Report Code: 12456 | Available Format: PDF

Agricultural Lubricants Market Size and Share Analysis Report by Type (Mineral Oil, Synthetic Oil, Bio-based), Distribution Channel (Online, Offline), Application (Engines, Gears & Transmission, Hydraulics, Greasing) - Industry Demand and Development Forecast to 2030

- Report Code: 12456

- Available Format: PDF

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

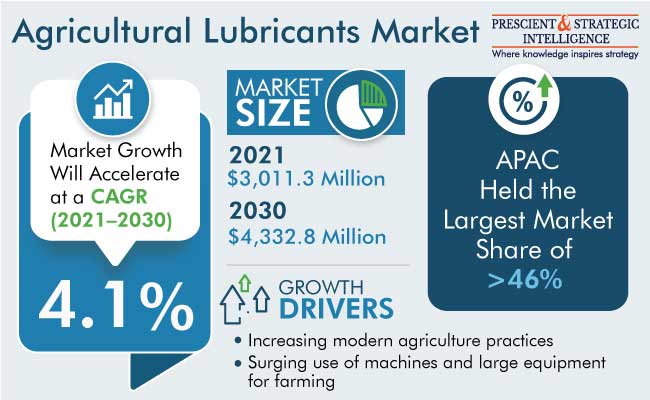

The agricultural lubricants market size stood at $3,011.3 million in 2021, advancing at a compound annual growth rate of 4.1% during 2021–2030, to reach $4,332.8 million by 2030. This is ascribed to the increasing modern farming practices, mechanization of agricultural processes, and the surging requirement to improve crop productivity. Moreover, farming activities and related products will continue to expand at a rapid pace in the coming years, due to the rising cost of farm labor. In addition, the surging rate of farm mechanization and the appeal of high-performance synthetic greases are expected to support the market expansion.

Furthermore, in recent years, significant technological advancements have taken place in the agronomical sector. Innovative approaches and strategies, including inorganic compost, have generated awareness among farmers to improve crop yields, increase production efficiency, and decrease operational costs. Thus, modern machinery and technology are being used in fields to reduce the time of operations and effort and increase productivity.

China, India, the U.S, and Brazil are the top performers of crop cultivation practices, where complimentary mechanization is being performed with several modern ways of farming, and thus they have accounted for major revenue of agricultural lubricants and farming equipment.

In addition, LATAM is the emerging market for agricultural lubricants, which is expected to witness a CAGR of 4.2% % in the coming years. The market can be driven by the rising demand for high-performance lubricators from commercial and agronomy farmers and the increasing adoption of modern agriculture machinery, which boosts the use of greasing products in the agriculture industry.

Government Initiatives Boost the Agriculture Sector

Government agencies are putting in place a number of farmer subsidy schemes in developing countries like India, Mexico, and others. These subsidiaries are meant to help farmers buy tractors, harvesters, power sprayers, paddy transplanters, threshers, and other comparable pieces of equipment. Due to this, more sophisticated machinery is being used by farmers, which raises the demand for agricultural machine lubricating products.

For instance, in India, the government offers subsidies of around 30–50% for the procurement of farming machinery. Thus, the usage of modern equipment for the cultivation of crops is increasing, which, in turn, is driving the demand for lubricants and opening up prospects for their producers, allowing them to expand their operations internationally.

Moreover, in the U.S, the agriculture, food, and related industries contributed around $1.05 trillion to the U.S. gross domestic product (GDP) in 2020. The output of the country’s farms contributed about $134 billion, which is about 0.6% of its GDP. Also, the farm bill has been passed every five years by the government, which has a tremendous and favorable impact on farming livelihoods in the country.

Thus, the development in the agronomy sector and several government initiatives offer new opportunities to farmers, which promote the penetration of modern equipment. Thus, this factor propels the agricultural lubricants market growth.

| Report Attribute | Details |

Historical Years |

2017-2021 |

Forecast Years |

2022-2030 |

Market Size in 2021 |

$3,011.3 Million |

Revenue Forecast in 2030 |

$4,332.8 Million |

Growth Rate |

4.1% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Application; By Distribution Channel; By Region |

Explore more about this report - Request free sample

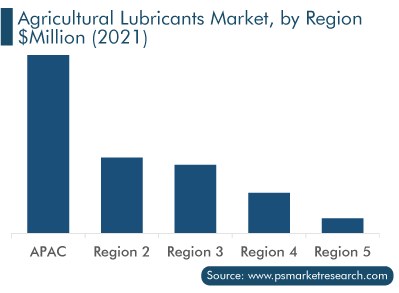

APAC Has the Largest Agriculture Sector

APAC accounted for the largest revenue share, of 46%, in 2021 in the global market. The regional market witnesses rapid developments in terms of investments, trade, and technology, due to the increase in the rate of urbanization and industrialization. Moreover, demographics, economic conditions, environmental conditions, technological advancements, and suitable landscapes are boosting the agriculture sector in the region, which, in turn, drives the demand for farm equipment and products, including agricultural lubricants.

Furthermore, countries like Australia and India are projected to increase oil production capacity to reduce reliance on imported oils. In addition, the rising environmental awareness and government measures to promote sustainability and self-reliance are also driving the regional demand for agro lubricants.

The APAC agricultural lubricants market outlook market is also expected to witness the fastest growth in the coming years, owing to the fact that manufacturers have moved their manufacturing facilities to the region, due to cheap labor and high consumer requirement. Therefore, market players are focusing on better investments and strategies to cater to the surging demand for these products.

Moreover, according to data, APAC has more than 56% of the world’s population, and more than half of its population relies on agriculture for a living. The large farm size offers assistance to equipment sales, which, in turn, increases the need for agricultural lubricants.

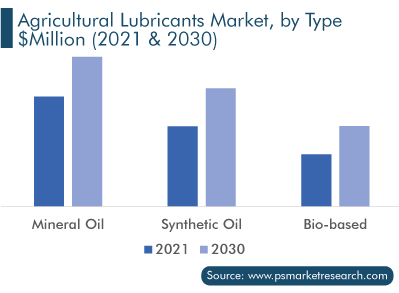

Biodegradable Lubricants Will Provide Future Growth Opportunities to the Industry

The demand for bio-based lubricants is projected to witness the fastest growth, advancing at a CAGR of around 4.9%, during the forecast period. The growing popularity of biodegradable oils is projected to provide lucrative opportunities to industry players. Bio-based products have been proven to offer superior lubricating qualities to mineral-based, with renewability and biodegradability being their primary assets. Moreover, their need is increasing, as agriculture companies and farmers are demanding heavy-duty machines for modern farming.

The bio-based lubricating products are widely used in Europe because of the country's strict laws about harmful substances. For instance, European regulations make it compulsory to consume oils with EOCLABEL specifications. A few benefits of EOCLABEL products are their lower impact on soil and water resources, lower carbon dioxide emissions, a high proportion of renewable raw materials, and restricted usage of dangerous compounds.

Moreover, stakeholders are focused on the research & development of new techniques and methodologies for the production of bio-based machine oils, with the increasing interest in economic values and a healthy environment. There is a dire need to replace conventional Polyalphaolefin (PAO)-based and mineral oil-based grease products, which will encourage the upstreaming of bio-based lubricating materials. Thus, the demand for bio-based greases will rise rapidly in the coming years.

Key Players in the Agricultural Lubricants Market Report Are:

- Chevron Corporation

- Phillips 66 Company

- Rymax B.V.

- Exxon Mobil

- TotalEnergies SE

- BP plc

- Petro-Canada Lubricants Inc.

- FUCHS PETROLUB SE

- Exol Lubricants Limited

- Witham Group

Agricultural Lubricants Market Size Breakdown by Segment

The study offers a comprehensive market segmentation analysis along with market estimation for the period 2017-2030.

Based on Type

- Mineral Oil

- Synthetic Oil

- Bio-based

Based on Distribution Channel

- Online

- Offline

Based on Application

- Engines

- Gears & Transmission

- Hydraulics

- Greasing

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The agricultural lubricants market size stood at $ 3,011.3 million in 2021.

During 2021–2030, the growth rate of the agricultural lubricants market will be around 4.1%.

Engines is the largest application area in the agricultural lubricants market.

The major drivers of the agricultural lubricants market include the increasing modern agriculture practices and the surging use of machines and large equipment for farming.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws