Market Statistics

| Study Period | 2019 - 2030 |

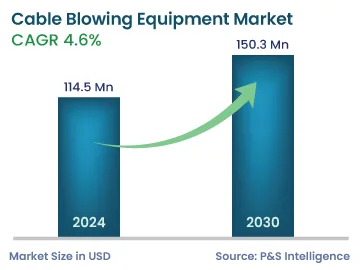

| 2024 Market Size | 114.5 Million |

| 2030 Forecast | 150.3 Million |

| Growth Rate(CAGR) | 4.6% |

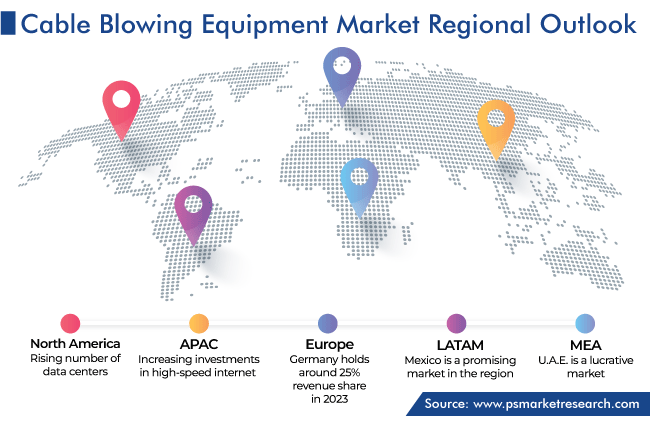

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12766

Get a Comprehensive Overview of the Cable Blowing Equipment Market Report Prepared by P&S Intelligence, Segmented by Power Type (Hydraulically Powered, Pneumatically Powered, Electrically Driven, Drill-Driven), Cable Type (Micro-Duct, Normal Duct), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 114.5 Million |

| 2030 Forecast | 150.3 Million |

| Growth Rate(CAGR) | 4.6% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The cable blowing equipment market size stood at USD 114.5 million in 2024, and it is expected to grow at a compound annual growth rate of 4.6% during 2024–2030, to reach USD 150.3 million by 2030. This is ascribed to the increasing demand for fiber cable connections, innovations in optical connections, the rising usage of optical fiber in telecommunications, and the surging number of data centers. Additionally, due to the increasing usage of the internet, network-providing companies are investing more and more in their infrastructure to offer fast and reliable networks to customers, which, in turn, drives the demand for such equipment.

Due to the increasing number of data centers, the use of optical fiber cables is rising, which, in turn, drives the market for cable-blowing equipment. The requirement for data centers globally is rising at a high rate because of the boom in the usage of advanced computer technologies. Furthermore, with the rising research and development investments in these centers in developed countries, such as Germany and the U.S., and the formation of next-generation centers, which are more efficient in terms of managing information and technologically advanced, the demand for such equipment is surging.

Due to various technological advancements, the usage of internet data has taken a massive jump, as people are shifting toward smart devices, such as mobile phones, laptops, and tablets, which use the internet. Also, with new technologies such as , , weather-tracking devices, and more, the demand for low-latency networks has increased over time. The emergence and widespread deployment of 5G networks is also one of the reasons, companies are upgrading their systems and equipment that can support high data speeds and low latency through high-speed fiber cables.

Moreover, there are various investments toward broadband, which are funded by governments including grants at state and federal levels in various countries globally. Also, governments have taken several initiatives to improve internet connectivity. For instance, the European Union has announced a new consultation to provide gigabit internet to all citizens and businesses in all the member countries by 2030 under the Gigabit Infrastructure Act. Under this act, all new and majorly renovated buildings will be equipped with fiber.

In addition, developing countries like India are also focusing on providing high-speed broadband internet connections to their rural areas. There are many projects like BharatNet Project under which 19,663 Gram Panchayats (GPs) have been made service ready, optical fiber cable networks of around 10 lakh route kilometers laid by PSUs like Bharat Sanchar Nigam Limited (BSNL), GAIL (India) Limited, RailTel, Mahanagar Telephone Nigam Limited (MTNL), and Bharat Broadband Nigam Limited (BBNL), and around 5.70 lakh telecom towers were installed by telecom service providers (TSPs), which have been mapped on the PM GatiShakti National Master Plan Platform. Thus, these factors drive the demand for cable-blowing equipment.

There are many recent technological advancements in optical fiber around the world. One of the advancements is the development of 10 Gigabit Symmetrical Passive Optical Network (XGS-PON) technology, which has become the standard for meeting the multi-gigabit bandwidth demands of residential and businesses. Presently, Gigabit Passive Optical Network (GPON) is the standard, which is being used by internet service providers (ISPs). This is capable of providing network access at a speed of up to 2.4 Gbps downstream and 1.2 Gbps upstream, while XGS-PON can provide over 4x downstream and 8x upstream bandwidth to users.

These advancements will help all users, including online , for streaming higher-resolution content on multiple devices. These technologies require high-quality fiber cables to run and in return drive the cable blowing equipment market.

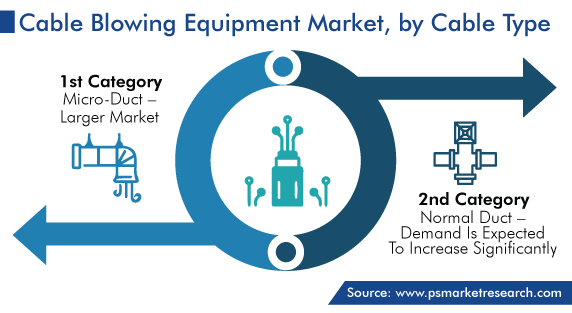

Based on cable type, the demand for micro duct cables is expected to grow at a higher CAGR, of 4.9%, in the forecast period. This can be because they are a reasonable solution for reducing the cost of network building, construction, and reinstallation. These solutions offer an inexpensive and alternative option to enhance, rebuild, and improve data pathways for meeting the increasing data demand. Also, these smaller cables allow for smaller enclosures and can be placed in existing vaults and pedestals. These cables range from 3 mm and 16 mm and are smaller in size and weigh less than the traditionally used cables.

Many major players like Prysmian Group, Daetwyler Cables, and OFS are also launching FTTH cables with high fiber density for micro ducts, which can bend easily and have a very small diameter. Due to the increasing product developments by various players, the market is growing in this category.

The pneumatically powered category held a significant revenue share of 25% in 2023 and it is expected to grow at a CAGR of 4.3% in the coming years. This is because it is cost-effective and uses high-pressurized air to blow the air into HDPE pipes, which is a more efficient way as compared to using other types of machines. Additionally, these machines are many used to blow fiber optic cables, multipair cables, and tiny coaxial cables, which are being used in many applications like high-speed internet connections and data centers. Due to these factors, the demand for pneumatically-powered cable-blowing machines is high and increasing.

Drive strategic growth with comprehensive market analysis

In 2023, North America accounted for the largest market share, of 50%, due to the rising number of data centers, the presence of highly advanced, extensive, and efficient technological infrastructure, and technological advancements in the region. In North America, the U.S. holds a major market share. Only the U.S. has over 2600 data centers, which is the highest in the world. Moreover, the research and development in the region are very strong which led to the development of next-generation data centers that are technologically advanced and efficient in terms of managing information.

In North America, various federal broadband funding grants and programs are being implemented to provide broadband services to underserved and un-served areas. These programs support FTTH deployments like Broadband Equity, Access, and Deployment (BEAD), with a funding of around $42.45 billion, which is administered by one of the agencies of the federal government named the National Telecommunications and Information Administration (NTIA). Also, the Canadian Radio-television and Telecommunications Commission (CRTC) funded around $3 billion for extending high-speed broadband connectivity into underserved rural and remote locations of Canada. Thus, these factors drive the regional market.

On the other hand, the APAC market will witness the fastest growth in the coming years. This can be ascribed to the various steps being taken for improving internet connectivity and increasing the development of data centers by major countries in the region like India and China.

For instance, Singapore is focusing on increasing investments in the advancements of data centers. There are more than 70 operational data centers in the country with a footprint of around 378 MW or more than 7% of Singapore’s electricity. Also, there are many U.S. companies that have invested in the country such as Digital Realty, Equinix, Savvis, IBM, Amazon, Microsoft, Google, and Verizon. With this rapid expansion in the country, the demand for cable-blowing equipment will also increase.

Additionally, countries like China are also increasing their investments in high-speed internet and data centers. In 2023, China launched a new project for building a centralized data center system across eight regions in the nation, named the East to West Computing Capacity Diversion Project. This focuses on channeling the increasing demand for computing and data analysis in the country. This type of project will increase the demand for fiber cables and in return boosts the need for cable-blowing equipment. Also, the low production costs of such equipment and the presence of big players are driving the market growth in the country.

The report analyzes the impact of the major drivers and restraints on the cable blowing equipment industry, to offer accurate market estimations for 2019-2030.

Based on Power Type

Based on Cable Type

Geographical Analysis

The cable blowing equipment market size stood at USD 114.5 million in 2024.

During 2024–2030, the growth rate of the cable blowing equipment market will be around 4.6%.

Micro duct is the fastest cable type in the cable blowing equipment market.

The major drivers of the cable blowing equipment market include the increasing usage of fiber optic cables in data centers and the telecommunication industry, the surging innovations in new optical connections, the rising number of data centers, and the growing usage of the internet.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages