Report Code: 12830 | Available Format: PDF | Pages: 240

Biocatalyst Market Size and Share Analysis by Source (Plants, Animals, Microorganisms), Type (Hydrolases, Oxidoreductases, Transferases), Application (Food & Beverages, Cleaning Agents, Biofuels, Agrochemicals & Animal Feed, Biopharmaceuticals) - Global Industry Demand Forecast to 2030

- Report Code: 12830

- Available Format: PDF

- Pages: 240

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Biocatalyst Market Size & Share

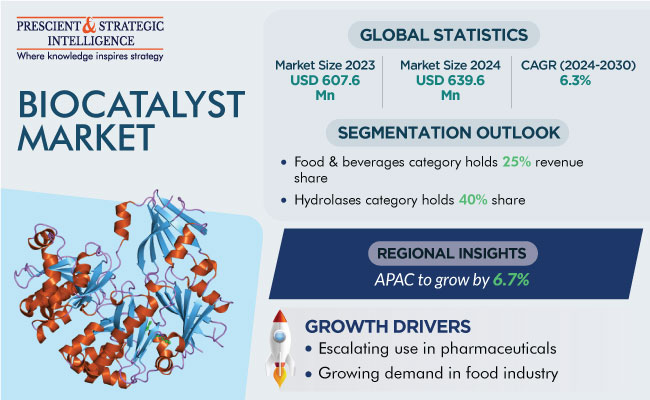

The biocatalyst market size stood at USD 607.6 million in 2023, and it is expected to witness a compound annual growth rate of 6.3% during 2024–2030, to reach USD 925.2 million by 2030.

Catalysts extracted from biological sources act as an alternative to those containing synthetic and, often, petroleum-based chemicals in several industrial applications. These products are largely used to synthesize specialty and commodity chemicals. In recent years, their production has been boosted by the emergence of economical genetic engineering technologies, which allow for quick, affordable screening of various sets of enzyme variants. These bio-enzymes ensure accurate reactions to get the desired products with least wastage and minimal by-products.

The market expansion is primarily ascribed to the surge in bio-enzyme usage in various industries, such as pharmaceuticals, food & beverages, and chemicals, enabled by advanced product launches, collaborations, acquisitions, and R&D activities. Further, the growing demand for eco-friendly biofuels is a strong biocatalyst market growth driver.

Escalating Use of Biocatalysts in Pharmaceuticals

Biocatalysts are increasingly being applied in biotransformation processes, and thus, they have become noteworthy almost in all sectors, particularly pharmaceuticals and chemicals. The development of cost-effective and eco-friendly chemoenzymatic processes strongly depends on the wider accessibility and pertinency of enzymes with high performance, regardless of environmental conditions.

Biocatalysis ensures that compound molecules are created with high precision, while meeting rigorous quality standards. This cements their cruciality in the pharmacological industry, where precise concentrations and quality are principal. The most-prominent industrial applications of biocatalysis are chiral compounds, which are required for pharmaceuticals, and flavors and fragrances. In pharmaceuticals, intermediate compounds containing chiral hydroxyl moieties are found in numerous APIs, as well as used in the synthesis of different chemicals.

Bio-based enzymes are an alluring technology for the pharmaceutical sector as the catalysis performed by them satisfies the ever-increasing demand for specific, safe, and sustainable medicinal manufacturing procedures. Further, biocatalysts have a large 3D structure, which allows for various points of contact with the substrate of interest, thus resulting in high selectivity. Further, the properties of a biocatalyst can be changed with modifications to the protein sequencing, via protein engineering. Additionally, biocatalysis offers both financial and ecological advantages over chemical catalysis (chemo catalytic) methods, as biocatalyst enzymes are produced from low-cost renewable resources and are biodegradable.

Further, the advent of several tools and techniques discussed above is expected to enhance the stability of bio-enzymes, thermostability, and enzyme–substrate affinity, which will, in, turn, lead to higher efficiency. Additionally, the integration of cell factory design, artificial metabolic pathways, and nanotechnology approaches is expected to aid in appropriate biocatalysis. This, in turn, is expected to ensure the desired productivity and quality of drugs.

In addition, the industry has incorporated green products and technologies quickly to curtail its negative environmental impact and reduce its carbon footprint. Moreover, the adoption of such green inputs in pharma production enables the replacement of multi-step synthetic pathways with a single enzymatic activity, thereby eliminating the usage of harmful reagents.

Hydrolases Held Substantial Revenue Share in 2023

Based on type, hydrolases accounted for a substantial market share of the revenue, of 40%, in 2023. These compounds play critical roles in various biological process, and they are one of the largest and most-diverse classes of enzymes, including amidases, proteases, and lipases. These enzymes are ingredients in approved drugs for indications such as Alzheimer's disease, type 2 diabetes, and infectious diseases. Hydrolases are also used to remove blood and protein stains, to provide clothes with a clean appearance and, hence, are added to detergents.

| Report Attribute | Details |

Market Size in 2023 |

USD 607.6 Million |

Market Size in 2024 |

USD 639.6 Million |

Revenue Forecast in 2030 |

USD 925.2 Million |

Growth Rate |

6.3% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Source; By Type; By Application; By Region |

Explore more about this report - Request free sample

Escalating Use of Biocatalysts in Food Industry

The food & beverages category held a revenue share of 25% in 2023 in the application segment. Biocatalysts are one of the most-important enzymes in the food industry as they are used for food processing and additive production. Bio-enzymes are used by the brewing, bread & bakery, dairy, meat, beverages, and sugar sectors.

In food processing, such catalysts are used for fermentation, to enhance the shelf life, digestibility, taste, and quality of the food. They are also used to create flavors and food additives that meet governments’ stringent safety and quality standards. Therefore, the surging consumption of processed food due to the busy schedules and the growing awareness of organic food products are driving the consumption of bio-enzymes.

Increasing Demand for Sustainable and Eco-Friendly Processes

Biocatalysis emerges as a favorable option in the era of the growing environmental awareness and focus on sustainability, when higher functional efficiency and safety are required across industries. The reason behind the process being sustainable with a smaller environment footprint is that it operates under mild conditions, including lower temperatures and, hence, cuts down energy consumption, waste, and the number of by-products. Moreover, with continuous innovation, biocatalysis can be adapted to meet the changing requirements of various industries.

The growth of various industries and the increase in the purchasing power of people are expected to positively influence the demand for biocatalysts globally. Bio-enzymes are used in ethanol and biodiesel production, which are witnessing increasing consumption with the rising sale of automobiles around the world.

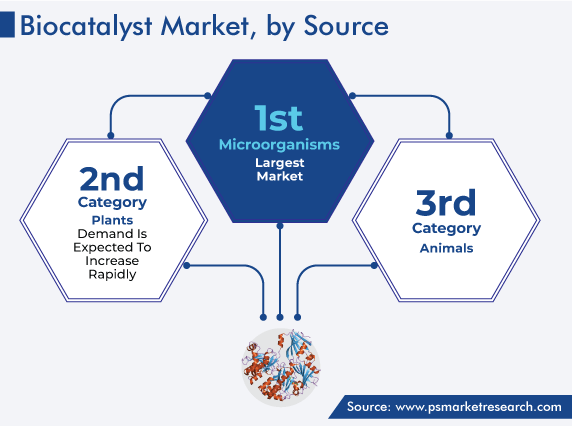

Microorganisms Category Is Highest Revenue Generator

Among the available sources, microorganisms accounted for a market value of USD 0.2 billion in 2023, and this category is expected to witness a significant growth rate over this decade. This is because enzymes produced from microbial sources result in a lower cost of production, can be cultured in bulk and in quick time, and contain a higher yet manageable enzyme content. Further, microbe-based enzymes are robust, drive reactions at a high rate, produce various active compounds, and are cost-effective.

Therefore, these chemicals are finding usage in an increasing number of reactions in different industries, such as cosmetics, biorefining, food & beverages, chemicals, pharmaceuticals, confectionery, textiles, and paper & pulp. They have also been progressively adopted in late-phase pharmaceutical R&D and in the manufacturing of APIs.

In 2023, North America Dominated Global Market

In 2023, North America was the most-substantial revenue contributor to the global biocatalyst market, and it is likely to grow at a significant rate during the forecast period.

The booming pharma and food industries across the region are the major drivers for the market. Globally, American and European companies lead global pharmaceutical production and sales. As per a government report, North America accounted for 49.1%, whereas Europe accounted for 23.4% of the worldwide pharmaceutical sales in 2021. Further, according to the European Federation of Pharmaceutical Industries and Associations (EFPIA), the U.S. and Europe accounted for 64.4% and 16% of the sales of novel drugs launched during 2016–2021, respectively.

Moreover, the regional market growth is due to the swift economic growth and easy accessibility of various enzymes for an extensive range of applications. Additionally, the consistent R&D by the industry players for creating high-performance products is bolstering the market in the region. For instance, in 2019, the U.S. invested USD 83 billion in R&D on pharmaceuticals and USD 122 billion in 2020.

The key reason behind the growing usage of biocatalysts in the F&B industry in North America is the rising inclinations toward diverse tastes and preferences owing to the multicultural population and people’s willingness to experiment with new food products and beverages. Besides the adoption of international flavors, consumers have begun preferring sustainable food alternatives, with the growing health awareness, need for higher food safety and quality, and technological advancements. Such requirements are transforming the entire supply chain from the use of raw materials to the marketing of F&B products. Therefore, the benefits associated with the use of bio-enzymes in various food products and the growing food industry are boosting the demand for biocatalysts.

Key Biocatalyst Manufacturers Are:

- Codexis Inc.

- DuPont de Nemours Inc.

- Koninklijke DSM N.V.

- Novozymes

- BASF SE

- Amano Enzyme Inc.

- Biocatalysts Limited

- AB Enzymes GmbH

- Lonza Group Ltd.

- Chr. Hansen Holding A/S

Market Size Breakdown by Segment

This report offers deep insights into the biocatalyst market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Source

- Plants

- Animals

- Microorganisms

Based on Type

- Hydrolases

- Oxidoreductases

- Transferases

Based on Application

- Food & Beverages

- Cleaning Agents

- Biofuels

- Agrochemicals & Animal Feed

- Biopharmaceuticals

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for biocatalysts will grow by 6.3% by 2030.

In 2030, the biocatalyst industry revenue will be USD 925.2 million.

Microorganisms are the preferred source in the market for biocatalysts.

The biocatalyst industry is driven by the growing end-use industries and rising awareness of sustainable ingredients and raw materials.

The key applications in the market for biocatalysts are pharmaceuticals, food & beverages, and personal care & cosmetics.

North America holds the largest biocatalyst industry share.

Players in the market for biocatalysts are launching new products and entering into partnerships.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws