Market Statistics

| Study Period | 2019 - 2030 |

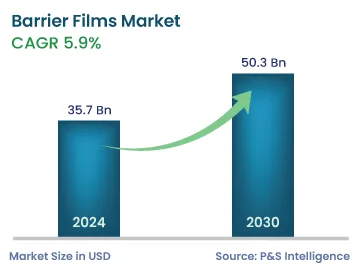

| 2024 Market Size | 35.7 Billion |

| 2030 Forecast | 50.3 Billion |

| Growth Rate(CAGR) | 5.9% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12769

Get a Comprehensive Overview of the Barrier Films Market Report Prepared by P&S Intelligence, Segmented by Type (Metalized, Transparent, White), Material (PET, PE, PP, PA), Coating Type (Organic Coating, Inorganic Oxide Coating), Packaging Type (Pouches, Bags, Blister Packs), End User (Food & Beverage, Pharmaceutical, Agriculture), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 35.7 Billion |

| 2030 Forecast | 50.3 Billion |

| Growth Rate(CAGR) | 5.9% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global barrier films market revenue stands at USD 35.7 billion in 2024, which will reach USD 50.3 billion by 2030, advancing at 5.9% CAGR between 2024 and 2030. This growth is driven by the increasing demand for packaged food & beverages, pharmaceuticals, electronics, and other consumer goods, which need to be shielded from moisture, oxygen, and other environmental forces. Essentially, the busy lifestyles and rising disposable income are boosting the demand for packed food & beverages, which must adhere to strict quality, freshness, and shelf-life standards.

Additionally, the demand for these materials is increasing swiftly in the e-commerce industry, which itself continues to boom. To ensure the secure and immediate delivery of goods to customers, these platforms need effective packaging solutions. This factor boosts the requirement for barrier films as they offer strong protection against moisture, oxygen, and other environmental variables.

The pharmaceutical industry is another major user of these materials, which are widely used to package ointments, tablets, injectables, capsules, and various other products. These foils protect these products from moisture, pollutants, and oxygen, thus increasing their shelf life and maintaining their quality. Furthermore, eco-friendly packaging options, such as biodegradable barrier films and organic coatings, are better than conventional plastic films, as the former are made from renewable resources and are completely recyclable. Thus, market players are focusing on creating such solutions to support a circular economy.

On the basis of type, the metalized category is the largest, generating estimated revenue of USD 16.9 billion in 2023, attributed to the increasing consumption of flexible packaging in the consumer goods, pharmaceutical & medical device, and agrochemical industries. These materials offer protection against oxygen, moisture, and light, thus keeping them fresh for a long time.

Moreover, the globalization of the food & beverage industry, surging concerns for health, rising demand to extend the shelf life of packaged foods, and increasing efforts to reduce plastic usage drive the demand for metalized films. Resultingly, several major companies in the market are conducting R&D for more-effective and sustainable packaging. The market is also driven by the growing popularity of ready-to-eat food products due to the changing lifestyles worldwide.

Additionally, the rising focus on healthy lifestyles since the COVID-19 pandemic and the growing demand for eco-friendly materials help the market expand. Barrier films made of recyclable or biodegradable materials offer the advantage of eco-friendliness over conventional packaging materials.

Additionally, the market continues to boom in Europe due to its strengthening economy and the government regulations for food and drug safety. Every product in the EU is regulated by REACH for the prevention of health and environmental harm. Since metalized barrier films are essential in this regard, their consumption is increasing in the continent. As the market continues to evolve, these films are expected to maintain their popularity due to their protective qualities and ability to meet modern packaging requirements.

Based on material, polyester, or PET, is the largest category in 2023, and this category will experience a CAGR of 6.0%. The key reason for the growth of this category is the rapid increase in the demand for barrier films made of polyester from the food & beverage industry.

Polyester is a transparent, durable, and lightweight plastic that is frequently used in the packaging of food and beverages, especially juices, soft drinks, water, alcoholic beverages, and edible oils. In addition, the FDA and other health & safety organizations worldwide have authorized PET for food & beverage contact applications, which has rapidly made it a preferred packaging material in this industry. Further, these films are becoming increasingly popular in other industrial applications as an insulating medium.

For instance, in October 2022, Sukano and Emery Oleochemicals announced the launch of a PET antifogging compound jointly developed for food packaging. The goal is to eliminate the need for additional antifogging coatings, thus making the packaging more efficient and environment-friendly.

Moreover, revenue of the category from the pharmaceutical industry is increasing significantly, as polyester films are preferred in blister packaging and laminating because of their optical clarity, chemical resilience, and capacity to keep their shape under different circumstances.

Organic coatings are expected to be the faster-growing coating type category, with a CAGR of 6.5%, during the forecast period. This will be due to the wide usage of films made from organic oxides in the food & beverage sector to improve shelf life by preventing moisture and gases from either entering or leaving the package.

Additionally, the use of organic coating barrier films is influenced by the rising need for flexible packaging and to protect electronic devices from dust and other contaminants. Consumers’ inclination is shifting toward organic goods due to their eco-conscious choices. Moreover, governments’ strict regulations regarding chemical usage in packaging materials favor the usage of organic coatings.

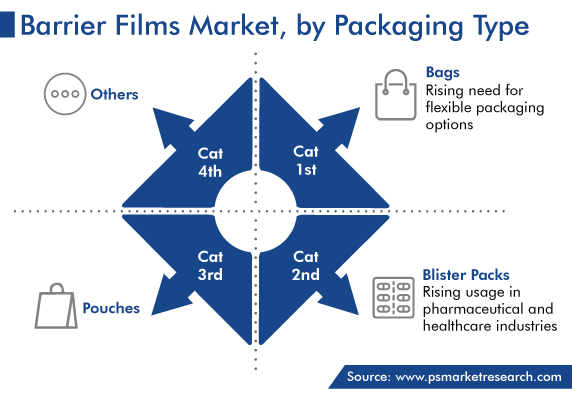

Based on packaging type, bags hold significant market share in 2023, due to the rising need for flexible packaging options. The increasing consumption of packaged products, sustainability concerns, and rapidly advancing technology drive the market in this category.

Further, the demand of the food & beverage industry to protect and preserve products and increase shelf life leads to the need to control pH and water activity, temperature, humidity, and other elements, or to prevent them from affecting the products altogether. Thus, barrier films are widely in the form of bags to store baked goods, frozen foods, meat, and dairy products. The demand for packaged food is increasing as customers are choosing grab-and-go products more frequently, which accelerates the adoption of bags for packaging purposes in the food & beverage business.

Moreover, the market for bags is driven by their growing usage in the electronics and agriculture industries. Bags protect electronic components from moisture and impurities during storage and transportation. And, in agriculture, they preserve products such as seeds and fertilizers by improving their shelf life.

The food & beverage packaging category is dominating the barrier films market, with revenue of USD 13.5 billion in 2023, due to the growing popularity of packaged foods. The rising sale of ready-to-eat meals and packaged instant-cook products from self-service outlets is contributing to the demand for these materials. This sector utilizes barrier packaging films to store and transport ready-to-eat meals, meats, bakery items, seafood, dairy products, confectionery, fruits, vegetables, as well as alcoholic and non-alcoholic beverages. This is done to offer a longer shelf life and preserve product quality.

Moreover, several manufacturers are investing in advanced packaging technologies to prevent contamination and get a competitive advantage. For instance, in July 2023, Winpak Ltd. became the first to install the CrystalClearConnect automated flexo platemaking system to increase production and reduce human intervention. With such innovations in the packaging technology, players are supplying barrier films to this sector.

Agriculture is the fastest-growing category in the end user segment, due to the rising need for modern farming solutions. This creates the demand for these packaging films to protect and increase the shelf life of fertilizers, pesticides, fungicides, and seeds. Further, silage films made of multi-layered, multi-extruded plastics form an airtight seal to preserve the nutrients and freshness of stored livestock feed.

Additionally, these films are used to create greenhouse covers, to offer a controlled environment that helps plants grow efficiently and stay protected from adverse weather. This, in turn, increases the crop yield, improves product quality, and enhances sustainability in agricultural processes.

Drive strategic growth with comprehensive market analysis

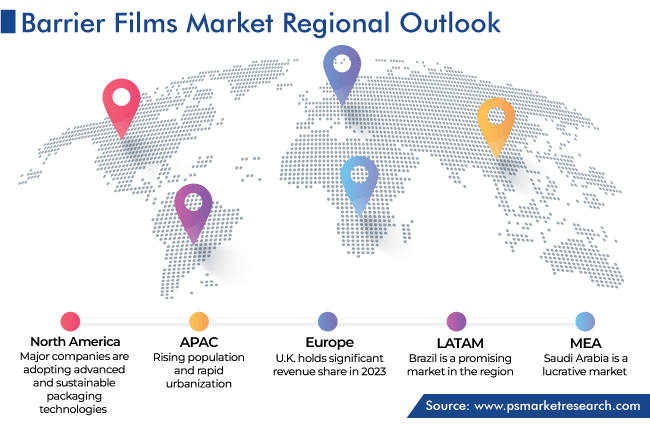

Globally, APAC is dominating the market, generating USD 18.6 billion in 2023, and it will further grow at 6.2% CAGR from 2024 to 2030.

This is due to the rising population and rapid urbanization, which have increased the consumption of packaged foods & beverages, medicinal products, and personal care products. Further, the rapidly growing e-commerce business in this region fuels collaborations, partnerships, and mergers between the players and packaging businesses to meet the demand for strong protective films that can endure handling and shipping procedures. For instance, in June 2023, Dow and P&G China announced a collaboration to develop a recyclable air capsule for e-commerce packaging. The shift in the retail landscape toward sustainability necessitates efficient packaging solutions, making barrier films crucial to ensure product safety and an extended shelf life.

Moreover, the Indian pharmaceutical industry is one of the largest by volume, which will continue to drive the barrier films industry over the forecast period. Maintaining the integrity and efficacy of medical items is imperative, which essentially drives the demand for these materials.

North America is also experiencing significant growth in revenue generation, due to the expanding usage of these films in the food & beverage, agriculture, and pharmaceutical industries. Several major companies are adopting advanced and sustainable packaging technologies to meet the environmental targets and cater to consumers’ need for food items packaged in an eco-friendly way.

This fully customizable report gives a detailed analysis of the barrier films market, based on all the relevant segments and geographies.

Based on Type

Based on Material

Based on Coating Type

Based on Packaging Type

Based on End User

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages