Report Code: 12902 | Available Format: PDF | Pages: 240

Clean Label Ingredient Market Size and Share Analysis by Type (Natural Colors, Flavors, Fruit & Vegetable Ingredients, Starches & Sweeteners, Flours, Malts), Form (Powder, Liquid) Application (Beverages, Bakery, Dairy & Frozen Desserts, Prepared & Processes Foods, Cereals & Snacks), Distribution Channel (B2B, B2C) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12902

- Available Format: PDF

- Pages: 240

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Clean Label Ingredient Market Overview

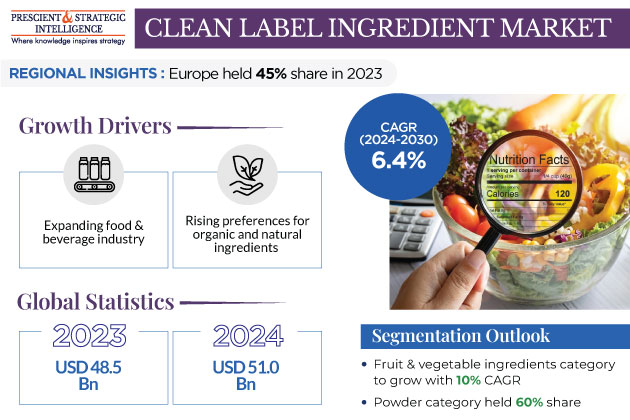

The clean-label ingredients market generated revenue of USD 48.5 billion in 2023, which is expected to witness a CAGR of 6.4% during 2024–2030, reaching USD 74.0 billion by 2030. This will mainly be due to the rising preferences for organic and natural ingredients that are free of artificial or chemical ingredients, expanding food & beverage industry, and health and safety concern related to artificial food additives.

- These ingredients are mainly derived from natural sources or made from as few raw materials as possible, in order to make sure consumers can use them easily at home.

- These labels are given to products with natural ingredients and no artificial flavors, colors, or preservatives, or synthetic additives.

- The labels also mandatorily contain information on how the ingredients were sourced and the products manufactured.

- One of their key features is minimal processing, which generally means that the ingredients are more natural than artificial.

Growing Health Awareness of Consumers

Health and wellness focus is booming, and consumers are more likely to spend on products that can improve their health, nutrition, fitness, and mindfulness. Artificial food additives have a high risk of causing cancer; for instance, a diet with a high content of nitrites and nitrates, which are commonly found in processed meats, has been linked to an increased risk of colorectal cancer.

Additionally, an additive that is mostly found in food packaging, bisphenol A (BPA), has been understood to increase the risk of endocrine dysfunction and cancer. Moreover, although it has been banned in baby products, it is still used commonly in some brands of cans, water bottles, and other kinds of packaging.

- According to studies, health issues such as ADHD, asthma, cancer, heart difficulties, and obesity are majorly caused by harmful additives and preservatives.

- These food additives interfere with hormones, and disrupt growth and development, which is A major reason many children are overweight nowadays.

- They are more likely than adults to be exposed to these food products.

- Moreover, several food additives are used by women during pregnancy and breastfeeding that are not fully safe.

Therefore, the demand for healthier and more-transparent food options has led to a significant shift in the food industry, thereby driving the market growth for clean-label food products.

Furthermore, consumers are becoming more conscious of the food they consume and seeking detailed information on the nutritional content of food products. They are rapidly inclining toward understanding the impact of food on their health, which has resulted in an increase in the demand for transparent and clean nutritional labeling. As these ingredients are naturally sourced and minimally processed, consumers are inclining toward them as they can be easily recognized and pronounced.

- Additionally, consumers now want to know the origin, sourcing, and production methods of their food more than ever.

- This has made supply chains more traceable and accountable.

- Food companies are leveraging technologies, such as blockchain, that provide verifiable information and assure consumers that the products they purchase meet stringent quality standards and ethical sourcing.

In the U.S., the ingredients label is placed either before or after the Nutrition Facts panel, as many consumers are concerned about what they are actually consuming. Moreover, people who are overly sensitive or even allergic to food products need this information because it helps them determine whether a food is safe for them to eat or likely to cause a severe reaction.

Powder Form Dominates Market

Based on the form, the powder category held the larger share, of 60%, in 2023. This is mainly due to powdered ingredients’ longer shelf life and ease of handling and storage. As these materials can be easily blended into dry mixes and batters, they reduce the risk of spoilage and allow for extended product storage. Moreover, as they are in dry form and contain less water content, they are lightweight. These attributes result in easy and cost-effective transportation, especially in the case of long-distance shipments. Moreover, powdered natural flavors, colors, and sweeteners are commonly used in baking, dry mixes, confectionery, and beverages.

The liquid form also held a significant market share in 2023.

- Liquid natural flavors are widely used when dispersion or blending is critical, such as in dairy products, beverages, and dressings.

- They provide a more-authentic taste and appearance to these products.

- In September 2022, Kerry Group plc launched Puremul, a new texture system of a label-friendly, non-GMO alternative, which overcomes the challenges in the supply of sunflowers.

- It is designed to replace sunflower lecithin and mono- and diglycerides in baked goods and plant-based beverages.

| Report Attribute | Details |

Market Size in 2023 |

USD 48.5 Billion |

Market Size in 2024 |

USD 51.0 Billion |

Revenue Forecast in 2030 |

USD 74.0 Billion |

Growth Rate |

6.4% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Form; By Application; By Distribution Channel; By Region |

Explore more about this report - Request free sample

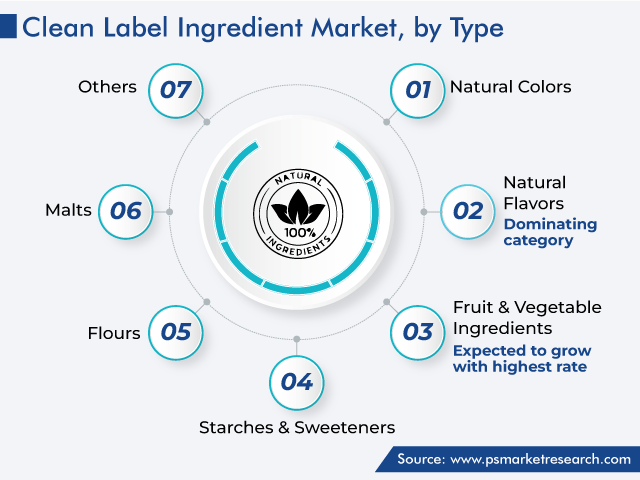

Natural Flavor Category Hold Largest Share

Based on type, natural flavor category dominated the market in 2023. Due to their growing focus on a healthy lifestyle, consumers are more inclined toward natural and healthy flavoring agents than artificial ones. Moreover, the consumer demand is shifting toward food products that are healthier, i.e., contain less fat, sugar, and artificial additives; and are more sustainable.

Common natural flavors, such as hydrolyzed vegetable protein (HVP) and autolyzed yeast extract (AYE), are added to foods for flavor and taste enhancement. The rising pace of innovations and launch of natural flavorings have profited the natural flavor industry. For instance, in September 2022, Solvay SA expanded the range of Rhovanil Natural CW with three new natural flavors: Alta, Delica, and Sublima. The flavors are extracted from vanillin.

The fruit & vegetable ingredients category is expected to witness the highest CAGR, of 10%, in upcoming years.

- Agents extracted from fruits and vegetables are commonly used to sweeten, color, texturize, preserve, fortify, and flavor.

- The market is also driven by the growing demand for food and beverages with naturally sourced fruit and vegetable ingredients.

- Raspberry puree is made of mature raspberries that have been selected, sieved, blended, pasteurized, and aseptically packed.

- Similarly, pumpkin powder is used in high volumes in the food and nutraceutical industries.

Flour category also holds a significant market share, as chia, quinoa, and hemp flour are widely used to produce gluten-free corn/rice bread. The use of 5–14% whole chia flour increases the levels of lipids, proteins, and dietary fiber compared to the gluten-free white breads. Moreover, many consumers are opting for gluten-free or allergen-free diets, which creates a high demand for clean-label flour.

Beverages Category Is Prime Revenue Contributor

Based on application, the beverages category held the largest share, of 30%, in 2023, and it is expected to witness a CAGR of 9% during 2024–2030.

- Labeling in the beverage industry is highly regulated, especially in the developed countries with high consumer awareness.

- Clean-label raw materials are widely in beverages, such as juices, soft drinks, tea, coffee, and functional beverages.

- As consumers are seeking products with transparent and easily understandable ingredients, along with healthier beverage options, the demand for natural flavors and sweeteners is rising.

B2B Category Holds Larger Share

Based on the distribution channel, B2B category held the larger share, of 80%, in 2023, as B2B companies can assure customers that their goods meet the particular quality parameters and can satisfy customer preferences. The stricter labeling laws are pushing business-to-business companies to sell minimally processed products.

Moreover, B2C category will witness significant progress in the coming years.

- The B2C category includes supermarkets, online channels, and convenience stores.

- The rising number of companies offering food and beverages with less-processed and organically sourced ingredients through online channels and convenience stores is propelling the demand in this category.

- Moreover, manufacturers are using social media platforms and other marketing strategies to increase the demand for their products among individual consumers.

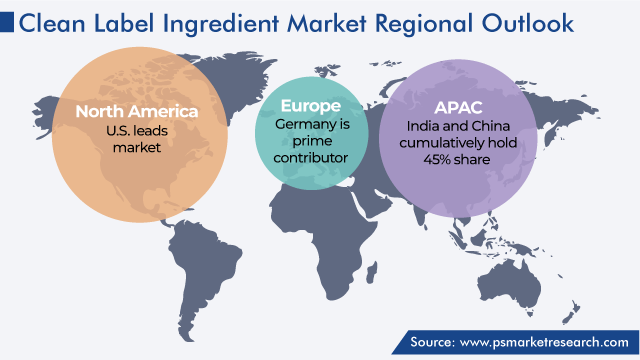

Europe Is Prime Revenue Contributor

Geographically, Europe held the largest share, of 45%, in 2023. This is mainly due to the presence of numerous market players, along with their rising investment in R&D. Moreover, the government initiatives to promote healthy eating are driving the growth of the market. According to studies, more than half of Germany’s population buys organic food and drinks, as they are GMP-free and do not contain pesticides and other chemicals. Moreover, there are no artificial additives and preservatives in organic food and drink products.

North America is expected to witness a significant CAGR over the forecast period.

- The market is driven by the rising consumer interest in plant-based food and food and beverages that offer transparency into their raw materials and manufacturing process.

- Consumers are likely to be more inclined toward products they are knowledgeable about and can trust.

- In the U.S., people are also more conscious of their health and lifestyle; so, they buy products that do not contain any artificial additives.

- Furthermore, the Food and Drug Administration (FDA) plays a crucial role in regulating food ingredients.

- It provides guidelines and standards for labeling and ensures that the ingredients meet its safety standards.

APAC is expected to witness the highest CAGR, of 8%, over the forecast period. The primary reason for this is the elevating living standards of people in India and China. Their population is more than ever focused on health and wellness, starting to choose clean-label products so that they are aware of what they are consuming. Further, in India, the government has implemented stringent food safety standards in order to boost consumer trust in processed food and beverages.

- The rise in the demand for convenience goods with clean labels is also driving the market.

- As a result, market players are focusing on promoting the benefits of such products.

- This is mainly due to the consumers’ changing eating habits and rising awareness of ingredients that are used to prepare food products.

- In November 2022, Vecan Foods Launched clean-label plant-based meat alternatives across Delhi.

- The company claims their products are clean-label, high-protein alternatives to conventional meat.

Clean-Label Ingredients Market Key Players

- Archer Daniels Midland Company

- Cargill

- DSM

- Kerry Group plc

- Tate & Lyle plc

- Corbion NV

- Sensient Technologies Corporation

- Ingredion Incorporated

- Brisan Group

- Limagrain Ingredients

Market Size Breakdown by Segment

This report offers deep insights into the clean label ingredient market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Type

- Natural Colors

- Natural Flavors

- Fruit & Vegetable Ingredients

- Starches & Sweeteners

- Flours

- Malts

Based on Form

- Powder

- Liquid

Based on Application

- Beverages

- Bakery

- Dairy & Frozen Desserts

- Prepared & Processes Foods

- Cereals & Snacks

Based on Distribution Channel

- B2B

- B2C

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Explore

The industry for clean-label ingredients will reach USD 51.0 billion in 2024.

The clean-label ingredients market value will reach USD 74.0 billion in 2030.

The European market for clean-label ingredients is the largest.

The growing food & beverage sector and the increasing fondness for natural & organic ingredients are the major clean-label ingredients industry drivers.

Beverages hold the larger clean-label ingredients market share.

The clean-label ingredients industry is observing the fastest growth in APAC.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws