Sodium Sulphate Market to Generate Revenue Worth $2,109.4 Million by 2024

- Published: February 2020

The sodium sulphate market was valued at $2,019.3 million in 2018, and it is projected to reach $2,109.4 million by 2024, progressing at a CAGR of 2.6% during the forecast period (2019–2024). Soaps & detergents held the largest revenue share in the market in 2018, among all applications. The salt is widely used as a filler to alter the physical properties and characteristics of the powder. The objective of adding fillers is to make the detergent fluidic. The absence of the salt in the detergent makes particles stick together easily, forming a big block. It is also preferred due to its easy availability and low cost. The maximum concentration of the salt in every batch of the detergent produced is around 35%.

In the forecast period, the textiles are expected to witness the fastest growth in the segment of application. This salt is known as the levelling agent, as it reduces the negative charges on fibers. By doing so, it allows dyes to penetrate the textiles evenly and effectively.

Demand for powder detergents in emerging economies driving the market

The demand for powdered detergents in emerging economies has created a high requirement for sodium sulphate, which provides easy movement and acts as a filler in detergents. Furthermore, low cost, easy availability, transportability, and ease of use, increase the adoption of detergents in emerging economies. The other major reasons that have contributed in the increasing adoption of these end products include macroeconomic growth and shift from hand to machine-based washing of clothes. These factors are propelling the demand for the salt in soap & detergent formulations, thereby helping the market prosper.

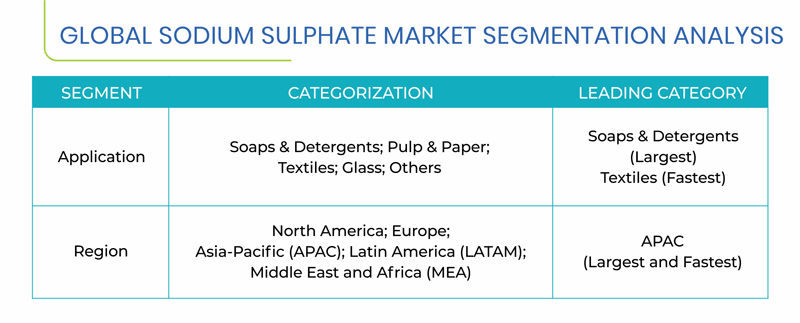

Segmentation Analysis of Sodium Sulphate Market

Soaps & detergents held the largest share in the application segment of the sodium sulphate market, in terms of value, in 2018, due to the adoption of salt in the manufacturing of these products, as a fining agent and desiccant, which helps in effectively locking the moisture that enters the detergent. Furthermore, it makes detergents less costly to produce, as it has a low cost, and it is a hydrogen (pH)-neutral substance that readily dissolves in warm water.

Geographical Analysis of Sodium Sulphate Market

Together, APAC and Europe are expected to account for over 65.0% revenue share in the global market by 2024. This can be mainly ascribed to the exponential production and consumption of the salt in China and Russia, in various industrial applications, such as soaps & detergents, paper & pulp, textiles, and glass.

Other regions, which include North America, LATAM, and MEA, also hold considerable shares in the global market, due to the presence of the major producers of the salt in the U.S., Brazil, and Iran, from where it is exported to other countries.

China is expected to lead the APAC sodium sulphate market, generating revenue of $880.9 million in 2024, The production in the country is being driven by the increasing exports of sodium sulphate from China to the U.S. and several LATAM and European countries. Besides, there is a presence of a large number of consumers for China-made this salt in other Asian countries, including Cambodia, Vietnam, the Philippines, South Korea, and Thailand.

Competitive Landscape of Sodium Sulphate Market

The sodium sulphate market is consolidated in nature, and MINERA DE SANTA MARTA S.A., Xinli Chemical, JSC Kuchuksulphate, Jiangsu Yinzhu Chemical Group Co. Ltd., China Lumena New Material Corp., Sichuan Hongya Qingyijiang Sodium Sulphate Co. Ltd., Grupo Industrial Crimidesa, and Nafine New Material Co. Ltd. are some of the major players.

Browse report overview with detailed TOC on "Sodium Sulphate Market Research Report: By Application (Soaps & Detergents, Pulp & Paper, Textiles, Glass) – Global Market Size, Share, Trends Analysis and Growth Forecast to 2024" at:https://www.psmarketresearch.com/market-analysis/sodium-sulphate-market

In January 2019, Albemarle Corporation announced the commencement of construction at its lithium hydroxide (LiOH) conversion site in Kemerton, Western Australia. The plant will process spodumene ore (containing 6% lithium oxide), in order to produce lithium hydroxide, and sodium sulphate as a by-product. The volume of it, is expected to be in the tune of 200,000 tons annually.