Report Code: 12861 | Available Format: PDF | Pages: 230

Ceramic Substrates Market Size and Share Analysis by Type (Alumina, Aluminum Nitride, Silicon Nitride, Beryllium Oxide), End Use (Consumer Electronics, Aerospace & Defense, Automotive, Semiconductor, Telecommunication), Form (Plates, Sheets, Films) -Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12861

- Available Format: PDF

- Pages: 230

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

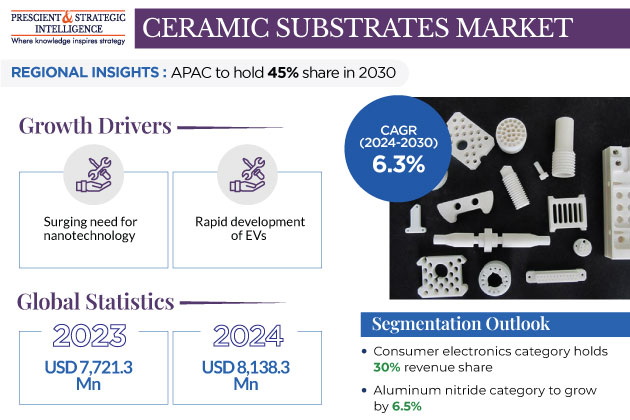

The ceramic substrates market is expected to grow from an estimated USD 7,721.3 million in 2023 to USD 11,740.8 million by 2030 at a CAGR of 6.3% between 2024 and 2030. This can be ascribed to the growing demand for these materials in various industries and the trend of the miniaturization of electronic devices.

Miniaturization and Advancing Architecture of Electronic Devices Are Driving Market

The demand for small yet reliable electronic equipment is being fueled by the rapid technological breakthroughs, themselves driven by research development. Further, as the semiconductor technology has advanced, electronic devices can now perform complex functions, which calls for the utilization of hybrid circuits integrated into ceramic substrates.

Moreover, the manufacturing of semiconductors itself requires ceramic substrates, such as those made of alumina–beryllium oxide and aluminum nitride. This is because they possess appreciable high-temperature performance, resistance to acids, alkalis, and wear, and hardness. Three other main benefits of these materials are efficient thermal conduction, hermetic sealing, and flexibility for miniaturization.

Moreover, thin-film ceramic substrates enable the downsizing of a wide range of electronic devices. Essentially, the downsizing of electrical hybrid circuits has resulted in a size reduction in electronic devices, largely due to the adoption of the ceramic substrate technology. Further, in harsh operating environments or when exposed to corrosive gases, liquids, and high humidity, substrates made of alumina and aluminum nitride offer resistance to chemicals and moisture.

Therefore, the market for ceramic substrates is expected to grow significantly as a result of the rising demand for these cutting-edge electronic goods. For instance, digital cameras make extensive use of multilayer low-temperature co-fired ceramic (LTCC) substrates, which enable a reduction in the volume of printed wiring boards, thus leading to a notable decrease in size and cost.

Expanding Usage in Various Industries Is another Key Driver

One of the biggest drivers for the market is the rising demand for these materials from a number of industries. In particular, in the electrical & electronics industry, ceramic substrates are essential in high-voltage power electronics. In this regard, the progress in the microfabrication technology and surface science and the rapid growth in the usage of semiconductors are the key drivers for the market.

These materials are one of the key components of semiconductors, which are, in turn, essential in solar PV power generation, EVs, consumer electronics, wind power generation, LED lighting, and a host of other modern-day products. Using ceramic substrates for semiconductor devices leads to good insulation, resistance to electrical breakdown, smooth surface, uniform thickness, high thermal conductivity, and many other advantages.

Further, with robust R&D, many new substrates are being developed for semiconductors. One of them is BeO, which has high thermal conductivity and high resistance among oxides. Its thermal conductivity at room temperature is as good as of metals.

The use of thin-film ceramic substrates has also significantly contributed to the downsizing of a wide range of electronic devices, including video cameras, e-book readers, tablet PCs, cellphones, and video cameras, all of which consist of hybrid circuits. To these products, these substrates offer strong resistance to wear, temperature, and corrosion.

Further, their corrosion resistance, biocompatibility, and thermal stability make them an important component of diagnostic equipment, dental instruments, and implantable devices. Hence, as the healthcare sector experiences growth, the ceramic substrates market will witness a robust advance as well.

| Report Attribute | Details |

Market Size in 2023 |

USD 7,721.3 Million |

Market Size in 2024 |

USD 8,138.3 Million |

Revenue Forecast in 2030 |

USD 11,740.8 Million |

Growth Rate |

6.3% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type, By End Use, By form, By Region |

Explore more about this report - Request free sample

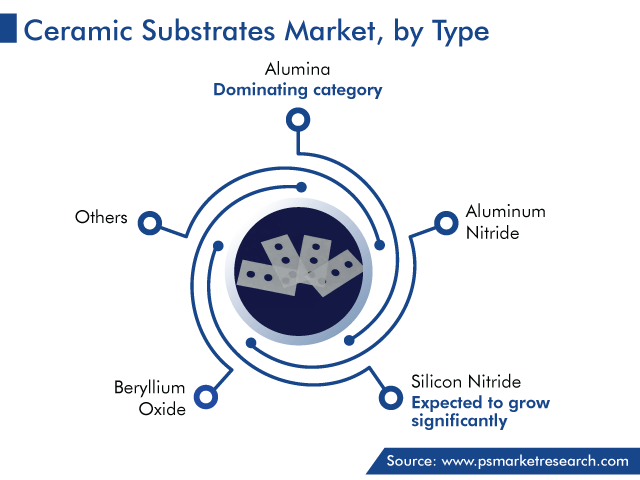

Alumina Category Is Generating Highest Revenue

The alumina category in the product segment is generating the highest revenue because Al2O3 is the most-widely used advanced oxide ceramic material. Alumina components are produced using a variety of manufacturing processes, such as injection molding, slip casting, isostatic pressing, uniaxial (die) pressing, and extrusion. Among its notable qualities are great hardness and strength, temperature stability, and extraordinary resistance to corrosion and wear.

Alumina substrates are a prime choice in the electrical & electronics industry since they meet the stringent requirements for insulation. When compared to alternatives, these substrates are also more affordable, which is why they are widely used in thin- and thick-film applications. This makes them a desirable option for businesses looking for trustworthy insulating materials for fabricating electronic components.

Consumer Electronics Category Has Largest Share in End Use Segment

The consumer electronics category in the end use segment held 30% market share in 2023. The consumer electronics industry produces a diverse range of gadgets intended for everyday usage, mostly in the areas of communications and entertainment. Thus, it uses an array of materials for packaging purposes, among which ceramic substrates are the most adaptable and affordable. These materials are available as printed thick-film substrates and used in backlighting in digital devices, touchscreen smartphones, gaming consoles, signage, video cameras, speakers, earphones, laptops, set-top boxes, desktop PCs, and tablets.

Most importantly, ceramic substrates of smaller sizes are essential for small-space packaging needs, such as those in earbuds and hearing aids. Thus, as the consumer electronics industry grows at a rapid pace due to the introduction of new technologies, including IoT, AI, and 5G, the demand for ceramic substrates will burgeon too.

Automotive Industry Is Fast-Growing Market

The automotive category will grow at the highest CAGR, of 6.7%, in the forecast period. In the last three decades, the automotive industry has grown by leaps and bounds, also experiencing massive changes through continuous innovation and upgradation. The industry uses ceramic substrates in numerous vehicle components as they have good mechanical, dimensional, and thermal stability and high reliability.

Specifically, LTCC and thin-film substrates are extensively used in ABS, engine control units, airbag control modules, LEDs, navigation systems, and entertainment consoles. Even in the 1980s, thick-film substrates were used for engine components, radios, audio amplifiers, and other vehicle parts. With the increasing awareness of the safety and quality of vehicles and improvements in engines and braking systems, the market for ceramic substrates will continue to grow in this end use category.

Further, the power modules in EVs and hybrid EVs require these materials to achieve smaller circuits and high-voltage isolation. As the size of the electronic components of automobiles decreases and their power consumption increases, thermal issues arise. Therefore, heat management is important to prevent damage and increase the life of the vehicle. This can be done by using ceramic substrates that offer high thermal conductivity.

As per the World Economic Forum, sales of EVs reached 10.5 million units in 2022, which was a surge of 55% from the previous year. The number of EVs and HEVs is increasing rapidly as supporting technologies are improving and countries are setting targets to decrease emissions. Essentially, the high-performance requirement with EVs/HEVs drives the market as their performance depends on high-voltage inverters, semiconductors, and other electronic components.

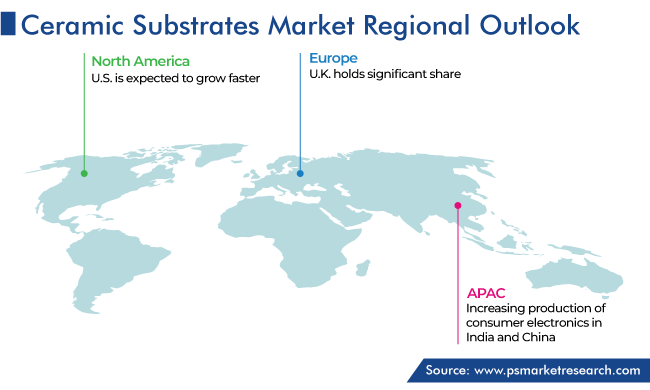

APAC To Dominate Market

Geographically, APAC is dominating the market, and it is expected to hold a share of around 45% by 2030. This can be ascribed to the increasing production and advancement of consumer electronics in India and China. Additionally, due to the growing demand for integrated circuits for artificial intelligence applications and the booming semiconductor industry, Asia is the largest manufacturer of semiconductors.

Further, the Chinese government has targeted to make the country 70% self-sufficient in integrated circuit production by 2025. With this, the semiconductor industry in this region will grow at a high rate, which will, in turn, propel the demand for ceramic substrates as well.

Additionally, in April 2022, the Semiconductor Industry Association (SSIA) of the U.S. and the India Electronics and Semiconductor Association (IESA) signed a memorandum of understanding to promote commercial and technological cooperation between electronics and semiconductor manufacturers. Seeing the opportunity, many companies in this region are launching new products for a wide range of purposes. For instance, in September 2023, KYOCERA launched silicon nitride hot surface igniters rated at 230 V for gas furnaces, boilers, and water heaters. These substrates, with high endurance and stable ignition performance, are designed for industrial and residential heating applications.

Another key reason for APAC being the dominant market is its highly productive automotive industry, especially in Japan, China, India, and South Korea. With the increasing demand for EVs/HEVs, as well as for better infotainment and other features in cars, the usage of ceramic substrates has a high scope. For instance, as per the World Economic Forum, in 2022, sales of new EVs in China increased by 82% compared to the previous year.

Ceramic Substrate Companies:

- KYOCERA Corporation

- MARUWA Co. Ltd.

- NIKKO COMPANY

- CeramTec GmbH

- KOA Corporation

- TONG HSING ELECTRONIC Industries Ltd.

- LEATEC Fine Ceramics Co. Ltd.

- Nippon Carbide Industries Co. Inc.

Market Size Breakdown by Segment

The study uncovers the biggest trends and opportunities in the ceramic substrates market, along with offering segmentation analysis at the granular level for the period 2017 to 2030.

Based on Type

- Alumina

- Aluminum Nitride

- Silicon Nitride

- Beryllium Oxide

Based on End Use

- Consumer Electronics

- Aerospace & Defense

- Automotive

- Semiconductor

- Telecommunication

Based on Form

- Plates

- Sheets

- Films

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for ceramic substrates generated USD 1,178.2 million in 2023.

The ceramic substrates industry CAGR till 2030 will be 7.0%.

Based on type, the alumina category is the largest in the market for ceramic substrates and aluminum nitride the fastest-growing.

The ceramic substrates industry is propelled by the advancements in semiconductors and growth of the automotive and other industries.

Consumer electronics are the largest end use in the market for ceramic substrates.

The miniaturization of electronic components and the adoption of BEVs/HEVs are the most-prominent ceramic substrates industry trends.

APAC generates the highest revenue in the market for ceramic substrates.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws