Tungsten Carbide Powder Market to Generate Revenue Worth $2,176.8 Million by 2023

- Published: November 2018

The global tungsten carbide powder market was valued at $1,762.1 million in 2017, which is projected to reach $2,176.8 million by 2023, progressing at a CAGR of 3.6% during the forecast period (2018–2023). The rotary drilling & mining grades category dominated the market throughout the historical period (2013–2017), among all grades.

Recycling of Tungsten Carbide Scrap

Recycling of granular and powdered tungsten carbide scrap into reusable tungsten carbide is observed as a major trend in the tungsten carbide powder market. Tungsten carbide exhibits high rigidity, high thermal conductivity, and high resistance against corrosion and wear. However, on account of volatility in raw material prices and supply constraints, many manufacturers are recycling and refining tungsten carbide scrap in-house.

Increasing Adoption of Tungsten Carbide Due to its Superior Properties

Tungsten carbide is nearly twice as stiff as steel, and exhibits high thermal conductivity and high resistance to indentations and scratches. It also displays good resistance to acetone, ethanol, gasoline, ethanol, ammonia, water, and weak acids. Owing to such properties of tungsten carbide, it is widely adopted in the defense, oil & gas, metalworking, automotive, and power generation industries. This drives the growth of the tungsten carbide powder market.

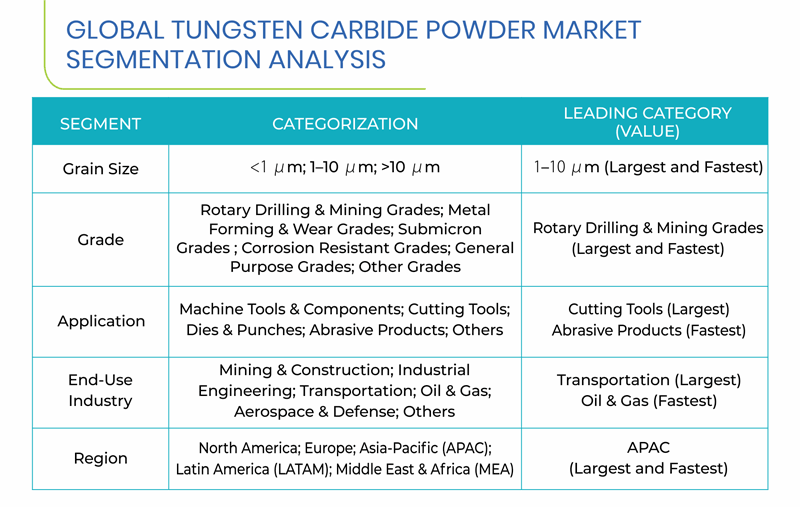

Segmentation Analysis of Tungsten Carbide Powder Market

The 1–10 μm category held the largest revenue share in 2017. Tungsten carbide powder of grain size 1–10 μm is ideal for making variety of cutting tools, machine equipment, and abrasive products, owing to which it is used in large amount.

The rotary drilling & mining grades category is projected to witness the fastest growth during the forecast period, on account of their large-scale demand in the oil & gas, construction, and mining industries.

The cutting tools category accounted for the largest revenue share in 2017. This is ascribed to the wide use of tungsten carbide powder in manufacturing of cutting tools used in the automotive and construction industries for metal cutting ad stone working purposes.

The oil & gas category is expected to exhibit the fastest growth in the tungsten carbide powder market during the forecast period. This can be attributed to the increasing exploration & production (E&P) spending and shale gas exploration.

Geographical Analysis of Tungsten Carbide Powder Market

Together, APAC and North America are expected to account for over 70% share in the tungsten carbide powder market by 2023. This can be mainly attributed to the presence of established players, high demand for tungsten carbide from the automotive industry, and rise in shale gas exploration activities in these regions.

Europe, LATAM, and MEA also hold considerable shares in the tungsten carbide powder market, on account of the increasing demand for automobiles and high demand for tungsten carbide-based tools in the oil & gas industry.

Germany is expected to lead the European tungsten carbide powder market over the forecast period. This can be mainly attributed to the high demand for this powder from automobile industry, as the country is the hub of major automobile manufacturers.

Brazil is the fastest-growing market for tungsten carbide powder in the LATAM region. Growing adoption of tungsten carbide and its derivatives in the automotive industry is the major factor contributing to the growth of the market in the country.

Owing to the rising consumption of tungsten carbide powder in the oil & gas and transportation industries, Saudi Arabia is expected to hold considerable share in the MEA tungsten carbide powder market during the forecast period.

Competitive Landscape of Tungsten Carbide Powder Market

In recent years, major players operating in the global tungsten carbide powder market have taken several strategic measures, such as acquisitions and geographical expansion, to gain a competitive edge in the industry. For instance, in December 2016, Umicore announced that it signed a share purchase agreement to acquire 100% stake of Eurotungstene Poudres SAS, an Eramet Group company specialized in the production of tungsten-based products including tungsten carbide powder, to expand its product line. With this acquisition, Umicore has been able to tap into the growing tungsten carbide powder market.

Some of the key players in the tungsten carbide powder market are Chongyi Zhangyuan Tungsten Co. Ltd., GuangDong XiangLu Tungsten Co. Ltd., Nanchang Cemented Carbide Limited Liability Company, China Minmetals Corporation, and Kennametal Inc.