3D Bioprinting Market Analysis

Explore In-Depth 3D Bioprinting Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

Report Code: 10744

Explore In-Depth 3D Bioprinting Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

The inkjet technology has the largest revenue share in 2024 as the usage of living cells allows for the printing of complex organs and tissues on culture substrates. The widespread usage of inkjet printers in the medical industry is also because of its high reliability.

The magnetic levitation technology is expected to witness the fastest growth during the forecast period on account of its cost-effectiveness. With its higher speed and accuracy, magnetic levitation technology is set to eliminate the significant errors, such as poor biocompatibility, in bio 3D printing.

Additionally, toxicity testing, vascular muscle printing, and human cell regeneration can all be achieved using the maglev bioprinting technology. For instance, using magnetic-levitation-based devices, BioAssay has created a structure that looks similar to tissue. Because of the quick adoption of new technologies around the world, additive manufacturing machines using the maglev technology are the most likely to have the fastest sales growth during the projection period.

Here are the technologies covered in the report:

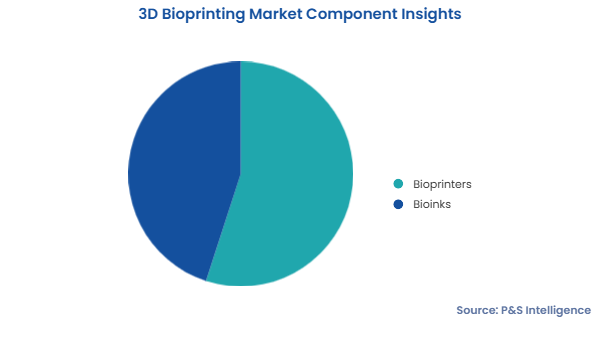

Bioprinters occupy the larger share as they are the most component of 3D bioprinting. As these machines need to be more advanced than the 3D printers used in non-medical sectors, they are highly expensive. Further, these machines are undergoing rapid advancements, in parallel with the evolving regulations over artificially created human organs and tissues.

Bioinks will witness the higher CAGR, of 15%, during the forecast period. Unlike printers, inks are a repetitive purchase, as their stocks dwindle with regular usage. Additionally, a variety of bioinks are required for different purposes, and as 3D bioprinting moves from the laboratory to the hospital, the demand for these consumables will increase swiftly.

The following components are analyzed:

The research category dominates the market with 75% share, attributed to the niche and evolving nature of this technology. Much of the usage of 3D bioprinting is aimed at establishing its applications and ascertaining the safety and reliability of 3D-printed organs. Further, this technology is increasingly being used in drug R&D, especially for trials and precision medicine studies. Here, 3D bioprinting addresses the concerns over animal and human testing, with the potential to quicken up drug approvals.

The clinical bifurcation will witness the faster growth over the forecast period. This is attributed to the increasing usage of 3D-printed tissue and dental implants, as well as the rising application of this technology in personalized medicine and drug testing. Moreover, as research progresses, this technology is expected to become the cornerstone of organ transplants, reducing the reliance on live and deceased donors and improving organ availability.

The segment is bifurcated as below:

Pharmaceutical and biotechnology companies are the largest end user in the market, and they will witness the highest CAGR during the forecast period, of 16%. This is because these companies are rapidly incorporating 3D bioprinting in their R&D strategies to lower expenses, tackle concerns over live organism testing, deal with poor patient compliance during trials, and shorten the time to market. Additionally, with the increasing popularity of precision medicine, they are combining their knowledge of genomics and their DNA sequencing and analysis technologies with 3D bioprinting to enhance biocompatibility and effectiveness. An important topic of research being conducted utilizing 3D bioprinting is disease modeling, where diseases are simulated in artificially created organs and tissues to unearth targeted treatments.

The report offers insights into the below-mentioned end users:

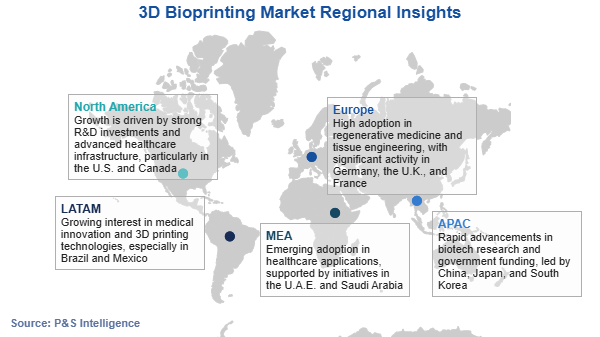

The North American market for 3D bioprinting solutions holds around 40% share in 2024 due to technological advancements, increasing research and development activities, and enhancing healthcare infrastructure. Moreover, the high healthcare expenditure, growing geriatric population, and increasing prevalence of chronic diseases are supporting the demand for this technology, especially in the pharmaceutical industry.

As per the Health Resources & Services Administration of the Department of Health & Human Services, 103,223 patients are on the transplant list in the country. Compared to this, just over 46,000 transplants were performed in the U.S. in 2023. Further, one patient is added to the transplant list every 8 minutes in the country. Additionally, the unavailability of organs for transplantation causes the death of 17 patients per day.

Furthermore, North America is witnessing a rapid increase in the geriatric population and high incidences of orthopedic conditions, which is expected to fuel the demand for bio-printed tissues in the region.

Additionally, the American Academy of Plastic Surgeons and the National Institute on Aging state that a significant portion of the population, primarily those between the ages of 16 and 33, is demanding advanced dermatology and dental services. The growing self-care awareness is one of the key drivers propelling the bio printing demand in developed nations, since it makes it possible to bio-print skin tissues.

The U.S. is the larger market for bio three-dimensional printing in North America due to the increasing R&D for tissue engineering and fabrication, which is leading to technological advancements in this field. The presence of a large number of market players and increasing chronic disease incidence are also fueling the three-dimensional bioprinting industry advance.

Asia-Pacific will be the fastest-growing market, with 16% CAGR, primarily because of its large consumer base, rising R&D in this domain, and government support and tax breaks.

Chinese researchers have made major advancements in this technology, such as the liquid-in-liquid printing process, in which liquid polymers are combined to form a stable membrane. They assert that the resulting liquid formations can maintain their shape for up to 10 days, before they start to combine. They were able to print a variety of intricate shapes using this new method, which has further paved the way for the printing of tissues from living cells.

Here is the geographical breakdown of this market:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages