Global Wind Turbine Composite Materials Market to Witness 7.8% CAGR during 2016 – 2022

- Published: April 2017

The global wind turbine composite materials market valued at around $4.0 billion in 2015 and is expected to witness a CAGR of 7.8% during 2016–2022. The several benefits of composite materials over other materials, along with strict environmental regulations and increasing government support for wind power projects, are driving the market growth. The market is also predicted to generate revenue owing to advancements in technology. Besides, the largely uncharted Latin American (LATAM) and Middle Eastern and African (MEA) markets are creating ample opportunities for the manufacturers and retailers of wind turbine composite materials across the world.

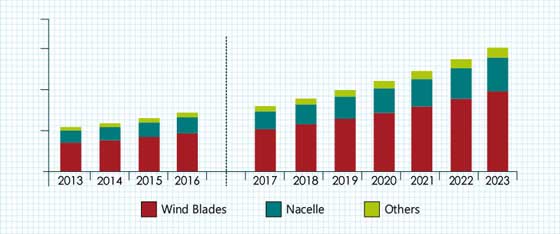

GLOBAL WIND TURBINE COMPOSITE MATERIALS MARKET, BY APPLICATION, KILOTONS (2012 – 2022)

Insights on the market segments

On segmenting by type, the wind turbine composite materials market is categorized into fiber and resin. Between the two, the fiber category led the market in 2015 in terms of volume. The fiber category is further divided into glass, carbon and others, of which the glass fiber category is expected to continue dominating the market. Further, the carbon fiber category is predicted to witness significant growth during the forecast period, as carbon fibers are becoming immensely popular in the manufacturing of wind turbine blades due to their high-strength and low-weight properties.

On the basis of application, the wind turbine composite materials market is categorized into wind blade, nacelle, and others. Among these, in 2015, composite materials were consumed in the largest amount for the manufacturing of wind blades.

Asia-Pacific stands as the largest consumer of wind turbine composite materials

Globally, Asia-Pacific (APAC) led the wind turbine composite materials market in 2015, accounting for the largest volume share. The cumulative wind power generation capacity in APAC, which was 100.8 GW in 2012, increased to 146.4 GW in 2014. The growth in wind power production capacity resulted in increased requirement for wind turbine composite materials in the region. China was the largest market for wind turbine composite materials globally, in terms of both volume and value. The total installed wind power capacity in the country was 75.3 GW in 2012, which rose to 114.6 GW in 2014.

However, the fastest growth in the wind turbine composite materials market was witnessed in the MEA region during 2012–2015. This can be attributed to the considerable rise in the region’s wind power generation capacity during this period. The total installed wind power capacity in MEA was 1.1 GW in 2012, which grew to 2.5 GW in 2014.

Increasing need for energy independence and geopolitical energy security to impact the market growth

The U.S., Brazil, Canada, and Mexico along with several other countries in the European Union (EU) and Asian regions envision energy independence in the long term and are, therefore, focusing on reducing their dependence on oil imports through numerous initiatives. For example, the EU has set targets under the Renewable Energy Directive (RED) to meet at least 20.0% of its total energy requirement with renewable sources by 2020. The directive clearly marks the policy for promoting and producing electricity from renewable sources throughout the EU.

Similarly, governments of various countries around the world are focusing on alternative sources of energy to decrease their dependency on conventional sources, such as coal and crude oil. Wind energy is among the most-efficient alternatives to conventional, fossil fuel-based power, as it can be produced within a country. Governments across the globe are, thus, working toward replacing at least a part of their conventional energy production with wind energy. This can help these countries utilize money on national security and economic growth, which is otherwise spent on crude oil and coal imports. Therefore, the rapid development in the wind power industry is predicted to lead to an increase in the demand for composite materials, which, in turn, would help the wind turbine composite materials market to grow during the forecast period.

Key market players collaborating to offer better services

The key players in the market are entering into partnerships and collaborations to improve their services. For instance, Barracuda Advanced Composites and Gurit teamed up in April 2016 to bring wind blade mold services and technologies in the Brazilian market. Other important players in the global wind turbine composite materials market are Cytec Solvay Group, Toray Industries Inc., Hexcel Corporation, TPI Composites Inc., Teijin Limited, Koninklijke Ten Cate N.V., and Molded Fiber Glass Companies.