Acoustic Vehicle Alerting System Market Analysis

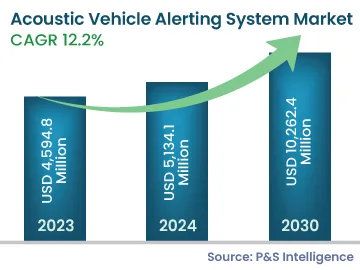

The global acoustic vehicle alerting system market generated USD 4,594.8 million revenue in 2023, and it is projected to witness a CAGR of 12.2% during 2024–2030, reaching USD 10,262.4 million by 2030. This is owing to the stringent emission norms and government support, in the form of tax rebates, grants and subsidies, and other non-financial benefits, to promote electric vehicle (EVs) adoption.

The AVAS has become an integral component of all types of EVs, as it concerns pedestrian safety, especially the more vulnerable sections, including children, blind people, aged people, and people with partial vision.

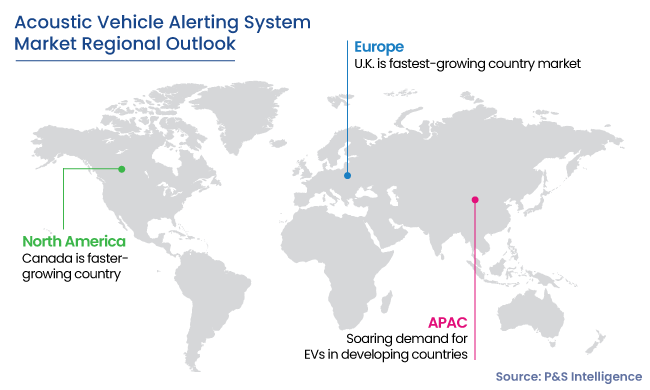

Additionally, the mandate to install this system has come into force in several countries, for instance, in the U.S., the National Highway Traffic Safety Administration (NHTSA) has mandated the acoustic vehicle alerting system (AVAS) in every electric vehicle and hybrid electric vehicle sold in the country. Similarly, in Europe similar mandate has been introduced for all new hybrid and electric vehicles. Further, the sound of this system may vary from region to region.

Increasing pollution all around the world is a major global concern. Thus, governments are concerned about the poor air quality index by fumes from ICE vehicles. Greenhouse gas emissions from traditional vehicles led to the formation of stringent environmental policies by governments. This leads to an increase in government initiatives to support the adoption of electric vehicles, globally.

The electric vehicle is a perfect antidote to reduce air pollution and reduce carbon emissions in the environment. The rising usage of electric vehicles will make the reduction of GHG possible, which further propels the growth in the demand for electric vehicles and thereby AVASs.

It is observed that electric vehicles are 37% and 56% prone to accidents involving pedestrians and cyclists, respectively. Thus, it becomes a potent threat to vulnerable road users, including children, elderly people, cyclists, and inattentive pedestrians. Therefore, OEMs and speaker manufacturers are producing AVASs for low-noise vehicles to alert pedestrians and people with limited or without vision. They have teamed up with bands, music composers, and others to create special tones for their vehicles. But the best alternative would be the copied sound of a conventional IC engine.