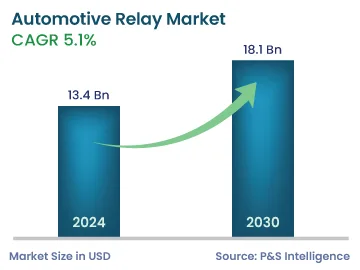

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 13.4 Billion |

| 2030 Forecast | 18.1 Billion |

| Growth Rate(CAGR) | 5.1% |

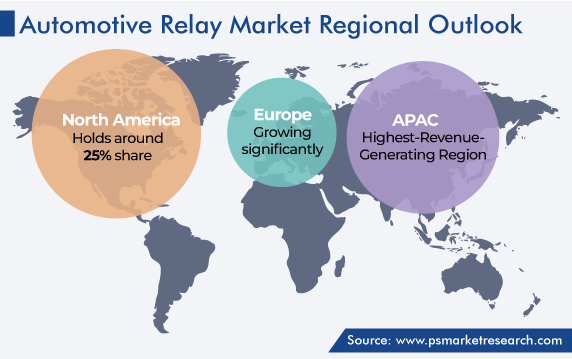

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Report Code: 12767

Get a Comprehensive Overview of the Automotive Relay Market Report Prepared by P&S Intelligence, Segmented by Type (PCB, Plug-In, High-Voltage, Protective, Signal, Time), Application (Door Locks, Power Windows, Sunroofs, Power Seats, Electronic Power Steering, Lighting, Fuel Injectors, Air Conditioners, Starters, Anti-Lock Braking Systems, Traction Control Systems, Cooling Fans, Engine Management Modules, ADAS), Ampere (5A–15A, 16A–35A, >35A), Vehicle Type (BEVs, PHEVs, FCEVs), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 13.4 Billion |

| 2030 Forecast | 18.1 Billion |

| Growth Rate(CAGR) | 5.1% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global automotive relay market size stands at USD 13.4 billion in 2024, and it is expected to advance at a compound annual growth rate of 5.1% during 2024-2030, to reach USD 18.1 billion by 2030.

This is due to the rising need for safer and more-comfortable automobiles, as well as for hybrid and electric vehicles, which is increasing the integration of high-voltage relays. The surging population globally is resulting in an increasing demand for vehicles, specifically in Asia-Pacific, where the population is already huge. Hence, the rising automobile production amidst technological advancements, to cater to the massive demand, is boosting the need for relays.

The rapidly growing integration of electric powertrains into BEVs, PHEVs, and HEVs has increased the need for high-voltage DC relays for shifting purposes. There are several applications for these components in EVs and conventional vehicles, such as HVAC, , and power steering pumps. A relay bears the electrical load and offers a high switching capacity, as sufficient spacing is required for several EV components.

In EVs, it is used for pre-charging, main, and DC charging interfaces. For this purpose, Panasonic has created and patented a relay that helps in boosting the performance of the vehicle. Moreover, the rising e-tailing activities in the automotive aftermarket and the increasing focus on vehicle weight reduction are propelling the demand for such instruments to enhance the driving performance.

The increasing efforts for the protection of the environment, majorly owing to the high rate of ozone layer depletion, are driving the growth in EV sales around the world. This is propelling the demand for relays because there are many applications for them in such automobiles. Presently, the automotive & transportation sector is responsible for over 40% of the global emissions. Hence, Environmental agencies’ concerns over the air pollution caused by vehicles are resulting in the implementation of numerous kinds of government initiatives.

Countries are taking initiatives to curb the emissions by reducing the usage of fuel-based vehicles. EVs are an effective antidote for curbing the impact of pollution on the environment. Further, the stringent government regulations for emission reduction are driving a shift in auto parts manufacturers’ focus toward lightweight raw materials, to increase vehicle efficiency.

The European Commission is also looking to encourage the usage of relays to reduce emissions by balancing the engine burning gas. As per its CO2 emission regulation, the total CO2 emission from new passenger cars was mandated to decrease from 130 grams per km of travel in 2015 to 95 grams per km of travel by 2021. Additionally, according to the European Economic Area (EEA) and European Commission, average emissions have decreased by 20 grams of CO2 per km (14.2%) since 2010, while the average emissions level of the new cars registered in 2018 in the EU was 120.4 grams of CO2 per km.

Government administrations in North American and European countries have also formulated extensive plans for enhancing vehicles’ features in order to reduce the cases of road accidents. Due to this the demand for automotive relays is increasing as they are essential for and other cutting-edge functionalities.

The growing adoption of EVs across the world is the most-important factor contributing to the growth of the market. In 2021, the global electric car fleet surpassed 10.1 million units, increasing by over 3 million units from 2019. Further, it is expected that by 2030, the fleet size will exceed 130 million units. With such a massive growth expected in EV sales, the demand for their components is also forecast to increase. The rise in EV adoption is itself propelled by two major factors, namely the surging concerns for the environment and the government support for their adoption in different countries.

Supportive initiatives include tax exemptions, purchase rebates, and financial incentives to the buyers. For instance, the federal government in the U.S. provides an Internal Revenue Service (IRS) tax credit of $2,500−$7,500 per new EV purchased. The subsidy amount depends on the size of the vehicle and the battery capacity. Due to the expensive components, the overall price of EVs is higher than conventional vehicles. Thus, the financial support by governments helps in increasing their adoption, which is simultaneously drives the demand for relays.

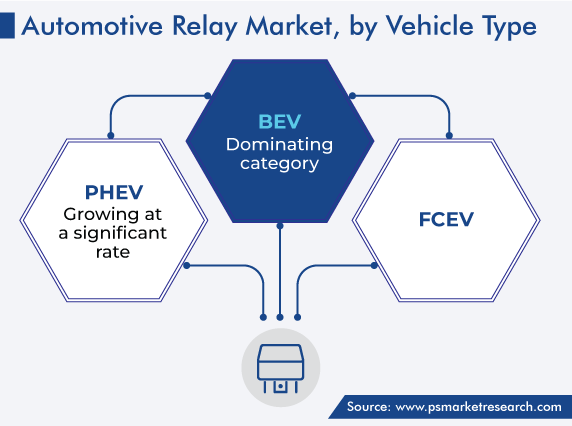

Battery Electric Vehicles Are Expected To Dominate Market

The battery electric vehicle category holds the largest market share, of 50%, and it is also expected to dominate the market during the forecast period. The is because relays are used for several purposes in EVs, such as electric power steering, traction motors, headlights, interior lighting, battery systems, active seat ventilation systems, passive cabin ventilation systems, advanced driver-assistance systems, and other power electronics modules. All of these components consist of electrical circuits, which require relays of variable power ratings. Further, the growing need for luxury electric cars with enhanced features, such as grille shutters, sunroofs, and infotainment consoles, propels the requirement for these electrical switches.

Drive strategic growth with comprehensive market analysis

The Asia-Pacific region dominates the market with a share of 55%, and it is also expected to remain the largest among all the regions over the next few years. The electric vehicle industry across the Asia-Pacific region has undergone tremendous innovations over the last few years. The region alone saw a sale of 3 million BEVs the previous year. Countries with prominent car manufacturing industries have begun the transition to EVs, which is essentially driving the demand for relays in the regional market.

Small cars account for a significant share of the electric car market in APAC due to their low prices and the cost-sensitive buying behavior of customers. The demand for electric cars in APAC is expected to grow rapidly over this decade, driven by the government support, escalating incomes, and increasing environmental awareness. Moreover, economies in this region are making efforts to reduce their dependence on costly fossil fuels, such as promoting electric cars. For instance, India plans to replace all the ICE cars with electric ones by 2030. Similarly, China offers considerable benefits on electric cars, depending upon the battery size.

The rising income levels and the increasing rate of urbanization in the emerging economies create an opportunity to own a vehicle. This, in turn, opens doors for EV OEMs as well as relay manufacturers in the region. Moreover, in India, policies have been implemented to curb emissions; for instance, commercial vehicles that are 20 years old or older were to stop plying from 2020. In addition, the Supreme Court of India has banned more than 15-year-old petrol (gasoline) and 10-year-old diesel vehicles in Delhi-NCR.

China is expected to hold the largest market share because the shifting consumer preference toward EVs is raising the demand for relays. Additionally, it has mandated AVASs in pure-electric vehicles of categories M1 and N1, hybrid electric vehicles that support pure-electric driving mode, and FCEVs, which will boost the demand for relays.

This fully customizable report gives a detailed analysis of the automotive relay market from 2019 to 2030, based on all the relevant segments and geographies.

Based on Type

Based on Application

Based on Ampere

Based on Vehicle Type

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages