Automotive OTA Updates Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024 - 2030)

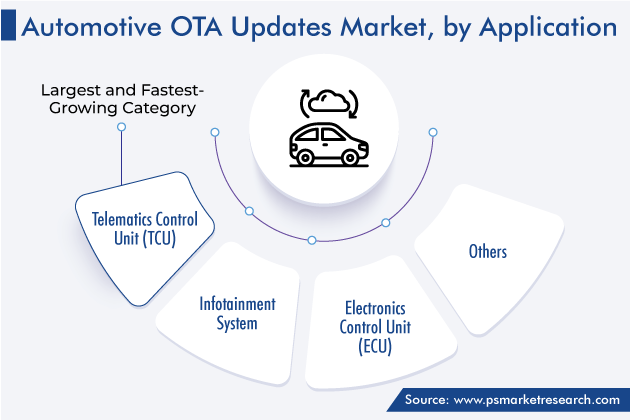

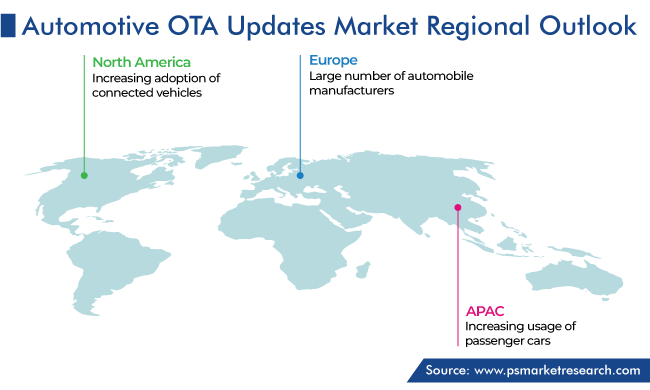

Get a Comprehensive Overview of the Automotive OTA Updates Market Report Prepared by P&S Intelligence, Segmented by Type (Software, Firmware), Propulsion (Internal Combustion Engine, Electric), Vehicle Type (Passenger Vehicle, Commercial Vehicle), Application (Telematics Control Unit, Infotainment System, Electronics Control Unit), and Geographic Regions. This Report Provides Insights From 2017 to 2030.