Autonomous Commercial Vehicle Market Analysis

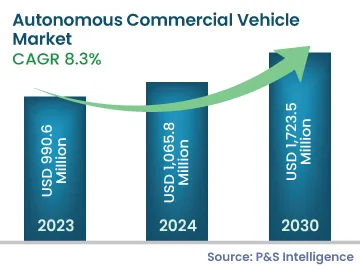

The global autonomous commercial vehicle market generated revenue of USD 990.6 million in 2023, and it is expected to progress with a CAGR of 8.3% during the forecast period 2024–2030. This is due to the technological advancement in connected vehicles, the surging need for an efficient and safe driving option, and increasing government initiatives for the deployment of autonomous commercial vehicles.

The demand for connected vehicles is constantly increasing in countries across the world due to rapid technological advancements and also owing to their unique features that are not available in conventional commercial vehicles. These include smartphone connectivity within the vehicle, roadside assistance, traffic and collision warnings, automobile diagnostics, and real-time traffic monitoring.

Connected vehicles also offer other added advantages to users, such as V2V and V2I interfaces, and sensor applications. The increasing digitization of connected vehicles is also propelling the growth of autonomous commercial vehicles around the world.

The integration of autonomous technology in connected vehicles is comparatively easier as compared to conventional vehicles, as connected vehicles are already equipped with V2V and V2I connectivity, which are two of the primary requirements for achieving vehicle autonomy.

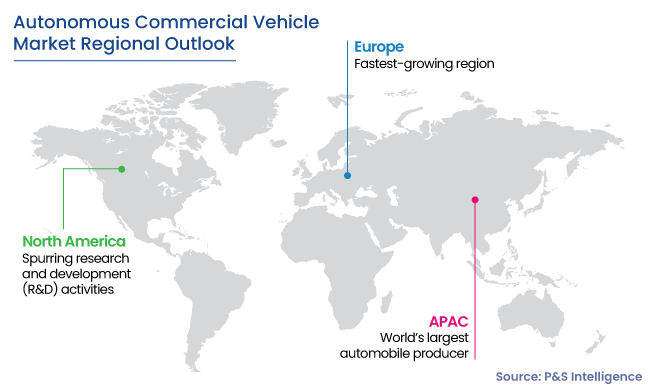

Major global auto manufacturers, such as Ford Motor Company and General Motors Company, are focused on developing connected and autonomous commercial vehicles. These manufacturers have numerous production facilities, which is further expected to benefit the market in the coming years.