Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 890.2 Million |

| 2030 Forecast | USD 1,447 Million |

| Growth Rate(CAGR) | 8.4% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12624

Get a Comprehensive Overview of the Anti-Biofilm Wound Dressing Market Report Prepared by P&S Intelligence, Segmented by Mode of Mechanism (Physical, Chemical, Biological), Application (Chronic Wounds, Acute Wounds), End User (Hospitals, Specialty Clinics, Home Healthcare), Age Group (Under 14 years, 14-49 years, 50-64 years, 65-74 years, 75-80 years, Above 80), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 890.2 Million |

| 2030 Forecast | USD 1,447 Million |

| Growth Rate(CAGR) | 8.4% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

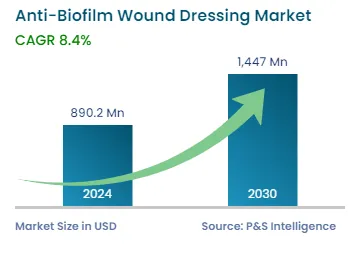

The anti-biofilm wound dressing market size stood at USD 890.2 million in 2024, and it is expected to grow at a CAGR of 8.4% during 2024–2030, to reach USD 1,447 million by 2030.

The growth can be primarily ascribed to the unhealthy and sedentary lifestyles and rising tobacco and alcohol consumption. Essentially, the increasing prevalence of chronic diseases because of these reasons, which, in turn, increases the occurrence rate of acute and chronic lesions, as well as the growing threat of antimicrobial resistance, drives the demand for these products.

Thus, in February 2022, Asep Medical Holdings Inc., bolstered by U.S. Army funding, announced the creation of an anti-biofilm peptide technology for advanced, effective wound dressings, in order to treat and prevent biofilm-associated abrasions, along with burns and soft tissue infections. Thus, the increasing focus of companies on the development of advanced technologies for treating injuries is contributing to the progress of the industry.

The rising number of mishaps, such as trips, slips, road accidents, and burns, is also propelling the demand for such products. Already, around 1.3 million individuals die every year because of road traffic crashes. Moreover, the majority of the injuries in workplaces are due to slips, trips, and falls. Additionally, the rising prevalence of burns is a key driver for the market. According to government reports, approximately 1.1 million burn injuries are reported in the U.S. Out of this, more than 50,000 people need hospitalization, which, in turn, boosts the requirement for anti-biofilm lesion dressings.

Moreover, the majority of the surgical abrasions are deep and expand in size, producing fluid from blood vessels, which is why they require extensive care. Several products, such as those containing iodine and silver, aid in managing large bruises, while minimizing infection risk.

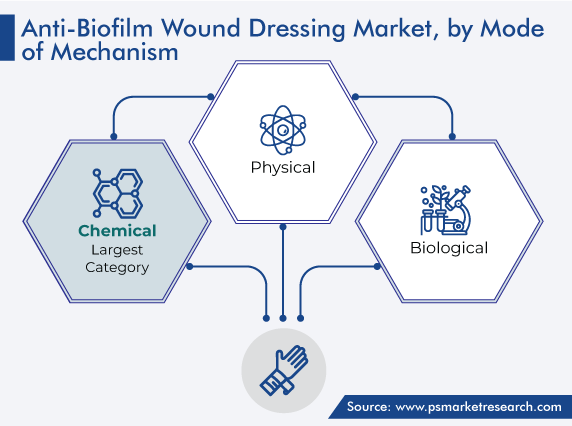

The chemical category holds the largest share, of around 46%, attributed to the increasing count of surgeries and rising prevalence of chronic wounds all over the world. Chemical anti-biofilm wound dressings increase the healing rate and recovery efficiency of such injuries via a multi-faceted action against biofilms. Moreover, they minimize the risk of recontamination by microorganisms.

The existence of various key players offering such products with ionic silver and iodine is the major factor driving the growth of this category.

Moreover, researchers have started focusing on the development of advanced products for chronic and acute bruises. This is why the physical category holds the second-largest share, owing to the growing R&D activities for the introduction of novel product lines.

Chronic wounds are the larger application in the market, ascribed to the surging prevalence of several long-term diseases, especially diabetes. Many of these diseases result in wounds and injuries that do not heal for a minimum of 4 weeks. Persistent infections and pain are the primary symptoms of such injuries. They occur because of exposure to bacteria or trauma, pressure on or around the injury, or insufficient blood and oxygen supply. It is understood that 1–2% of the population suffers from these injuries at least once in its life.

Surgical and chronic abrasions take way longer for recovery. The growing incidence of traumatic injuries, booming geriatric population, rising incidence of obesity and diabetes, and increasing count of surgeries are contributing to the surging prevalence of such bruises. According to government reports, around 2% of the total population is expected to be affected by chronic abrasions. Moreover, society will reel under a significant financial burden with the rising aging population.

The acute wounds category will witness the faster growth in the coming years, because of the increasing cases of trauma and burns and the large number of surgeries being conducted. An acute injury occurs unexpectedly and includes abrasions, incisions, burns, punctures, and scratches. It can take place anywhere on the body and vary from small scratches to deep lesions, and its treatment depends mainly on location and severity. Dressings that prevent biofilm formation are included in the primary treatment; hence, the rising number of patients suffering from acute abrasions will drive the growth of this category.

Hospitals are the largest end users, because of the surging count of sports-related injuries and surgical procedures, along with the growing number of burns and trauma cases, which boosts the need for products that can minimize the occurrence of surgical site infections. Additionally, hospitals generally have long-term contracts with suppliers because they require these products in high volumes.

The home healthcare category is expected to grow considerably over the forecast period because such places provide various advantages to patients, which include home-delivered meals and personalized care. In addition, the geriatric population is increasing across the globe, which boosts the demand for home healthcare services because of the convenience they offer to aged people, who cannot travel on a frequent basis.

According to government reports, in the U.S., there are more than 40 million people aged 65 years or more. Along with this, a large number of organizations offer homecare services in various countries, thus propelling revenue generation in the home healthcare category.

The age group of 14–49 years is predicted to witness the highest CAGR, as people in this age group experience the highest exposure to the environmental factors causing wounds and injuries.

Moreover, people in the age group of above 60 years are showing a significant growth in the demand for these products because of the decreased inflammatory response in their bodies, slower epithelialization process, and multiple existing comorbidities.

The number of diabetic patients continues to increase incessantly across the world. According to reports, in 2021, approximately 537 million adults were living with this common endocrine disorder, and they are expected to number around 700 million by 2045. It is also estimated that 1 in 2 adults remain undiagnosed and that more than 3 in 4 individuals suffering from diabetes live in low- and middle-income countries.

The prevalence of diabetes is expected to increase rapidly with the rising count of elderly and obese people. In diabetic patients, wounds tend to develop rapidly and heal slowly; therefore, frequent dressing is needed. Thus, with the growing aging population, along with the surge in the prevalence of diabetes, the demand for such wound care products is increasing across the world.

Drive strategic growth with comprehensive market analysis

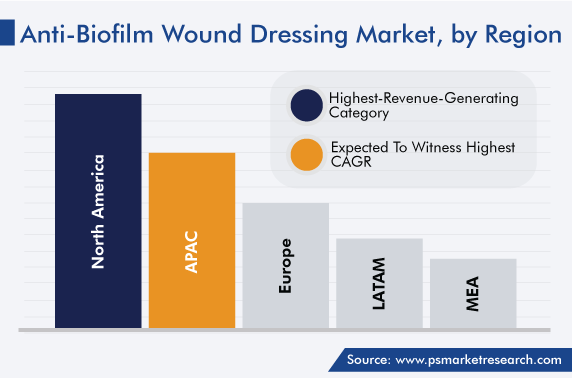

North America has the leading position in the anti-biofilm wound dressing market, and it will hold the same position till 2030, with a value of USD 434 million. This is attributed to the increasing count of road accidents and rising prevalence of sports injuries.

In North America, the U.S. holds the leading position, and it will grow with a CAGR of around 9%, attributed to the presence of several key players and robust healthcare infrastructure. Moreover, the existence of favorable reimbursement policies is expected to fuel the growth of the industry in the forecast period.

Furthermore, technologically advanced products are easily available, and the number of clinics is increasing in the region. The surging use of advanced products in the healthcare facilities in the U.S., such as ambulatory surgical centers and hospitals, is, therefore, one of the major factors contributing to the growth of the market.

Essentially, the rising expenditure on the management of bruises, such as pressure ulcers, is leading to the increasing demand for such wound care solutions, as are the increasing number of road accidents and developed healthcare infrastructure. According to government reports, in 2021, around 42,900 people died in motor vehicle crashes in the country, which was an increase of 10.5% from 2020.

This report offers deep insights into the anti-biofilm wound dressing industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Mode of Mechanism

Based on Application

Based on End User

Based on Age Group

Geographical Analysis

The market for anti-biofilm wound dressing generated USD 890.2 million in 2024.

Chemical variants are preferred in the anti-biofilm wound dressing industry.

The market for anti-biofilm wound dressing is propelled by the growing incidence of chronic wounds and the rising count of burns, violence, and accident cases.

Chronic wounds dominate the anti-biofilm wound dressing industry, and acute wounds will have the higher CAGR.

APAC is the fastest-growing market for anti-biofilm wound dressing, based on region.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages