Market Statistics

| Study Period | 2019 - 2030 |

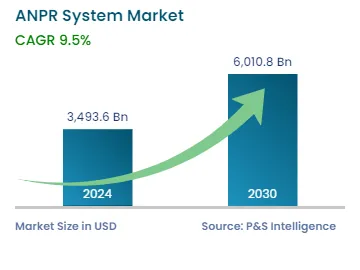

| 2024 Market Size | 3,493.6 Million |

| 2030 Forecast | 6,010.8 Million |

| Growth Rate(CAGR) | 9.5% |

| Largest Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12684

Get a Comprehensive Overview of the Automatic Number Plate Recognition System Market Report Prepared by P&S Intelligence, Segmented by Type (Fixed, Mobile, Portable), Component (Hardware, Software), Application (Traffic Management, Law Enforcement, Electronic Toll Collection, Parking Management, Access Control), End User (Government, Commercial), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 3,493.6 Million |

| 2030 Forecast | 6,010.8 Million |

| Growth Rate(CAGR) | 9.5% |

| Largest Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global automatic number plate recognition system market size is estimated to have valued at USD 3,493.6 million in 2024, and this number is expected to increase to USD 6,010.8 million by 2030, advancing at a CAGR of 9.5% between 2024 and 2030. This is attributed to its growing usage by agencies, including toll plaza, parking, police force, and traffic management; the burgeoning trend for pay-per-use roads; the developing automotive sector; the high capital investments particularly in emerging nations; and the surging adoption of advanced technology and systems by several governments to manage traffic.

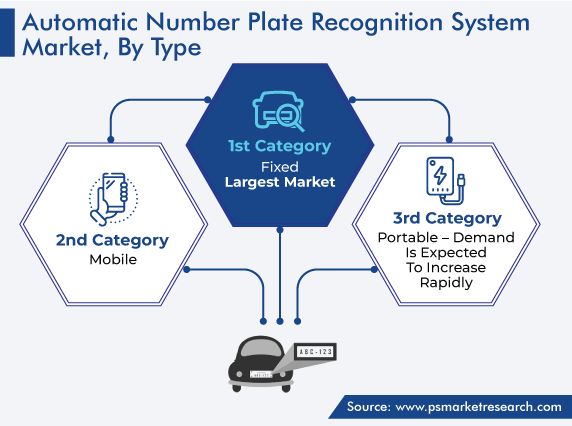

The portable systems category will witness the highest growth rate during the forecast period, advancing at a CAGR of around 10%. This can be because such systems are widely used in automating access control and security including the detection of robbed vehicles in real-time, and in police patrolling cars and identifying vehicles that are used for checking over speeding of vehicles on roads or highways. Moreover, these devices are extensively implemented by law enforcement and public safety agencies, due to their flexibility of usage and cost-effectiveness.

Whereas, the fixed systems category accounted for the largest revenue share in the market in 2022, and it is further expected to maintain its dominance during the predicted period. This is due to the rising usage of such systems for traffic management; highly deploy in interstate borders and areas with heavy congestion and traffic; the surging modernization in road infrastructure; and the burgeoning requirement for automated parking management systems. In addition, advantages offered by such technology including continuous surveillance in major density traffic locations and allowance of real-time enforcement for recurrent toll violators are some other factors responsible for the market growth in this category.

Nowadays, the acceptance of ANPR systems in traffic management and security & surveillance applications is rapidly increasing to identify frauds and crimes in toll collection, check stolen vehicles and expired insurance policies, and monitor terrorist activities. Additionally, law enforcement agencies employ ANPR services to collect evidence and lines of inquiry in crime investigations. In addition, ANPR cameras are installed across the city to achieve clear monitoring. Also, several end users are using mobile-based ANPR systems for guaranteeing enhanced surveillance, security, and traffic legislation.

Due to these factors, in numerous sectors including law enforcement, government, commercial, and defense and security, the demand for such advanced technologies is increasing. Additionally, several governments increasing their funding for intelligent transport systems, and offering initiatives and supporting traffic rules to improve road safety by implementing such technology are fueling the market demand.

The government category accounted for a larger revenue share in 2022, and it is also expected to maintain its dominance during the predicted period. This is ascribed to the increasing number of government infrastructural projects; the surging adoption of advanced technologies by public safety agencies due to the rising vehicle-related crimes including hit-and-run, theft, reckless driving, and wallet snatching; the mounting need for traffic surveillance; and high investments by governments to develop effective vehicle surveillance systems and congestion-free roads.

Whereas, the commercial category will register faster growth in the coming years. This can be due to the rising count for shopping malls, commercial complexes, and luxury apartments, where such technology is employed for parking management; highly utilized by premise security agencies; and the surging infrastructure growth in the retail and commercial sectors.

The traffic management category contributed significant revenue to the market in 2022, and it is further expected to maintain its position during the predicted period. This is due to the rising incidence of vehicle jams or congestion, owing to a large number of vehicles on roads and the occurrence of vehicle collisions; the surging need for solutions for the measurement of section-related traffic data; the rising trend of smart cities across the globe where effective traffic management is primarily needed; and the increasing traffic authorities’ requirement for real-time actions or immediate attention to address accidents.

Moreover, operators, authorities, and end users can use fully-fledged solutions including intelligent transportation systems and intelligent traffic management systems, to control and analyze vehicle movement and automatically identify numerous types of violations, which further contribute to the growth of the automatic number plate recognition system market.

On the other hand, the electronic toll collection category will witness the highest growth in the coming years. This can be because such systems help owners of vehicles to pass through toll plazas without stopping their vehicles and toll tax will be deducted from their respective accounts, which makes them efficient enforcement tools for tolling systems. Additionally, these systems are faster and make highways or roads congestion-free.

In addition, the parking management category contributes significant revenue. This is ascribed to the surging need for parking spaces and their effective management; the increasing requirement for efficiency, profitability, and convenience of vehicle parking at premises in the public and private sector; the rising need to record accurate readings of vehicle number plates with no human intervention; and the high implementation of car parking systems by commercial complexes and shopping malls.

The software category will register faster growth in the coming years, advancing at a CAGR of more than 9.5%. This can be ascribed to the growing usage of optical character recognition (OCR) technology; the increasing need for online congestion control; the surging demand for vehicle tracking in homelands, parking lots, and during patrolling; development of road-rules enforcement; the rapidly growing IT industry; and the mounting emphasis of organizations on the development of web-based ANPR software.

Whereas, the hardware category accounted for a higher revenue share in 2022, and it is further expected to maintain its position during the forecast period. This is due to the emergence of IoT devices into hardware; the quick integration of hardware components into cloud-based software solutions; the rising demand for innovative devices such as intelligent traffic cameras, frame grabbers, and relay cards; the burgeoning trend of integrating such devices into UAVs and patrolling vehicles; the growing need to enhance the existing systems with cutting-edge technology; and the surging government spending for the installation of such systems.

Drive strategic growth with comprehensive market analysis

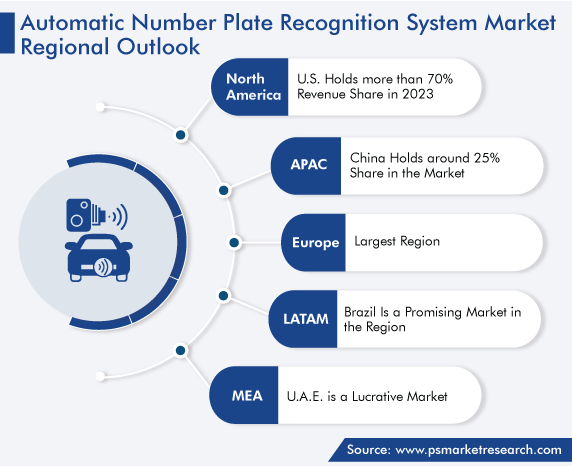

North America accounted for the significant revenue share, of 25%, in 2022, and it is expected to maintain the same trend during the forecast period as well. This is ascribed to the surging number of on-road vehicles or increasing car ownerships, high vehicles per capita, the growing automobile industry, the rising road infrastructure, the burgeoning digitalization, and the presence of government favorable policies and key industry players in the region.

Whereas, the APAC market will witness the fastest growth in the coming years. This can be ascribed to the rising urbanization; the mounting standard of living coupled with increasing per capita income; the easy availability of sensors used in such systems due to the presence of a well-developed electronics industry; the increasing number of vehicles; the growing IT infrastructure; continuous research and development activities for the employment of advanced ANPR devices; and the implementation of strict regulations for traffic control and parking management, in the region.

Europe held the largest revenue share in 2022 and is expected to maintain its position in the coming years. This is ascribed to the increasing need for high-resolution number plate imaging technology, the growing count for infrastructural development projects, and the implementation of strict road transportation legislation in the region.

By Type

By Component

By Application

By End User

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages