Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 9.8 Billion |

| 2030 Forecast | USD 36.6 Billion |

| Growth Rate(CAGR) | 24.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12611

Get a Comprehensive Overview of the Clear Aligners Market Report Prepared by P&S Intelligence, Segmented by Age Group (Adults, Teens), Material Type (Polyurethane, Plastic Polyethylene Terephthalate Glycol, Polyvinyl Chloride), End User (Hospitals, Standalone Practitioners, Group Practices), Duration Segment (Comprehensive Malfunction, Medium Treatments, Small Little Beauty Alignments), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 9.8 Billion |

| 2030 Forecast | USD 36.6 Billion |

| Growth Rate(CAGR) | 24.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

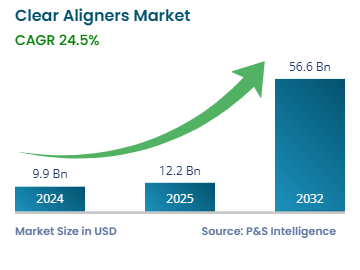

The clear aligners market size stood at USD 9.8 billion in 2024, and it is expected to advance at a compound annual growth rate of 24.5% between 2024 and 2030, to reach USD 36.6 billion by 2030. This is primarily ascribed to the technological advancements in dental treatments, the rising number of individuals suffering from malocclusions, and the increasing demand for customized aligners.

Moreover, with the surging focus of individuals on online platforms because of the rising number of direct-to-consumers, the sales of such products are also increasing through online sales channels. Further, people do not want to go to an orthodontist’s office for treatment, which, in turn, has increased the adoption of these products.

Several advancements such as additive fabrication, 3D impression systems, digital scanning technology, temporary anchorage devices, CAD/CAM appliances, nickel and copper-titanium wires, incognito lingual braces, and clear aligners are contributing to making the treatment more predictable, efficient, and effective. Customized dental treatments and advancements in technologies including digital impression systems are also aiding in the development of accurate systems to treat moderate-to-mild misalignment conditions.

Invisible aligners are developed with the help of computer-aided design (CAD), virtual digital models, and thermoformed plastic materials (polycarbonate plastic or co-polyester). However, metal and ceramic braces cause inconvenience and gum sensitivity for a longer period of time. This results in faster adoption of aligners by dentists and patients. The major role of these products is to provide the wearer with flexibility and comfort. According to research articles, it is evaluated that they are becoming more popular with time and an alternative to fixed products for the purpose of tooth straightening, while they are also a comfortable and aesthetically appealing choice.

Governments and organizations in several regions have also started to organize various initiatives, such as orthodontia workshops and conferences, to create awareness among people related to dental health and treatments. For the enhancement of existing methods, awareness is increased through these conferences. Some of the major organizations involved in this field include the European Federation of Orthodontic Specialists Associations (EFOSA), the American Association of Orthodontists (AAO), and the Asian-Pacific Orthodontic Society (APOS). Thus, the rising awareness among people related to available treatment options and the increasing alertness about these products, coupled with the growing disposable income, are driving the market growth.

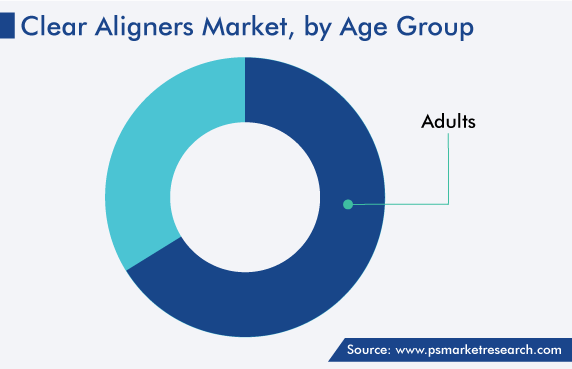

Based on age group, the adults category accounted for the largest revenue share, of around 66%, in 2022. This is attributed to several teeth issues including the prevalence of malocclusion among the population. These issues affect the quality of life, and may also lead to problems including disturbances of oral function, such as swallowing, mastication, and speech, and greater susceptibility to periodontal disease and trauma.

Currently, adults are very focused on their appearance and acceptable aesthetic appearance such as dental appearance. In the orthodontics field, aligner therapy is one of the fastest-growing areas, which is driven specifically by patients who considered it a more convenient, comfortable, and discreet alternative to fixed appliances.

Whereas, the teens category is expected to show the highest growth rate over the coming years. This can be because aligners help teens avoid irritation due to plastic and smooth edges. Also, the flexibility and fewer dietary restriction help teens to adapt to these products easily because it is difficult for teens to wear braces.

According to government websites, the prevalence of Class I and Class II malocclusions among teenagers is rising. Teens have also several dental problems, such as crowded teeth, diastema, overbites, crossbites, and underbites, during the time of their development. Further, many teenagers prefer the look aesthetically appealing as they are more concerned about their looks. Thus, these reasons, along with the rising focus on oral hygiene, fuel the demand for clear aligners among teenagers.

Polyurethane material is mostly preferred for making aligners because it can be used for both their soft and hard parts. Using this material, it is possible to create the hard part of the product strong enough, due to which the pulling of teeth into alignment becomes easy. The soft part is responsible for making it comfortable to wear for a longer period. Moreover, it helps in feeling smoother and does not cause irritation. Further, polyurethane-based aligners are easy to handle and wear, which helps in easy biting and grinding.

Standalone practitioners are leading the market, ascribed to the factors such as patients do not have to wait for longer durations, the existence of advanced equipment for the diagnosis of issues, and high-quality services. In addition, lesser administrative work, flexibility, customized services designed as per patients’ needs, control over the practices, a rise in healthcare expenditure, and an increase in the number of standalone practitioners are also boosting the industry in this category. According to government reports, in February 2023, the last remaining NHS dentists in Felixstowe goes private and will start providing private services.

Based on duration, the medium treatment duration category is expected to witness the highest CAGR, of around 32%, during the forecast period. This can be because it is considered as the appropriate time for the treatment by specialists, and it usually depends on the condition of teeth and their spacing or over-crowded issues. For instance, according to the European Journal of Pediatric Dentistry, the average treatment time for maxillary expansion is around 8 months.

Drive strategic growth with comprehensive market analysis

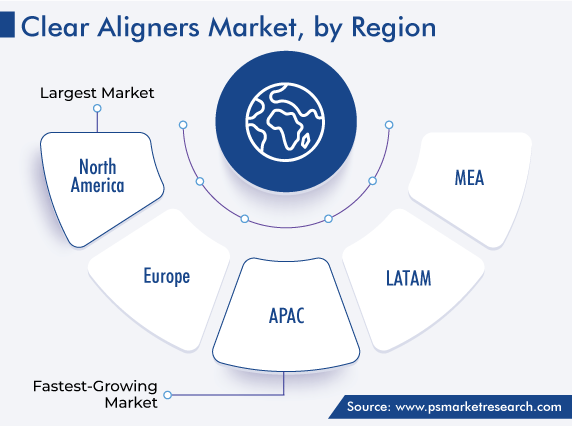

North America has the leading position in the clear aligners market, and it will hold the same position in the coming years, with a value of USD 21,256 million by 2030. This is attributed to the faster adoption of new and advanced technologies, high healthcare spending, and high disposable income in the region. In North America, the U.S. market holds the leading position, and it will grow at a CAGR of more than 30% during the forecast period. This can be due to the robust healthcare infrastructure and the existence of a large number of key players in the country.

The rising R&D investments of key players to obtain new patents, various convenient options available for treating teeth misalignment, a rise in awareness regarding recent developments in dental hygiene, and a sudden increase in beauty standards have forced people to adopt these products, which, in turn, propel the growth in the regional market.

In addition, companies in the region are also focusing on product launches, collaborations, mergers, and acquisitions to improve their market position. For instance, in February 2022, OraPharma announced the launch of a custom clear aligner system, OraFit, which is used for correcting crooked or misaligned permanent teeth.

Based on Age Group

Based on Material Type

Based on End User

Based on Duration Segment

Geographical Analysis

The clear aligners market size stood at USD 9.8 billion in 2024.

During 2024–2030, the growth rate of the clear aligners market will be around 24.5%.

Standalone practitioners is the largest end user in the clear aligners market.

The major drivers of the clear aligners market include the rapid adoption of digital technologies, such as digital tooth setups, intraoral scans, CAD/CAM appliances, and 3D printers, in the dental sector; the increasing popularity of cosmetic dentistry procedures; the growing prevalence of dental problems; and the surging awareness and concern about oral hygiene.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages