Market Statistics

| Study Period | 2019 - 2030 |

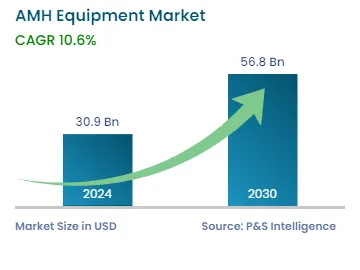

| 2024 Market Size | USD 30.9 Billion |

| 2030 Forecast | USD 56.8 Billion |

| Growth Rate(CAGR) | 10.6% |

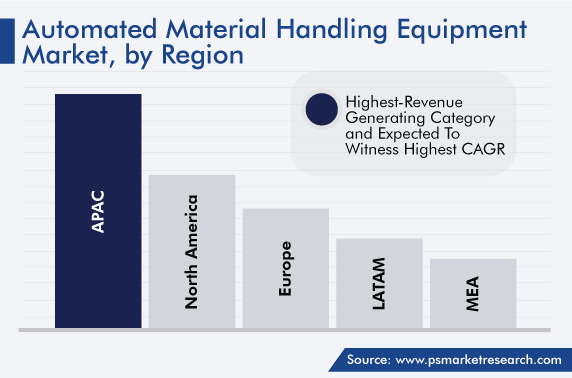

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12628

Get a Comprehensive Overview of the AMH Equipment Market Report Prepared by P&S Intelligence, Segmented by Product (Robots, ASRS, Conveyors & Sortation Systems, Cranes, WMS, AGV), System Type (Unit Load Material Handling, Bulk Load Material Handling), Vertical (Automotive, Metals & Heavy Machinery, Food & Beverages, Chemicals, Healthcare, 3PL, Semiconductors & Electronics, Aviation, E-Commerce), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 30.9 Billion |

| 2030 Forecast | USD 56.8 Billion |

| Growth Rate(CAGR) | 10.6% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global automated material handling equipment market stood at USD 30.9 billion in 2024, and this number is expected to increase to USD 56.8 billion by 2030, advancing at a CAGR of 10.6% during 2024-2030. This is attributed to the rising demand for improved order accuracy, the surging need for high supply chain productivity, the maximizing customer service level, the increasing concept of warehousing, and the growing adoption of robots in material handling.

Moreover, technological advancements, a rise in Industry 4.0 investments, and the growth in end-use industries including e-commerce, healthcare, and automotive are also responsible for the expansion of the market.

Technological Advancements and Mounting Need for Automated Solutions Boost the Market Expansion

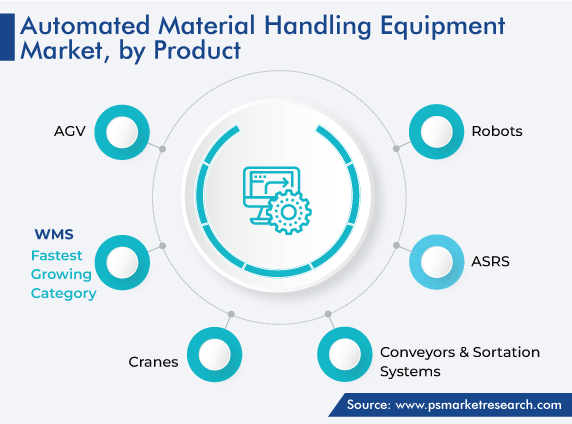

The increasing demand for Industry 4.0, IoT, and industrial automation makes the incorporation of automated equipment simpler into systems, which, in turn, offers favorable opportunities for businesses offering automated material handling (AMH) systems. Companies are investing more to build their systems more reliable, fast, and accurate to increase productivity, reduce assembly line time, and maximize operational efficiency. For this, organizations acquire advanced products and technologies for automation including robots, ASRS, cranes, AGV and WMS, and others.

Also, technologies, which are embedded in material handling systems including data analytics and cloud connectivity, improvise asset performance and deliver real-time actionable information. The integration of these systems in various facilities provides remote-controlled operations, which help in delivering better diagnostics and lessen commissioning time. Moreover, the mounting trend of smart factories will further contribute to the market, where advanced equipment is highly employed for the pick-up, sortation, and transit of goods.

The e-commerce category will register the fastest growth during the forecast period, advancing at a CAGR of around 9%. This can be ascribed to the high demand for automated storage and retrieval systems (ASRSs) in the industry for storing and retrieving products from specific locations, the rising number of e-commerce platforms and online retailers, the growing preference for online shopping, and the improving logistics infrastructure. Additionally, emerging economies such as China and India are playing a vital role in the expansion of the e-commerce sector, owing to the increasing per capita income, which leads to rising consumer spending.

In addition, the healthcare category accounted for a significant revenue contribution to the market in 2022, and the category is expected to grow at a substantial CAGR in the coming years. This is ascribed to the high investment of private companies and governments for the automation of production lines of healthcare products, the rising number of healthcare providers, and the growing population and per capita income, especially in emerging nations such as China and India, which creates opportunities for pharmaceutical manufacturers.

Furthermore, the automotive category will witness significant growth in the coming years. This can be due to the high usage of automated storage and parking systems in which ASRSs are employed, the surging need to scale up automobile production, the increasing demand for electric and hybrid vehicles, the rising need for automation to minimize the product damage while transporting, and the mounting requirement for boosting the speed of material handling at assembly lines in this sector.

In addition, the food & beverages category held a significant revenue share in 2022, and it is also expected to maintain its position during the predicted period. This is due to the burgeoning population across the globe, the rising need for packaged food, the increasing number of frozen food manufacturers, and rapid globalization.

The WMS category will witness the fastest growth during the forecast period, advancing at a CAGR of 9.1%. This can be due to the mounting count of warehouse units, the growing concern of retailers regarding the concept of warehouses, the rising freight costs, the increasing number of e-commerce platforms, the surging clod-based solution offerings by companies, the mounting need for multi-channel distribution networks, and the burgeoning global supply chain networks.

The conveyors & sortation systems category accounted for a significant revenue share in 2022, and it is further expected to maintain its position during the predicted period. This is because such automated conveyors are highly employed in manufacturing units and distribution centers for conveying raw materials and finished goods; and sortation systems are employed for the identification, induction, separation, and transportation of products to specific locations. Moreover, a rise in the count of industrial operations, including manufacturing, wholesale, retail, and distribution, across all industries will create a high demand for conveyors and sortation systems in the automated material handling equipment market.

In addition, the AGV category held a significant revenue share in 2022, and it is also expected to maintain its position in the coming years. This is attributed to the rising industrialization, the mounting need for customized material handling systems, the increasing demand for timely execution of supply chain operations, and the burgeoning requirement for improving productivity and replacing manual labor in testing, as safety is a major concern. Additionally, the usage of automated forklifts and automated tows/tractors is increasing, due to the rising need for stacking and unstacking of goods, precise handling, and intralogistics operations.

The unit load material handling category accounted for a higher revenue contribution in 2022, and it is further expected to maintain its dominance during the forecast period. This is ascribed to the mounting trend of smart factory and factory automation and the surging requirement to make easier the distribution and storage of products at warehouses. Also, such AMH equipment has several benefits, as it can handle multiple commodities at a time, reducing the trips and time intervals for loading and unloading.

Additionally, in the growing manufacturing industries, including metals & heavy machinery, automotive, and semiconductors & electronics, such systems are primarily employed for ongoing operations to assist prompt delivery and buffer storage in the production processes.

Furthermore, the bulk load material handling category will witness significant growth in the coming years. This can be because bulk load material handling systems are highly used to transit goods from one place to other without manual labor, and in sorting the goods in huge quantities. Moreover, the burgeoning food & beverages and pharmaceutical industries create a high demand for such equipment.

Drive strategic growth with comprehensive market analysis

The APAC market accounted for the largest revenue share, of around 42%, in 2022, and it is further expected to maintain its dominance during the forecast period. This is ascribed to the rising number of manufacturing sites as well as manufacturing processes and warehouse units, the emerging trend for smart factories, the rising urbanization, the surging material handling practices to improve production capabilities, and the increasing count of local AMH manufacturers in the region.

Furthermore, the European market will register significant growth during the predicted period. This can be because of a high acceptance rate of advanced technology, the presence of a large number of key players, the burgeoning manufacturing of industrial robots, the mounting demand for warehouse automation, and the presence of government-supporting policies for automation.

Moreover, North America held a significant market share in 2022, and it is further expected to maintain its position in the coming years. This is ascribed to the presence of a large number of well-developed industries as well as industrial operations, a rise in the requirement for timely and accurate order fulfillment, an increase in the need to reduce industrial operational costs such as product handling and product distribution and freight, and the growth in the retail business, in the region.

This report offers deep insights into the AMH equipment industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product

Based on System Type

Based on Vertical

Geographical Analysis

The automated material handling equipment market size stood at USD 30.9 billion in 2024.

During 2024–2030, the growth rate of the automated material handling equipment market will be around 10.6%.

Automotive is the largest vertical in the automated material handling equipment market.

The major drivers of the automated material handling equipment market include the rising usage of automated storage and retrieval technologies, technological advancements, the surging trend of Industry 4.0, rapid industrialization associated with digitalization, and the increasing number of manufacturing sites and warehouses across the globe.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages