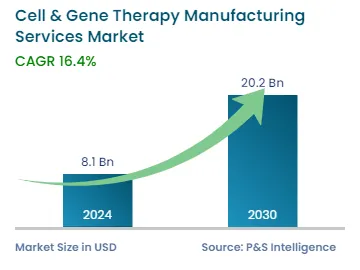

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 8.1 Billion |

| 2030 Forecast | USD 20.2 Billion |

| Growth Rate(CAGR) | 16.4% |

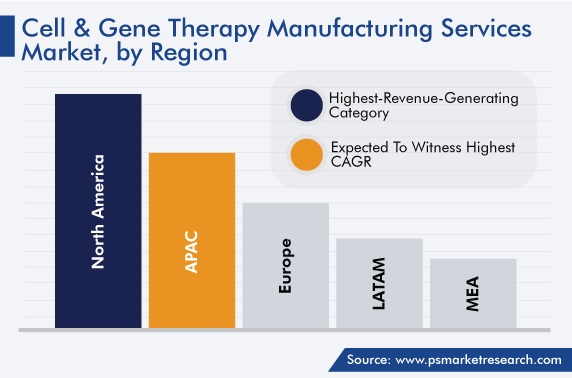

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12626

Get a Comprehensive Overview of the Cell & Gene Therapy Manufacturing Services Market Report Prepared by P&S Intelligence, Segmented by Therapy Type (Cell Therapy, Gene Therapy), Indication (Oncology Disease, Cardiovascular Disease, Orthopedic Disease, Ophthalmology Disease, Central Nervous System Disease, Infectious Disease), Application (Clinical Manufacturing, Commercial Manufacturing), End User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes), Mode (Contract, In-house), Workflow (Cell Processing, Cell Banking, Process Development, Fill & Finish Operations, Vector Production), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 8.1 Billion |

| 2030 Forecast | USD 20.2 Billion |

| Growth Rate(CAGR) | 16.4% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global cell & gene therapy manufacturing services market was valued at USD 8.1 billion in 2024, and it is expected to reach USD 20.2 billion by 2030, advancing at a CAGR of 16.4% during 2024–2030. This is due to the high incidence of cancer and other target diseases, increased pharmaceutical R&D spending, and a large number of therapy development activities.

There is a prominent role of contract manufacturing organizations (CMOs) in this market, and it is also one of the key trends. Cell & gene therapy manufacturers are actively engaging in outsourcing the manufacturing of vectors and gene therapy products, providing them with economic benefits. Some of the advantages of outsourcing vector and gene therapy manufacturing include an increase in productivity, business efficiency, time-to-market, and quality gains. For instance, in 2022, ENCell, a CMO, and Polypus, a solutions provider of advanced biologic and cell and gene therapy production, partnered for optimizing a range of manufacturing technologies of viral vectors.

Cell therapy held a larger revenue share, of around 62%, in 2022. This is because cell-based therapy is widely used for the clinical investigation of cardiovascular diseases, due to rigorous pre-clinical studies of cell biology, phenotypic efficacy, mechanism of action, and immunology.

Standard immunologic dogma accounts that any foreign tissue is expected to cause an immune reaction. This impression is evident in hematopoietic transplantation and solid organ, in which hostile immunosuppression is the key to safeguarding allografts from rejection. As the cell-based therapy field evolves, several cell types such as MSCs have adequate ability to suppress or/and evade the immune system to the level that they are applied as allografts without the need for concomitant immunosuppression.

Moreover, allogenic therapy leads to great functionality of cells. Allogenic T-cells are available readily, compared to a manufacturing time of around a month for a custom, patient-specific product. This is advantageous, since irrecoverable disease progression may occur while awaiting autologous cell therapy manufacture.

The oncology disease category held the largest revenue share in 2022. With a regular increase in the cases of cancer and other rare diseases, the demand for cell & gene therapies is increasing globally. This is because these therapies are able to cure genetic diseases and have several advantages, such as cancer gene therapy does not require long-term transgene expression. Thus, the increasing burden of cancer is pushing pharmaceutical and biotechnology companies to develop novel gene therapies for its treatment. For instance, in 2021, in the U.S., there were around 2 million new cancer cases. In 2022, there were around 2.0 million new cancer cases diagnosed and over 0.6 million cancer deaths in the country.

Based on application, the clinical manufacturing category held a larger revenue share, of more than 58%, in 2022, in the global cell & gene therapy manufacturing services market. In 2022, the FDA approved five new cell and gene therapies, and various therapies are in pipeline and to be launched in the coming years. By 2024, more than 20 cell therapies and more than 30 gene therapies are expected to be launched, including around 30 AAV therapies. Also, companies are focusing on developing new therapies for the treatment of diseases, such as cancer, cardiovascular diseases, auto-immune disease, and infectious diseases, which, in turn, drives the demand for clinical manufacturing services.

The rising participation of public and private research organizations in gene therapy research is boosting the growth of the gene therapy sector, globally. Although the development of the gene therapy process is complex and requires many new techniques, with the development of technologies over decades, the resurgence in the development of gene therapies has advanced significantly, through the optimization of the type of vectors, the introduction of new techniques, such as induced pluripotent stem cells in combination with current models of gene editing, and even by trials in germ cells.

Moreover, researchers and manufacturers are increasingly focusing on the development of new experimental vectors, increased treatment efficiency, improved specificity of delivery systems, and a greater understanding of the inflammatory response, which will balance the improvement of safety with the expansion of techniques in clinical applications. Therefore, with the rising research activities, the industry is expected to address unmet medical needs for the treatment of rare diseases.

Drive strategic growth with comprehensive market analysis

North America leads the market, accounting for a revenue share of around 49% in 2022. This is due to the increasing number of product launches, the surging incidence of cancer cases, the growing focus on the treatment of rare diseases, the rising number of clinical trials, and the presence of major industry players in the region.

Moreover, technological advancements in the region are increasing the demand for gene therapies. The developments of novel platforms for the precise targeting of small molecules, gene and stem cell therapies, gene modification, and gene rectification technologies offer new prospects for therapies and cures for rare and genetic diseases. One of the most significant innovations is the discovery of the potential of RNA, which was historically underestimated.

In addition, gene editing technologies can be utilized in the identification of novel targets for a whole host of therapeutic areas through genomic screens. Moreover, companies are further focusing on enhancing the development process of cell & gene therapies, which is expected to drive the market growth in the region.

Furthermore, the U.S. demographics for the aged population of 65 years and above increased to over 50 million in 2021. Thus, the growing aging population with chronic diseases at an exponential pace has boosted the growth of the industry. Also, with the rising demand for CDMO facilities, companies are investing in the region. For instance, Fujifilm is investing USD 2 billion to expand its CDMO capabilities in the U.S.

Moreover, chronic diseases, such as cancer, heart disease, and diabetes, were the leading causes of death in the U.S. and cost more than USD 4.0 trillion in 2021 to healthcare systems. Also, around 45% of the U.S. population has at least one chronic ailment, and by 2025, around 165 million Americans will be suffering from more than one chronic disease. The huge burden of cost regarding the treatment of a large number of chronic cases has created an urge from patients as well as healthcare systems to seek alternatives to the high-cost branded drugs.

Furthermore, Europe held a significant share of the market. In the region, around one-third of the total population of 15 years and above are suffering from at least two chronic ailments. The occurrence of more than one chronic illness has become common in Europe. This trend is attributed to unhealthy diets, increasing smoking habits, and surging alcohol consumption. The European government is amending the rules and focusing on providing healthy food by implementing regulations on food quality testing, as the prevalence of obesity is at its peak in regional countries.

Moreover, smoking is another big concern claiming one life every six seconds in Europe, as tobacco use is high in the region. For instance, more than 17% of adults and more than 14% of the young generation (15–26-year age group) are using tobacco in Europe. Similarly, the region has recorded an increase in alcohol consumption, which is a high-risk factor for deaths in adults and young people who are drinking heavily. Thus, these factors drive the demand for therapy manufacturing services in the region.

This report offers deep insights into the cell and gene therapy manufacturing services industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Therapy Type

Based on Indication

Based on Application

Based on End User

Based on Mode

Based on Workflow

Geographical Analysis

The cell & gene therapy manufacturing services market size stood at USD 8.1 billion in 2024.

During 2024–2030, the growth rate of the cell & gene therapy manufacturing services market will be around 16.4%.

Oncology Disease is the largest indication in the cell & gene therapy manufacturing services market.

The major drivers of the cell & gene therapy manufacturing services market include the high incidence of cancer and other target diseases, the increasing pharmaceutical R&D spending, and the rising private and public investments in the cell and gene therapy industry.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages