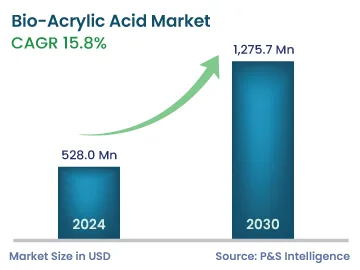

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 528.0 Million |

| 2030 Forecast | 1,275.7 Million |

| Growth Rate(CAGR) | 15.8% |

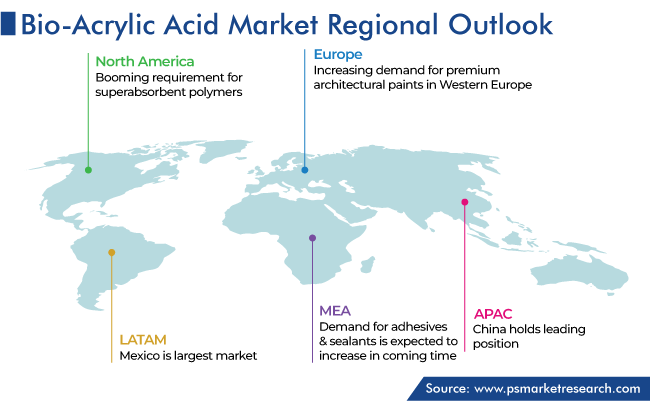

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Report Code: 12807

Get a Comprehensive Overview of the Bio-Acrylic Acid Market Report Prepared by P&S Intelligence, Segmented by Derivative (Methyl Acrylate, Ethyl Acrylate, Butyl Acrylate, 2-Ethylhexyl Acrylate, Elastomers, Superabsorbent Polymers), Application (Paints and Coatings, Adhesives and Sealants, Surfactants, Textiles, Sanitary Products), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 528.0 Million |

| 2030 Forecast | 1,275.7 Million |

| Growth Rate(CAGR) | 15.8% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The bio-acrylic acid market size stands at an estimated USD 528 million in 2024, and it is expected to advance at a compound annual growth rate of 15.8% during 2024–2030, to reach USD 1,275.7 million by 2030.

The growth can be primarily ascribed to the increasing usage of this chemical in paints and coatings, surfactants, textiles, and adhesives and sealants. In regard to paints, it is majorly used for exterior walls as it possesses high absorbance, adhesion, and ultraviolet resistance. Therefore, in the forecast period, the market is expected to grow because of the wide usage of paints and coatings in various industries. Moreover, the demand for eco-friendly coatings is increasing in a wide range of industrial, architectural, and automotive applications. The long-standing popularity of acrylic acid as an ingredient of such products has now opened the doors for its environment-friendly counterpart.

The growing requirement for adhesives and sealants is another key driver for the market advance. The chemical has adhesion properties and provides protection against UV rays and harsh climate to the adhesive, due to which it is prized as an ingredient of such products in the automotive and construction industries.

Moreover, adhesives containing this chemical find wide usage in the packaging sector because of their resistance against moisture. The widening use of bio-acrylic acid is providing opportunities to the key players for the development of more-sustainable products that do not harm the environment. Hence, many research institutes and companies are trying to develop novel and advanced technologies from catalysis- and fermentation-based processes for the preparation of bio-acrylic acid.

Over the past few decades, the rapid economic development in emerging economies, such as China and Indonesia, has resulted in an increase in the per capita income. In turn, with their growing income, people’s standard of living has also risen. And, with the changing lifestyle, there has been an increase in the demand for packaging solutions, which, in turn, has augmented the use of bio-acrylic acid.

Tapes are now one of the key marketing tools for brand owners, due to the developments in digital printing. To extend the reach of their brand beyond retail stores and into consumers' homes, brand owners are now requesting secondary packages, which utilize printed tapes. Thus, in February 2022, Mitsubishi Chemicals announced the development of a new pilot plant, which produces MMA from plant-derived raw material. Employing plant-derived materials with the existing manufacturing processes will enable Mitsubishi to produce acrylic acid from 100% bio-derived carbon.

Superabsorbent polymers hold the significant share, attributed to their ability to absorb a large quantity of aqueous solutions. This is the biggest reason behind their usage in diapers, incontinence pads, absorbent medical dressings, controlled-release drugs, and many more products. According to government reports, in a day, infants require up to 12 diapers. This propels the requirement for superabsorbent polymers as diapers must be able to absorb significant amounts of urine and fecal matter, to keep the baby dry and comfortable.

For the same reason, these derivatives are used in sanitary napkins. Governments around the world are taking several initiatives to create awareness among people about the benefits of personal hygiene. This increases the usage of sanitary napkins among women, which will, in turn, drive the consumption of superabsorbent polymers in the forecast period. Furthermore, with the growing research and development focus, more-absorbent diapers and sanitary napkins are being created, which offers market players opportunities for growth.

The butyl acrylate category is growing at a significant pace, as governments are increasingly investing in infrastructure projects, especially in the APAC region. Silanes are widely used to protect buildings from deterioration. In regard to construction, silanes are a key ingredient of the coatings used in hospitals, food & beverage production facilities, kitchens, and pharmaceutical manufacturing areas.

The elastomers category is also expected to grow rapidly in the coming years, attributed to the wide usage of these chemicals to enhance texture and increase stretchability. Along with this, they have high thermal stability and resistance against oil.

The consumption of methyl acrylate is also growing because of its resistance against water, UV rays, sunlight, and chemicals, ability to withstand a wide range of temperatures, and muti-substrate adhesion property.

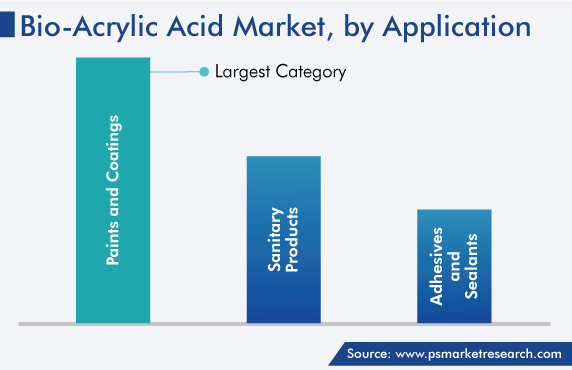

Paints and coatings are the largest application, ascribed to the wide range of advantages of bio-acrylic acid in these products, such as improvement in consistency, shelf life, and texture. In regard to paints and coatings, the rising automobile requirement, attributed to the increasing level of urbanization; growing construction activity, and booming oil & gas industry are fueling the market advance. Furthermore, the increasing awareness among consumers of the importance of low-VOC paints and coatings in keeping diseases such as cancer at bay will contribute to the growth of the market.

Essentially, the increasing disposable income and upgrading living standards of people are supporting the growth of the market. According to the Bureau of Economic Analysis (BEA), in the first quarter of 2021, consumer expenditure reached USD 15.1 trillion. On an annualized basis, that was an 11.4% gain over the fourth quarter.

This chemical is also widely used in personal care products, especially diapers and adult incontinence products. In addition, around the world, the booming demand for other personal care products, such as hair wash, body wash, and cleansers, is propelling the consumption of this base chemical.

Surfactants are expected to showcase the highest growth rate because of the rising demand for coatings in the aerospace, automotive, and paper industries. The chemical is used in surfactants as it aids in penetrating the dye evenly.

Based on Derivative

Based on Application

Drive strategic growth with comprehensive market analysis

APAC has the leading position in the market, and it will hold the same position till 2030, with a value of USD 0.2 billion. This is attributed to the growing industrial activities, which are, in turn, propelling the demand for paints and coatings. In APAC, China holds the leading position, and it will grow with a CAGR of 16.2% because of the increasing awareness related to personal hygiene and the rising construction activities. Furthermore, consistent growth is being seen in the automobile industry, which will fuel the demand for bio-acrylic acid as a key component of automotive coatings over the coming few years.

In addition, construction activities are rising all over the region because of the increasing rate of urbanization. This will also fuel the demand for bio-acrylic acid as an ingredient of paints and coatings in the forecast period. The Indian population is rapidly shifting to urban areas, which has increased the requirement for housing units that need to be affordable. Further, the increasing disposable income has resulted in a rise in the sale of automobiles, which is another key driver for the market.

Additionally, governments of regional countries are implementing strict guidelines on the construction and automotive sectors to reduce their VOC emissions. This will further promote the applications of environment-friendly and isocyanate-free solutions.

The 2023 revenue of the market for bio-acrylic acid is USD 528 million.

The bio-acrylic acid industry CAGR till 2030 will be 15.8%.

Superabsorbent polymers hold the largest share in the market for bio-acrylic acid.

The biggest global trends impacting the bio-acrylic acid industry positively are sustainability and VOC emission reduction.

The market for bio-acrylic acid is propelled by the growing demand for paints, coatings, adhesives, and sealants in numerous industries.

Paint and coating applications have the highest bio-acrylic acid industry value.

APAC is the largest and fastest-growing market for bio-acrylic acid.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages