Report Code: 12034 | Available Format: PDF | Pages: 161

Chlorine Market Research Report: By Application (EDC/PVC, Inorganic Chemicals, Isocyanates & Oxygenates, Solvents, Chloromethanes), End Use (Plastics, Water Treatment, Pharmaceuticals, Pulp & Paper, Pesticides)- Global Industry Analysis and Demand Forecast to 2030

- Report Code: 12034

- Available Format: PDF

- Pages: 161

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

The chlorine market value was $36,845.0 million in 2019, and the market is predicted to advance at a CAGR of 5.2% between 2020 and 2030. The increasing usage of the chemical in water treatment applications and burgeoning requirement for polyvinyl chloride (PVC) are the major factors driving the expansion of the market.

The COVID-19 pandemic is positively impacting the growth of the chlorine industry. Moreover, the industry revenue is predicted to surge sharply in the post-COVID-19 world, primarily due to the increasing concerns being raised over the existence of pathogens in water supply systems. While the announcement of lockdowns and the subsequent shutting down of manufacturing plants and facilities, for controlling the spread of the virus, negatively affected the market, it was only a minor setback. The market is predicted to register rapid expansion in the coming years because of the growing public awareness about the importance of treated water and sanitization.

Ethylene Dichloride (EDC)/PVC Held Largest Market Share

The EDC/PVC category held the largest share under the application segment of the chlorine market in 2019. This was because of the extensive usage of the chemical in the chlorination process required for producing EDC/PVC. With the soaring requirement for EDC/PVC in several applications in the automotive, building & construction, electrical & electronics, and various other sectors, its production is booming all over the world. Thus, with the mushrooming requirement for the EDC/PVC in these industries, the global consumption of chlorine is skyrocketing, thereby causing the expansion of the category in the market.

Water Treatment Category Set To Exhibit Fastest Growth

The water treatment end use category is predicted to demonstrate the fastest growth in the market for chlorine in the coming years, primarily due to the surging concerns over water safety across the world. Chlorine is heavily used in water utilities as a disinfectant, for providing safe drinking water and clean water for sanitation. Because of this reason, the demand for the compound is rising sharply, which is, in turn, fueling the advance of the category.

Furthermore, in the U.S., the Environmental Protection Agency (EPA) has mandated that treated tap water must contain a certain detectable level of chlorine, for ensuring that it remains free of germs till it reaches the taps of consumers. This is massively boosting the requirement for the chemical for water treatment purposes, thereby propelling the expansion of the category in the chlorine market.

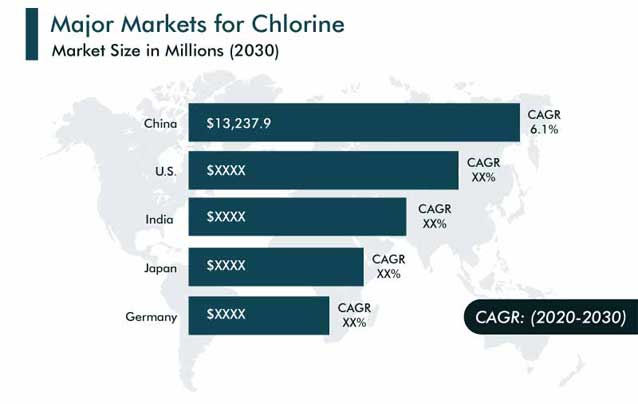

Asia-Pacific (APAC) To Hold Largest Share and Witness Fastest Growth

APAC was the largest market for chlorine in 2019, and this trend is predicted to continue in the coming years. This is credited to the soaring requirement for the chemical in emerging economies, such as India, Thailand, and China, for producing EDC/PVC. The production of EDC/PVC is rising here on account of its soaring consumption in the electrical & electronics, automotive, and building & construction sectors. PVC is heavily used for insulation, roofing, shingles, flooring, and door sidings. Thus, in order to cater to the soaring requirement for EDC/PVC in these applications, its production will shoot up, which will, in turn, propel the sale of chlorine in the future.

Moreover, the element is being extensively used in water treatment applications and the pharmaceutical sector in these countries. The growing public awareness about the water-borne diseases caused due to the consumption of untreated water, such as trachoma, hepatitis, and diarrhea, and the increasing understanding of this issue in the emerging economies of APAC, such, as India, Indonesia, and China, are the major factors driving the expansion of the chlorine market in the APAC region.

Additionally, the compound has the ability to impart a white appearance to paper, by removing lignin, which is a wood fiber element that makes paper appear yellow under sunlight. With the advance of the pulp & paper industry in the region, the demand for the chemical is exploding. For instance, in May 2019, a memorandum of understanding (MoU) was signed between Asia Pulp & Paper (APP), a paper company based in Indonesia, and the Government of Andhra Pradesh (India) for the eventual construction of a new pulp & paper mill with a capacity of 5 million tons per year in the Indian state. Therefore, with the surge in investments and development of pulp & paper production facilities, the demand for chlorine is predicted to soar in this region in the coming years.

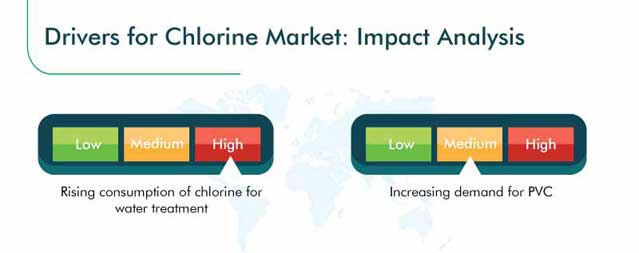

Surging Demand for Treated Water

Over the last few years, the consumption of chlorine has increased massively, primarily due to the sharp rise in the demand for treated water for sanitation and drinking, a trend that will continue in the chlorine market in the coming years. Emerging economies, such as India, Thailand, and Brazil, are increasingly focusing on raising public awareness about the harmful effects of consuming untreated water and its role in fueling the incidence of diseases such as cholera, typhoid, Hepatitis E, and Hepatitis A. As chlorine has the ability to kill bacteria and other pathogens, its usage in water treatment is surging.

The compound is also increasingly being used for treating water in order to make it suitable for swimming pools and irrigation. Additionally, the governments of several countries are taking strict measures to regulate the supply of treated, clean, and safe water. These factors are predicted to propel the usage of the chemical, thereby driving the advance of the market.

Mushrooming Consumption of PVC Propelling Market Growth

Chlorine is extensively used during the chlorination process required for producing PVC. The usage of the element in PVC provides various benefits, such as aa higher melt viscosity and improved thermal stability during the production process. Because of this reason, the gas is being heavily used in PVC, and this is one of the major chlorine market drivers. With the burgeoning requirement for PVC in siding and piping applications in the building & construction sector, windshield system parts in the automobile sector, and non-breakable containers in the medical sector, its consumption is ballooning, which is, in turn, fueling the demand for chlorine across the world.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$36,845 million |

Forecast Period CAGR |

5.2% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Company Share Analysis, Companies’ Strategical Developments, Competitive Benchmarking, Company Profiling |

Market Size by Segments |

Application, End Use, Region |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Japan, China, India, South Korea, Brazil, Mexico, Argentina, Saudi Arabia, South Africa, U.A.E. |

Secondary Sources and References (Partial List) |

Alkali Manufacturers Association of India, American Chemical Society, American Chemistry Council, Asia Pulp & Paper, Chlorine Institute, Essential Chemical Industry, Euro Chlor, International Water Association, Plastics Pipe Institute, U.S. Department of Health & Human Services |

Explore more about this report - Request free sample

Chlorine Manufacturers Expanding their Capacities and Geographical Presence

The global chlorine market is consolidated in nature, with presence of few major players. The major players operating in the market include Olin Corporation, Occidental Petroleum Corporation, Westlake Chemical Corporation, The Dow Chemical Company, Covestro AG, and INEOS Group Holdings S.A.

Manufacturers in the industry are increasing their production capacities as well as geographical presence, in order to gain a competitive edge. For instance:

- In October 2019, Ercros SA announced that the company has completed the third expansion of the capacity of the chemical compound and caustic soda production plant at the Vila-seca I factory, with the start of a new electrolyzer that expands the capacity of the plant by another 26,000 tons per year.

- In April 2019, Nouryon announced that company is going to increase its production capacity for chloromethanes methyl chloride by more than 30% at its site in Frankfurt, Germany. This upgrade will improve overall supply reliability for its customers and support their growth plans. As per the company, the expansion is expected to be completed in 2020.

- In June 2018, Covestro AG announced that the company has invested around $231.6 million at Tarragona facility, in Spain, to increase the site competitiveness for the chemical compound. The site will use oxygen-depolarized cathode technology. In addition, the company also stated that construction of the new plant in Tarragona would scheduled to begin in the first half of 2019.

Some of the Key Players in the Chlorine Market Include:

-

Nouryon

-

Occidental Petroleum Corporation

-

Westlake Chemical Corporation

-

The Dow Chemical Company

-

BASF SE

-

INEOS Group Holdings S.A.

-

Olin Corporation

-

Covestro AG

-

Shin-Etsu Chemical Co. Ltd.

-

Formosa Plastic Corporation

Chlorine Market Size Breakdown by Segment

The chlorine market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Application

- Ethylene Dichloride (EDC)/Polyvinyl Chloride (PVC)

- Inorganic Chemicals

- Isocyanates & Oxygenates

- Solvents

- Chloromethanes

Based on End Use

- Plastics

- Water Treatment

- Pharmaceuticals

- Pulp & Paper

- Pesticides

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Asia-Pacific (APAC)

- China

- India

- Japan

- South Korea

- Latin America (LATAM)

- Brazil

- Mexico

- Argentina

- Middle East & Africa (MEA)

- Saudi Arabia

- U.A.E.

- South Africa

The chlorine market will value $63,121.6 million in 2030.

The major chemical demand in the chlorine industry will be generated for the water treatment end use.

The fastest growth in the chlorine market will be witnessed in APAC.

The consolidation in the chlorine industry is due to the presence of just a few major players.

In order to increase their revenue, key players in the chlorine market are raising their production capacity.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws