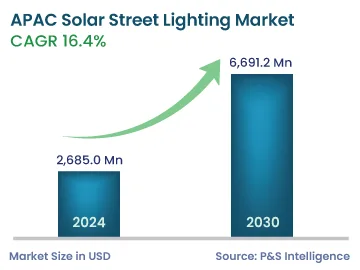

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 2,685.0 Million |

| 2030 Forecast | 6,691.2 Million |

| Growth Rate(CAGR) | 16.4% |

| Largest Country | China |

| Fastest Growing Country | China |

| Nature of the Market | Fragmented |

Report Code: 12722

Get a Comprehensive Overview of the APAC Solar Street Lighting Market Report Prepared by P&S Intelligence, Segmented by Structure Type (Standalone, Centralized, Portable), Component (Lamp, Solar Panel, Battery, Controller), Installation (Retrofit, New), Application (Highways & Roadways, Bridges, Airport Runways, Parks & Playgrounds, Manufacturing Sites, Parking Lots), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 2,685.0 Million |

| 2030 Forecast | 6,691.2 Million |

| Growth Rate(CAGR) | 16.4% |

| Largest Country | China |

| Fastest Growing Country | China |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The APAC solar street lighting market size stood at USD 2,685.0 million in 2024, and it is expected to advance at a compound annual growth rate of 16.4% during 2024–2030, to reach USD 6,691.2 million by 2030. This is primarily ascribed to the declining price of such solutions, the increasing number of smart cities, and the surging urbanization in developing countries.

According to Worldbank.org, around 63% population of China lives in cities, and the urban population is expected to continue rising in the coming years. With rapid urbanization, the requirement for utilities, such as water, lighting, energy, and sanitation, would also rise, further necessitating the development of associated infrastructure in cities to meet the needs of residents. Considering these factors, governments have increased their focus on projects for the development of smart cities. Thus, with the building of smart cities across the region, the market would grow significantly in the forecast period.

A major trend witnessed in the market is the growing popularity of smart solar streetlights. systems are energy-efficient, as they mostly use and possess different control units and sensors in all lamps, which enable data transmission to central controlling systems.

Moreover, governments are adopting smart solar-powered streetlights as they can be operated at a very low cost. Fault detection has also become quicker by using smart solar streetlights. These control decisions can be made in real-time, either by a central control unit or by a device. All these factors significantly reduce both maintenance and energy generation costs.

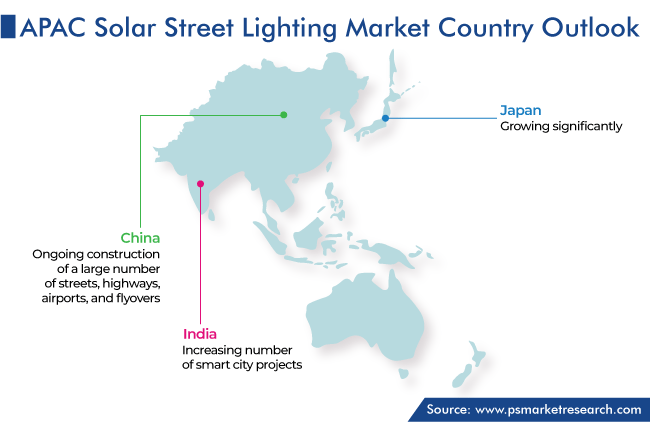

The rising number of smart cities in the region is driving the growth of the market. There are several development projects in China, India, South Korea, and other countries. China recorded the highest number of smart city pilot projects as compared to other APAC countries. In India, it is estimated that out of 7742 projects, around 5002 smart city projects are completed and approximately 2740 projects are ongoing. As a result, to enhance the urban landscape and increase energy efficiency, the demand for solar LED lighting is increasing in the region.

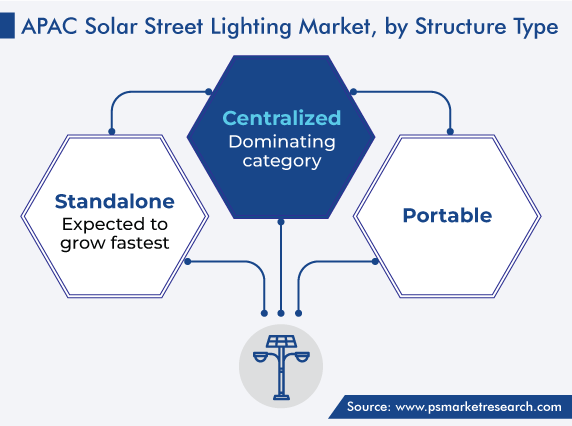

Based on structure type, the centralized category accounts for the largest share of the market. This is due to the rising deployment of on-grid-based solar streetlights that get the continuous energy supply from a grid to power lights at a high illumination.

Whereas, as per data analysis, the standalone category is expected to witness the highest CAGR, of 16.6%, during the forecast period. Manufacturers in the industry have been working on off-grid, heat-resistant standalone lighting solutions, which has led to the improvement in the working of such lighting models, making them more user-friendly.

In terms of price, the centralized solar streetlight is more expensive than the standalone type. This is because, during the installation of centralized solar streetlights, trenching wire and energy utility costs are included. Moreover, standalone solar streetlights are not connected to the grid for the power supply. These systems contain batteries that are used to store solar energy.

Based on component, the solar panel is the largest category, holding a share of 35% in 2023. This is because it is important for the functioning of complete street lighting through renewable energy. The solar panel is more expensive than other related components, further generating the highest revenue in the market.

Whereas, the lamp category is projected to witness the fastest growth during the forecast period. This can majorly be attributed to the rising adoption of LEDs in solar streetlights. The rising focus to adopt LEDs is due to the surging government initiative in countries, like India and China, toward the adoption of energy-efficient LED lights. Further, with various energy-saving features offered by LED lights, there is an increasing demand for solar street LED lighting in APAC.

The new installation category is expected to witness the fastest growth in the coming years, advancing at a CAGR of 16.8%. This can be due to the increasing government initiatives toward the installation of LED lights in the region, mainly in India and China. Moreover, the rising number of solar streetlight projects is expected to contribute to the market growth in this category during the forecast period.

On the other hand, the retrofit category contributed the highest revenue to the market in the past. This is attributed to the increasing replacement of incandescent and sodium vapor lamps with LEDs in the region. Also, with the phasing out of incandescent bulbs in APAC countries, the demand for the replacement of older technology lamps with LED lamps is growing, which is further expected to drive the demand for solar streetlights in this category in the coming years.

The highway & roadway category held the largest revenue share, of 25%, in the market in 2023. This is due to the increasing government focus on developing high-class infrastructure, the surging deployment of outdoor lighting on highways and roadways, the rising replacement of older technology lights used in streetlights with solar LED lights to reduce energy consumption and CO2 emissions, and the mounting number of solar streetlight projects.

Drive strategic growth with comprehensive market analysis

In APAC, the Chinese market holds the leading position, and it will grow at a CAGR of 17.0% during the forecast period. This is attributed to the ongoing construction of a large number of streets, highways, airports, and flyovers, the surging urbanization, the increasing demand for energy, the decreasing prices of LEDs, and the growing awareness about using energy-efficient lighting in the country.

Moreover, the increasing number of urban lighting projects for roads, buildings, and railways; the surging spending of the government on the improvement of lighting outside shopping malls, offices, and hospitals; and the rising demand for energy-saving and eco-friendly lighting products are propelling the demand for solar streetlights in the country. In addition, local governments are increasingly implementing LED subsidies. For instance, Guangdong Province has the largest LED industry size and has a relatively higher number of subsidies offered in the province. Hence, with the increasing number of subsidies being offered in the country, the market for LED lights is growing significantly.

This report offers deep insights into the APAC solar street lighting industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Structure Type

Based on Component

Based on Installation

Based on Application

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages