand for such medications. Thus, this factor increases the number of clinical trials and contributes to the market expansion in this category.

Whereas, the nervous system disorder category is projected to grow at the highest CAGR during the forecast period, owing to the increasing prevalence of nervous system disorders, including tension-type headaches, migraine, dementias, and traumatic brain injury. Moreover, the absence of essential drugs is driving the demand for drug developments, which, in turn, propels the market.

Players Are Engaged in Acquisitions and Collaborations

The global market is competitive and the major players have been increasingly engaged in partnerships and acquisitions to strengthen their position. For instance:

- In March 2022, IQVIA Inc. collaborated with argenx SE, for the development of new indications for VYVGART (efgartigimod alfa fcab), for the treatment of generalized myasthenia gravis.

- In October 2021, Syneos Health Inc. announced the acquisition of RxDataScience Inc., a healthcare-focused data analytic, data management, and AI company, to provide technology-enabled, insights-powered solutions to biopharma customers.

Key Players in the Clinical Trials Outsourcing Market Are:

- ICON plc

- PAREXEL International Corporation

- Charles River Laboratories International Inc.

- Thermo Fisher Scientific Holdings Inc.

- IQVIA Inc.

- Laboratory Corporation of America Holdings

- Syneos Health Inc.

- Medpace Inc.

- WuXi AppTec Co. Ltd.

- CTI Clinical Trial and Consulting Inc.

Market Size Breakdown by Segment

The report provides a comprehensive market segmentation analysis along with market size estimation for the period 2017-2030.

Based on Phase

- Phase-I

- Phase-2

- Phase-3

- Phase-4

Based on End User

- Small & Mid-size Companies

- Large Companies

Based on Application

- Cancer

- Cardiovascular Diseases

- Infectious Diseases

- Nervous System Disorder

- Musculoskeletal Diseases

- Gastroenterology Disease

- Other Diseases

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The clinical trials outsourcing market size stood at $40,428.4 million in 2021.

During 2021–2030, the growth rate of the clinical trials outsourcing market will be around 7.2%.

Cancer is the largest application area in the clinical trials outsourcing market.

The major drivers of the clinical trials outsourcing market include the increasing R&D investments, the rising number of CROs, the surging prevalence of diseases, the growing production of new pharmaceuticals, and the presence of a strong government regulatory framework for drug safety.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws