Report Code: 12833 | Available Format: PDF | Pages: 480

Automotive Camera Market Size and Share Analysis by View Type (Front View, Rear View, Surround View), Vehicle Type (Passenger Cars, Commercial Vehicles), Application (Adaptive Cruise Control, Adaptive Cruise Control + Forward Collision Warning, Adaptive Cruise Control + Forward Collision Warning + Traffic Sign Recognition, Blind Spot Detection + Lane Keep Assist + Lane Departure Warning, Adaptive Lighting System, Intelligent Park Assist, Driver Monitoring System, Night Vision System, Park Assist), Technology (Digital, Infrared, Thermal), Level of Autonomy (Level 0, Level 1, Level 2, Level 3, Level 4, Level 5) - Global Industry Demand Forecast to 2030

- Report Code: 12833

- Available Format: PDF

- Pages: 480

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Automotive Camera Market Size & Share

The automotive camera market size stood at USD 8,091.4 million in 2023, and it is expected to showcase a compound annual growth rate of 11.8% during 2024–2030, to reach USD 17,326.1 million by 2030.

The extensive R&D in the automotive world has led to many advancements that contribute toward vehicles’ safety. Among these, ADAS is highly prominent among auto manufacturers and users, which is a principal factor driving the demand for automotive cameras globally. These components play a crucial role in ADAS operation by allowing the driver to see better the vehicle’s surroundings, by providing HD videos and images, to maximize road safety. Moreover, a smart camera is capable enough to identify traffic lights, signs, and other markings on the road, as well as detecting pedestrians and other vehicles, their path, and approximate distances.

Essentially, the automotive camera market is propelled by companies’ collaborative steps, government mandates for higher passenger safety, heightening demand for safer and more-convenient driving experiences, and surging investments in advancing driving technologies.

Augmenting Incorporation of ADAS in Vehicles Is Biggest Market Driver

ADAS requires different types of cameras to perform various functions, such as pedestrian detection, blind spot detection, and parking assist. Imaging sensors perform well in assisting the driver, and in adverse weather conditions, these camera modules act as an important self-diagnosis system for better and safe driving. Therefore, over the past few years, these systems have increasingly gained attention in modern car models. Further, their advantages have encouraged OEMs to invest in research projects and form strategic alliances to integrate cameras into their new models.

For instance, ZF develops autonomous driving systems and offers advanced object identification technology utilizing Mobileye’s EyeQ processor-based camera systems for long-distance sensing competences in vehicles. In 2022, ZF produced more than 10 million cameras, and by January 2023, it had supplied more than 50 million to over 10 vehicle manufacturers.

Stringent Road Safety Regulations Driving Adoption of Automotive Cameras among OEMs

The growing stringency of government regulations is boosting the adoption of rear, surround, and other cameras in all vehicle types. For instance, in 2016, the Indian government mandated a backup camera or the rearview sensors on all new vehicles, in order to reduce collision risk with pedestrians or any other obstacle. Further, many car manufacturers have already implemented driver-monitoring systems. For instance, Cadillac’s Super Cruise driver-assistance technology uses a driver-facing camera to check whether the driver's eyes are focused on the road. If the eyes are not on the road, the system warns the driver and eventually stops the vehicle and dials an emergency number.

Earlier, these improved technical devices used to be available only on luxury cars. However, with road safety mandates coming into force, even mid-segment and economy cars are being provided with such components. Additionally, such advanced devices are now accessible on various models of passenger cars and light and heavy commercial vehicles due to the substantial decline in the cost of technology. With more cameras inside and outside the vehicle recording everything, road accident deaths are expected to reduce in number. The type of camera and the extent of their functionality depend upon the desired usage, safety measures, and technical advancements adopted.

According to the U.S. government, in the age group of 1–44 years, more Americans die each year from violence and injuries, including those caused by traffic accidents, than any disease. The newly introduced cameras for motor vehicles are designed to increase safety and prevent collisions by allowing the driver not only to see straight behind the vehicle but also under it. Further, the cost of camera-based active safety systems is decreasing rapidly enough to make them available on mainstream vehicles.

| Report Attribute | Details |

Market Size in 2023 |

USD 8,091.4 Million |

Market Size in 2024 |

USD 8,868.2 Million |

Revenue Forecast in 2030 |

USD 17,326.1 Million |

Growth Rate |

11.8% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By View Type; By Vehicle Type, By Application, By Technology, By Level of Autonomy; By Region |

Explore more about this report - Request free sample

Growing Demand for EVs Is also Propelling Automotive Camera Integration Rate

As per the International Energy Agency’s Global EV Outlook 2023 report, more than 10 million electric cars were sold across the world in 2022 and sales were expected to grow by another 35% in 2023, to hit 14 million units. The key reasons behind the EV market growth are the rising environmental concerns, government support for clean-energy vehicles, and technological advancement. The booming EV industry is also supporting the incorporation of advanced features, including cameras, for a better driving experience.

Further, the electric vehicle camera market is witnessing several trends, such as the integration of AI and ML algorithms into these camera systems to enable them to recognize and interpret objects and pedestrians more accurately, thereby enhancing the overall functionality and effectiveness of ADAS.

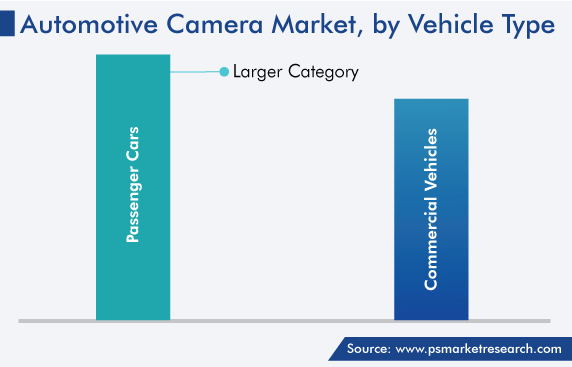

High Demand for Passenger Cars Equipped with Advanced Components

The vehicle type segment is dominated by the passenger cars category with 65% revenue share in 2023. Moreover, this category is expected to grow with a considerable rate during the forecast period.

In passenger vehicles, front cameras have been introduced to offer various advanced services, such as lane departure warning and forward collision warning. Similarly, rear cameras are required for backup assistance and to avoid collisions with obstacles. Further, the top-down view provided by surround, 360-degree, or bird’s-eye-view cameras assists drivers in parking and averting collisions with pedestrians and other vehicles. Moreover, a growing number of new passenger vehicles are being equipped with ADAS, which relies on various cameras and other sensors to enhance safety and driving comfort.

Commercial vehicles are also expected to witness significant growth in the automotive camera market owing to the escalating need for improved safety features. These cameras have the ability to keep a check on cargo loading, driver’s attentiveness, and vehicle performance with respect to what happens on the road. Therefore, OEMs are positively adding such components in order to provide enhanced vehicle performance and road safety considering that commercial vehicles have a higher potential for more-severe accidents owing to their massive nature.

Higher Usage of Digital Cameras

The market is dominated by digital cameras with revenue share of around 50% in 2023, and this category is expected to grow with a significant rate during the forecast period. The major reason for their wider usage is that they can be used for various applications for the driver and vehicle’s safety. On the other hand, other types of cameras—infrared and thermal—are only used for particular purposes, such as night vision, sensing heat, smoke, and dust, and ascertaining whether the headlights are working as desired or not.

High Demand for Optical Devices with Growing Level of Driving Automation

Automotive cameras not only play a crucial role in assisting the driver but also in achieving driving autonomy. Level 0 vehicles can have safety features such as collision warning, rearview cameras, and blind spot warnings. In level 1 automation, adaptive cruise control regulates acceleration and braking, typically during highway driving. Further, the number of various types of automotive cameras—forward, interior, rear, and surround—is substantially higher in level 4 (high automation) and level 5 (full automation) automobiles.

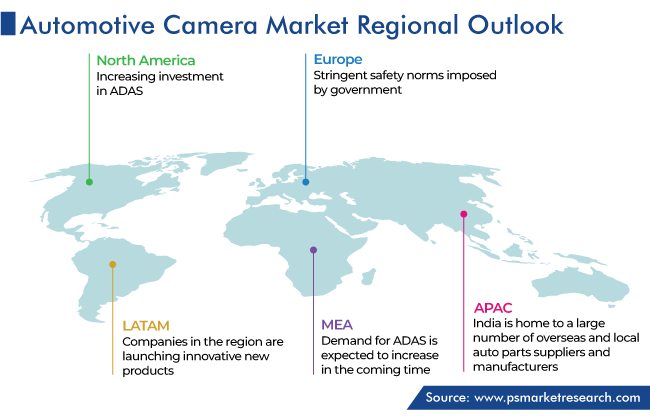

APAC Continues To Make Significant Revenue Contribution to Automotive Camera Manufacturers

Asia-Pacific had a considerable revenue share in the global automotive camera market in 2023. It is also the fastest-growing consumer of these components due to the rising production of and demand for passenger and commercial vehicles in China, Japan, India, and South Korea. This is itself credited to the rising disposable incomes, advancing technologies, swift urbanization, changing consumer preferences, and growing rate of road and IT infrastructure development.

Regional countries’ surging middle-class population and the easier affordability of automobiles have fueled the sale of vehicles with advanced features, such as cameras and ADAS sensors. The advanced features now being demanded in cars include connectivity options, safety systems, and innovative designs. Moreover, the addition of telecom towers ever more densely than before has enabled V2V, V2I, and even V2G connectivity, which is crucial for automotive cameras to work at their full potential.

Further, India is home to a large number of overseas and local auto parts suppliers and manufacturers, which is contributing to the development and attractiveness of the auto industry. Some of the domestic auto manufacturers, such as Mahindra & Mahindra, Maruti Suzuki, and Tata Motors, have a strong presence in various market segments, including passenger cars, LCVs, and HCVs. Further, due to a high demand potential, international automakers, such as Ford, Honda, Toyota, Volkswagen, and Hyundai, have set up manufacturing facilities in the country and made hefty investments in manufacturing capacity expansion. Thus, as automotive production increases, so will the demand for various vehicle components, including cameras.

Key Automotive Camera Manufacturers Are:

- Robert Bosch GmbH

- Continental AG

- Valeo

- ZF Friedrichshafen AG

- DENSO CORPORATION

- Aptiv plc

- Magna International Inc.

- Veoneer HoldCo LLC

- Ficosa Internacional SA

Market Size Breakdown by Segment

The report analyzes the impact of the major drivers and restraints on the automotive camera market, to offer accurate market estimations for 2017–2030.

Based on View Type

- Front View

- Rear View

- Surround View

Based on Vehicle Type

- Passenger Cars

- Commercial Vehicles

Based on Application

- Adaptive Cruise Control

- Adaptive Cruise Control + Forward Collision Warning

- Adaptive Cruise Control + Forward Collision Warning + Traffic Sign Recognition

- Blind Spot Detection + Lane Keep Assist + Lane Departure Warning

- Adaptive Lighting System

- Intelligent Park Assist

- Driver Monitoring System

- Night Vision System

- Park Assist

Based on Technology

- Digital

- Infrared

- Thermal

Based on Level of Autonomy

- Level 0

- Level 1

- Level 2

- Level 3

- Level 4

- Level 5

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for automotive cameras values USD 8,091.4 million in 2023.

The value of the automotive camera industry in 2030 will be USD 17,326.1 million.

Passenger cars hold the dominant share in the market for automotive cameras.

ADAS and self-driving technologies are trending in the automotive camera industry.

The digital technology is preferred in the market for automotive cameras.

APAC is a significant contributor to the automotive camera industry.

Product launches are significant in the market for automotive cameras.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws