Report Code: 10732 | Available Format: PDF

Automotive Fuel Injection System Market Research Report: Size, Share, Key Trends, Growth Drivers, Regional Outlook, Revenue Estimation and Forecast, 2024-2030

- Report Code: 10732

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

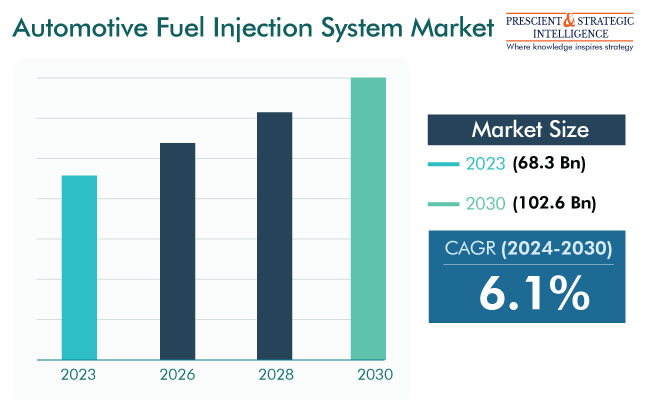

The automotive fuel injection system market is expected to advance from USD 68.3 Billion (E) in 2023 to USD 102.6 Billion in 2030, at 6.1% compound annual growth rate between 2024 and 2030.

The growth of this industry is because of the surging automobile production and the fact that most of the vehicles produced are still those with internal combustion engines. Moreover, the strict regulations for carbon emissions, fuel efficiency, and power output are boosting the need for these engine components.

Essentially, the surging requirement for two-wheelers in China, Brazil, and India is generating new opportunities for growth in this industry. Moreover, the increasing worries regarding the rising prices of fuel, coupled with the several guidelines on automobile exhaust gases and fuel economy, have driven the shift from carburetors to fuel injectors.

This is because approximately 23% of the overall environmental pollution is caused by the transportation sector. The frightening rise in the rate of air pollution has made governments establish stringent guidelines to limit emissions. Additionally, the reduction of fossil fuel reserves has boosted the costs of gasoline and diesel, as a result increasing the need for a higher mileage, which drives the market.

Surging Sales of Supercars and High-Performance Automobiles

The surging sales of supercars and high-performance automobiles are a key factor boosting the growth of this industry. Nowadays, performance-focused automobiles can attain extremely high speeds in a short duration, for which they are armed with cutting-edge drivetrains. With the increasing rate of technological development, the sales of such vehicles will surge continuously, thus resulting in a surging usage of fuel injectors in engines.

Moreover, the sales of passenger cars, two-wheelers, heavy commercial vehicles, and light commercial vehicles are likely to surge in the coming years. As per the OICA, around the world, 81,628,533 automobiles were sold in 2022, posting a substantial increase after slumping drastically in 2020 due to the pandemic. In addition, the surging need for automotive fuel injection systems is because of the rising need for substitute fuels, such as LPG and CNG.

| Report Attribute | Details |

Market Size in 2023 |

USD 68.3 Billion (E) |

Revenue Forecast in 2030 |

USD 102.6 Billion |

Growth Rate |

6.1% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Strong Focus on Enhancing Fuel Economy Is Key Trend

Nowadays, an automobile's electronic fuel injection (EFI) system is a typical part, rather than a new feature. EFI systems are increasingly becoming popular because of the mounting necessity to guarantee the ideal consumption of fuel. In this regard, the stringent regulations on fuel efficiency, such as the Corporate Average Fuel Economy (CAFE), drive the market. This is the reason the conventional carburetors have been almost entirely replaced by fuel injection systems.

Fuel Injector Category Is Leading Component Segment

The fuel injector category, based on component, is leading the automotive fuel injection system industry. This is primarily because this part plays an important role in the engine by directly pumping fuel into the combustion chamber from the fuel tank, via the fuel pump.

Gasoline To Observe Significant Growth

The gasoline category, based on fuel type, is likely to advance at a significant rate throughout the projection period. This is because gasoline is more-easily accessible compared to other types of fuels for light-duty automobiles. Moreover, the production of gasoline automobiles is higher than diesel automobiles, thus leading to the mounting product demand. In addition, due to the lower emissions and lower maintenance requirement for gasoline automobiles, the preferences of customers have changed toward them in the past few years.

Gasoline Direct Injection Systems Gaining Rapid Acceptance

The gasoline direct injection category, based on technology, is growing rapidly. This is because of the increasing worries regarding fuel efficiency, guidelines for automobile exhaust gases, and mounting costs of gasoline itself. Moreover, direct injection is gaining popularity over port injection across developing and developed nations.

This is why the diesel direct injection category is also a significant contributor. Diesel engines integrated with a direct injection system are highly efficient and offer high thermal efficiency. The demand for diesel engines continues to grow with the booming sales of medium- and heavy-duty commercial vehicles, such as trucks and buses.

Passenger Car Category Is Largest Contributor

The passenger car category, based on vehicle type, is leading the industry, mainly because of the enormous rate of production of these automobiles. The demand for passenger cars is likely to surge throughout this decade due to the aging of automobiles, strict rules to cut the rate of emissions, and arrival of advanced and new technologies in automobiles.

The light commercial vehicle category will advance at a profound rate throughout this decade. This can be because of the progress of retail and e-commerce organizations, which require vans for short-distance goods deliveries. In this regard, the growth in online shopping activities, driven by the easy smartphone and internet access, will propel the demand for fuel injection systems in LCVs.

Top Automotive Fuel Injection System Manufacturers Are:

- Schaeffler Technologies AG & Co. KG

- Hitachi Ltd.

- Robert Bosch GmbH

- Aptiv PLC

- DENSO Corporation

- Infineon Technologies AG

- Woodward Inc.

- Marelli Holdings Co. Ltd.

- Keihin Co. Ltd.

- Niterra Co. Ltd.

- Crowne Group LLC

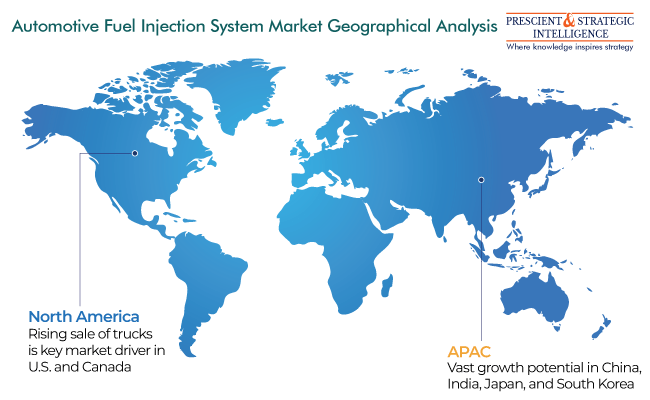

APAC To Observe Fastest Growth

APAC is likely to advance at the highest rate during the prediction period, primarily because of the surging production of automobiles. Moreover, the need for automotive fuel injection systems is surging in India, Thailand, and China because of the increasing need for higher mileages and implementation of strict emission regulations. Essentially, the increasing purchasing power in these nations boosts automobile sales.

Additionally, India, China, South Korea, and Japan are four of the largest automobile manufacturers in the world. The production is boosted by both a strong domestic demand and the increasing exports. The vast population of the region creates a massive need for vehicles for passenger and goods transportation, which offers good business for auto component manufacturers too.

The market in North America is also expected to grow at a steady rate during the projection period. This is because of the high utilization of automotive fuel injection systems in trucks, which form the backbone of the freight transport system in the continent. Additionally, the rising utilization of off-road automobiles, coupled with the growing purchasing power of consumers, will boost the progress of this regional industry.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws