Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 3,932.1 Million |

| 2030 Forecast | USD 9,346 Million |

| Growth Rate(CAGR) | 15.5% |

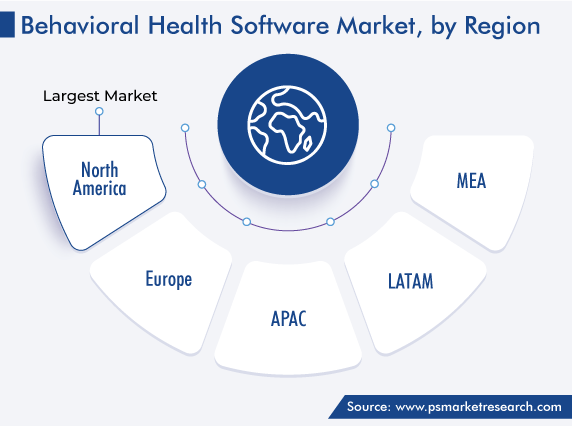

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12566

Get a Comprehensive Overview of the Behavioral Health Software Market Report Prepared by P&S Intelligence, Segmented by Component (Support Services, Software), Delivery Model (Subscription Models, Ownership Models), Functionality (Clinical Functionality, Administrative Functionality), End User (Providers, Payers, Patients), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 3,932.1 Million |

| 2030 Forecast | USD 9,346 Million |

| Growth Rate(CAGR) | 15.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global behavioral health software market generated revenue of USD 3,932.1 million in 2024, which is expected to witness a CAGR of 15.5% during the forecast period, reaching USD 9,346 million by 2030. The growth is mainly driven by the surging demand for mental wellbeing software, availability of government funding, and initiatives to propel the adoption of EHRs in psychiatric hospitals. Essentially, the incessant need for solutions to improve mental health is the key element driving the market expansion.

This is itself on account of the rising prevalence of mental disorders in the young and the old. Patients are seeking treatment due to the rising issue of stress, anxiety, and depression. As a result, healthcare facilities are adopting different software to ensure the mental stability of patients. According to the World Health Organization, depression is the most-prevalent mental disorder and one of the main causes of disability worldwide. According to it, depression affects an estimated 280 million individuals worldwide currently.

Additionally, the strong emphasis of healthcare professionals on high-quality mental healthcare, growing government support for the improvement of behavioral health services, new product and service launches, and collaborations among market participants are all accelerating the market's growth.

Moreover, due to the rising corporate peer pressure and stress, companies are also running behavioral wellbeing programs for their employees, under the umbrella of corporate wellness. This approach seeks to provide psychological and emotional care, along with the management of costs for employees. The players help corporate organizations achieve significant savings on their behavioral health programs, through a model of quality care, easy access, and streamlined administration.

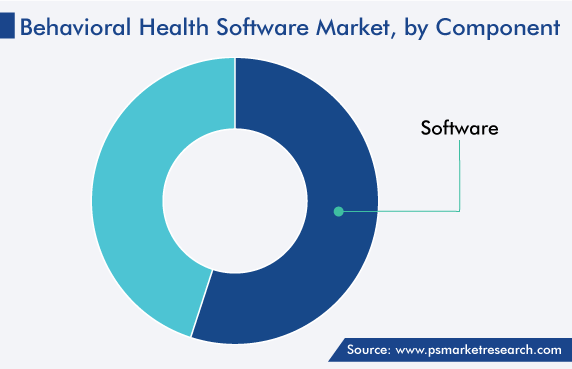

By component, the software category accounted for the larger revenue share, of around 55%, in 2022, and it is further expected to maintain its dominance during the forecast period. This is owing to the increasing adoption of technologically advanced solutions to manage the administrative, financial, and clinical aspects of psychiatric practices. For instance, patients can access services on the go with the help of mobile-integrated EHRs. These systems offer integrated claims and billing capabilities, which can simplify intricate billing processes.

Moreover, with the help of these solutions, medical practitioners can create and pick the best treatment plan for patients struggling with problems such as depression, anxiety, stress, substance misuse, and addiction, based on relevant patient information and clinical evidence. Additionally, corporations are adopting such software to ensure the wellbeing and optimum behavioral health of employees, as part of their corporate wellness responsibility. For instance, Woliba offers an all-in-one wellness and employee experience platform. With Woliba, organizations can implement mobile-friendly wellness, engagement, recognition, and rewards programs with automated communication and real-time data and analytics.

Additionally, between integrated and standalone solutions, the former is increasing in adoption among large enterprises. This is because the services include appointment scheduling, payroll management, billing, claims management, telemedicine, and e-prescriptions.

However, the smaller enterprises prefer standalone solutions as they focus on a specific functionality.

The subscription category held the major market share in 2022, and it is expected to register a CAGR of around 17% during the forecast period. Contrary to large medical offices or hospitals, most small mental healthcare providers do not have enough to send on solutions centered on advanced technologies. Medical professionals are, therefore, reluctant to spend substantial sums on such software, and smaller healthcare entities subscribe to such software because of their tighter financial constraints. Additionally, the availability of a wide variety of software on the subscription basis, to help manage patients’ health status on a routine basis, is another significant reason for the market growth.

Furthermore, the ownership model will show significant growth in this market, because large facilities prefer purchasing the software and installing it on in-house servers, for achieving a smoother workflow and tackling the wellness and behavioral health status of their employees. Additionally, major healthcare centers also prefer the ownership model for maintaining and checking the health status of their patients. Moreover, technical developments have increased the variety of software available on the ownership model, thus promoting the expansion of this category.

Based on functionality, the clinical category dominated the behavioral health software market in 2022, and it is expected to maintain its prominent position, advancing with a CAGR of 16.8%, over the forecast period. This is owing to the rising count of government initiatives to boost the adoption of EHRs. By helping maintain massive amounts of medical records for multiple institutions, EHRs provide real-time data on patients to these entities on a common platform, thus boosting interoperability.

Moreover, the adoption of clinical decision support systems among clinicians, staff, patients, and other participants across the psychological health value chain is rising due to their proactive filtering and presentation of knowledge and person-specific information at the appropriate time, to improve health and treatment efficacy. A range of tools are included in CDSSs to improve clinical workflow and decision-making. Additionally, the government supports the development, adoption, and implementation of the CDSS.

Hence, the rising count of government initiatives to encourage the adoption of advanced healthcare IT is a key driver for the market growth in this category. This is leading to an increase in the usage of e-prescriptions and telehealth around the world, especially since the COVID-19 pandemic.

The administrative category is forecast to witness the fastest growth in the coming years. Centralized scheduling systems are typically needed at large-scale medical centers to view various appointments for doctors. The software helps staff to assign beds to patients and scheduled appointments at various exam rooms at a single platform from one location. Using software to simplify administrative tasks, such as appointment scheduling, can enable timely yet cost-effective service. Further, the management of data that it is generated in healthcare environments can be made efficient and simple with such programs. Moreover, standalone and all-inclusive solutions are offered by market participants to enhance, simplify, and optimize clinical practice.

Drive strategic growth with comprehensive market analysis

North America captured the largest revenue share in the behavioral health software market, of around 42%, in 2022, and it is expected to maintain its prominent position in the market over the forecast period. The U.S.’s large share of the market in the region is attributed to the rise in the number of people requiring these services for freedom from mental illnesses, increase in the funding by the government for their provisioning, and implementation of various behavioral health reforms. Additionally, the easy availability of reimbursement for telepsychiatry services and rising knowledge of mental health software make the region a promising market.

Moreover, the initiatives of the government for telemental health service expansion drive the solution demand. For instance, the Telemental Health Expansion Act was presented in the U.S. Congress in November 2019 with the intention of removing the regional constraints that restrict people located remotely from connecting with a mental health service provider, via telehealth.

The APAC region is expected to register the fastest growth during the forecast period, due to the expanding older population in China, Japan, and India and the increasing smartphone and internet usage. The vast pool of smartphone users in China and India presents the market with an enormous growth potential. Moreover, the rising literacy rate in the regions is responsible for the increasing adoption of technology-driven solutions, such as telemedicine, e-prescriptions, telepsychiatry, and mental health software.

Moreover, the government initiatives to encourage healthcare IT usage is a key driver for the regional market growth. For instance, Australia has a national platform for digital health records, called My Health Record. Unless they have decided they do not want one, every Australian citizen has a "My Health Record". According to government sources, by the end of 2022, all healthcare practitioners in the nation were to be able to use and contribute to the platform's database of medical information.

Based on Component

Based on Delivery Model

Based on Functionality

Based on End User

Geographical Analysis

In 2024, the market for behavioral health software generated 3,932.1 million.

Providers make the largest contribution to the behavioral health software industry.

The market for behavioral health software is driven by the increasing occurrence of depression, anxiety, PTSD, and substance abuse in adults as well as adolescents.

The 2024–2030 CAGR of the behavioral health software industry will be 15.5%.

Software dominates the component segment of the market for behavioral health software, while the clinical category is the largest in the functionality segment.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages