Report Code: 11431 | Available Format: PDF | Pages: 153

Automotive Refinish Coatings Market Research Report: By Product Type (Clearcoats, Basecoats, Primer & Filter), Resin (Polyurethane, Acrylic, Alkyd, Epoxy), Technology (Solvent-Borne, Water-Borne, UV Curved), Auto Type (Cars, Commercial Vehicles, Two-Wheelers), Vehicle Age (<5 Years, 5-10 Years, >10 Years) - Global Industry Size, Share, Development, Growth, and Demand Forecast to 2023

- Report Code: 11431

- Available Format: PDF

- Pages: 153

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

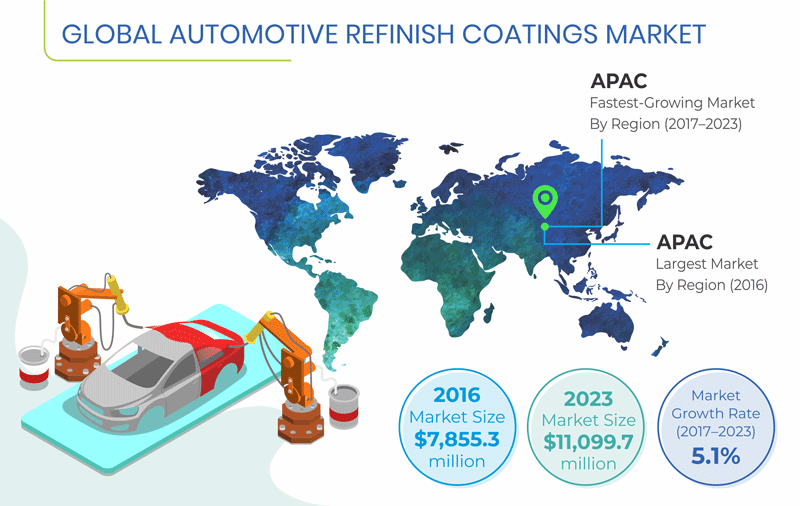

The global automotive refinish coatings market stood at $7,855.3 million in 2016, and it is projected to reach $11,099.7 million by 2023, registering a CAGR of 5.1% during the forecast period (2017–2023).

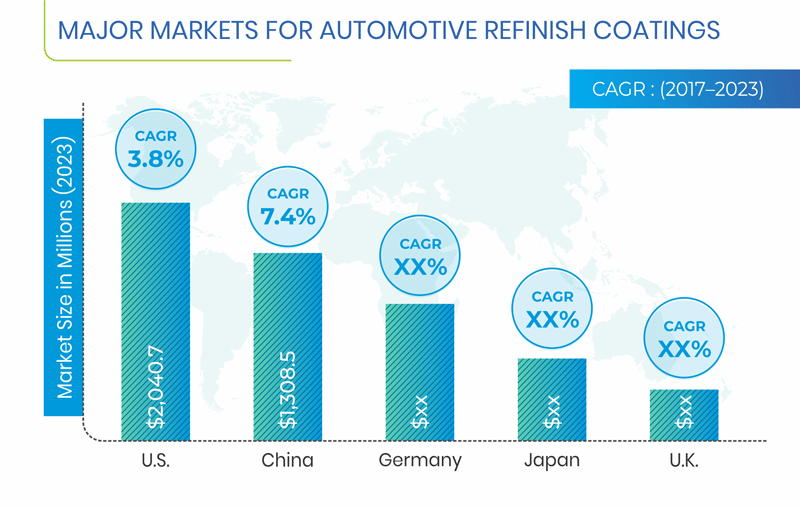

Asia-Pacific (APAC) is expected to witness the fastest growth in the industry, during the forecast period. This can be mainly attributed to the growing demand for vehicles from countries such as India and China and increasing number of automobile manufacturing facilities in the region.

Fundamentals Governing Automotive Refinish Coatings Market

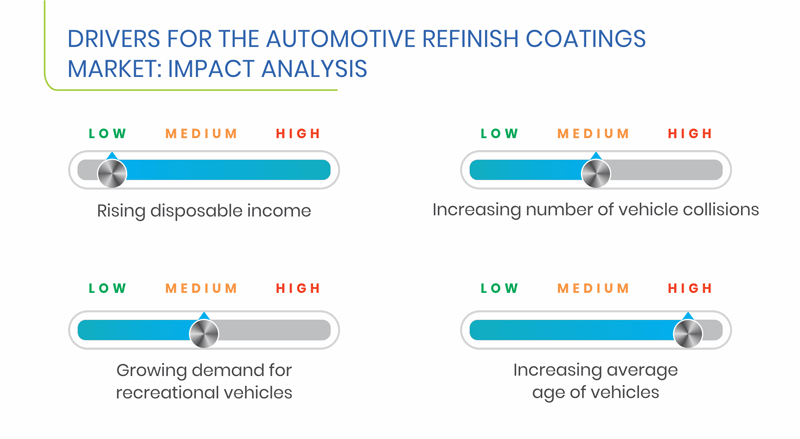

With the growing gross domestic product (GDP) and increasing income, automobile sales are rising, owing to which the consumption of refinish coatings is increasing in emerging economies, such as India and China. For instance, with the increasing GDP in China, the automotive sales increased by 28.03 million four-wheelers in 2016, thereby leading to the use of refinish coatings, for vehicle maintenance and repair, in heavy amounts. The increasing sale of vehicles is thus expected to drive the automotive refinish coatings market during the forecast period.

In 2016, the sale of used cars in India was 3.3 million, a robust increase when compared to the 1.6 million units in 2011. Similarly, in the U.S., the sale of used cars and trucks were at an all-time high, of 17.6 million units, in 2016. Due to their low prices, when compared to new vehicles, the middle-class has shown more interest in them, globally. In order to maintain the quality of used vehicles, various repair and maintenance services are done, either by the seller or the owner. Thus, the demand for used car services is expected to drive the automotive refinish coatings market.

Automotive Refinish Coatings Market Segmentation Analysis

The clearcoat category held the largest revenue share in 2016, based on product type. This can be attributed to the fact that clearcoats are used to protect the basecoats and give a shiny look. Additionally, as the final coating, it provides durability, protection against environmental damage, and scratch resistance to the overall coating.

The water-borne category is expected to exhibit the fastest revenue growth in the automotive refinish coatings market, over the forecast period, by technology. In water-borne coatings, water is used as a carrier, instead of the traditional solvents, due to which such products are less flammable. The focus of the regulatory authorities on reducing volatile organic compounds (VOCs) and hazardous air pollutants (HAP) has led to the widespread utilization of water-borne coating technologies.

Polyurethane was the highest revenue-generating category, among all resin types, in 2016. The resin is finding widespread usage in the automotive refinish sector, with numerous companies, such as Axalta Coating Systems, PPG Industries Inc., and Nippon paints, focusing on the polyurethane resin, mainly owing to its lower cost.

The two-wheeler auto type category is projected to witness the fastest growth in the automotive refinish coatings market, in the forecast period, in terms of value. This would be on account of the growing population, coupled with the increasing demand for two-wheelers.

In terms of value, in 2016, vehicles aged less than five years were the largest category. This can be attributed to an increase in the sales of new vehicles, which is leading to congestion on the roads. This has led to an increase in collisions, owing to which customers tend to refinish vehicles to retain their aesthetic look.

Global Scenario of Automotive Refinish Coatings Market

APAC was the largest automotive refinish coatings market in 2016, and it is expected to maintain the trend during the forecast period. This can be mainly attributed to the rising demand for two wheelers, passenger cars, and commercial vehicles in emerging markets, such as China and India. Moreover, the commercial fleet is growing due to high logistics demand, and the rise in the disposable income is driving the rental cab service market.

Additionally, APAC is expected to witness the fastest growth during the forecast period, mainly on account of an increase in the sale of used cars and new vehicles and high number of collisions in countries such as China and India.

Considering the future industry scenario, China is expected to lead the APAC automotive refinish coatings market, generating revenue worth $1,308.5 million in 2023.

Competitive Landscape of Automotive Refinish Coatings Market

The automotive refinish coatings market is highly fragmented, with the presence of a large number of small and medium-sized players, such as PPG Industries Inc., Axalta Coating systems, The Sherwin-Williams Company, BASF SE, and AzkoNobel Inc.

Recent Strategic Developments of Automotive Refinish Coatings Market Players

In recent years, major players in the automotive refinish coatings market have taken several strategic measures, such as product launches, acquisitions, and geographical expansions, to gain a competitive edge in the industry. For instance, in October 2017, The Sherwin-Williams Company introduced a clearcoat, CC200, which offers good performance with reduced time.

Moreover, in June 2017, Berger Paints India Ltd. acquired Saboo Coatings Pvt. Ltd, to further expand its product portfolio and distribution network of specialty liquid coatings used in various end-use applications, such as farm and construction equipment, automobiles, electronics, handicrafts, and home furnishings.

Market Size Breakdown by Segment

The Automotive Refinish Coatings Market report offers comprehensive market segmentation analysis along with market estimation for the period 2016–2023.

Based on Product Type

- Clearcoats

- Basecoats

- Primer & Filler

Based on Resin

- Polyurethane

- Alkyd

- Acrylic

- Epoxy

Based on Technology

- Solvent-Borne

- Water-Borne

- UV Curved

Based on Auto Type

- Cars

- Commercial Vehicles

- Two-Wheelers

Based on Vehicle Type

- <5 Years

- 5-10 Years

- >10 years

Geographical Analysis

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Netherlands

- Sweden

- Denmark

- Poland

- Asia-Pacific (APAC)

- Japan

- China

- India

- South Korea

- Australia & New Zealand (ANZ)

- Indonesia

- Thailand

- Vietnam

- Philippines

- Malaysia

- Singapore

- Rest of World (ROW)

- Brazil

- Argentina

- Saudi Arabia

- South Africa

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws