Bio Decontamination Market Future Outlook

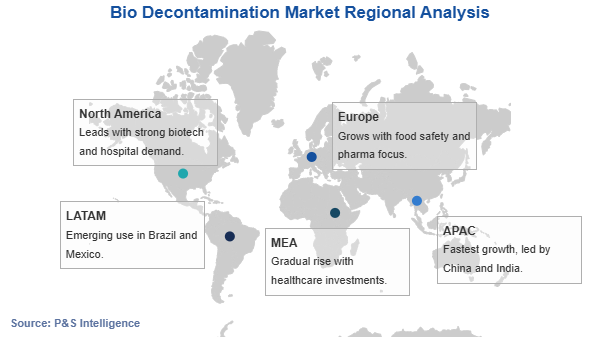

The global bio decontamination market was valued at USD 199.8 million in 2024, and the industry size will reach USD 331.9 million by 2032, advancing at a compound annual growth rate of 6.7% during 2025–2032. The market is driven by the increasing incidence of HAIs, growing number of surgical procedures, and growth in pharmaceutical and biotechnology industry.

In order to prevent a risk to health from exposure to biological pathogens, a high level of cleanliness is required for a variety of healthcare, pharmaceutical, and research facilities. These facilities include fermentation suites, animal facilities, CL3 and CL4 containment laboratories, hospital isolation and critical care rooms, tissue culture labs, blood banks, and cleanroom production areas for pharmaceuticals. While contamination of healthcare facilities, such as operating rooms, intensive care units, and isolation units pose a direct risk to patients or personnel, the sterilization and safety of equipment or pharmaceuticals being produced may be at risk in other types of decontamination processes.

Increasing surgical procedures are trending due to the growing prevalence of cancer, growth in geriatric population, rising prevalence of age related and chronic diseases, and technological advancement. The surgery field is experiencing an extraordinary technology and human partnership that could increase the precision and effectiveness of surgeries. With advancements in medical technology, there is always something new, including new techniques, new systems, and new ideas for utilizing existing systems or technology. The area is optimized to improve surgical results significantly as soon as optical imaging, robots, and other high-tech improvements add to improved precision and less invasive surgical procedures.

Moreover, age-related risk for specific cancers can be the cause of sharp increase in the incidence of cancer. In addition to the general risk, aging people have less effective cellular repair systems.