Report Code: 11736 | Available Format: PDF | Pages: 129

Sodium Sulphate Market Research Report: By Application (Soaps & Detergents, Pulp & Paper, Textiles, Glass) - Global Market Size, Share, Trends Analysis and Growth Forecast to 2024

- Report Code: 11736

- Available Format: PDF

- Pages: 129

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

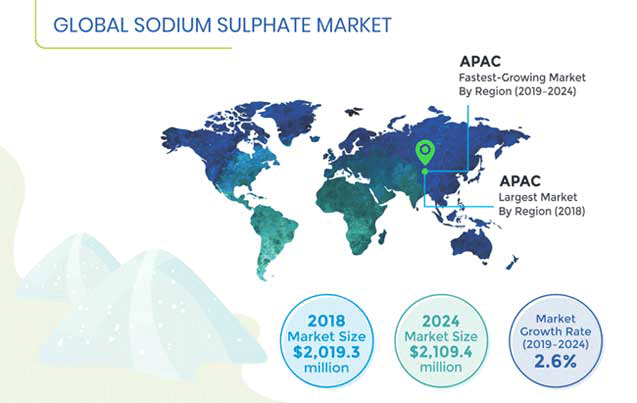

Valued at $2,019.3 million in 2018, the global sodium sulphate market is projected to surpass $2,109.4 million by 2024, witnessing a CAGR of 2.6% during the forecast period. The growth of the market can be mainly attributed to the increasing use of the salt as a raw material in the manufacturing of various products, including soaps and detergents, and glass, as well as in the Kraft process for paper pulping.

Asia-Pacific (APAC) is expected to witness the fastest growth, in terms of value, during the forecast period. This is mainly driven by the increasing demand for products such as soaps, detergents, paper, and glass to cater to the booming population in the region. The emerging countries in the region, such as China, India, and Vietnam, are contributing significantly to the sodium sulphate market prosperity, owing to the rising awareness related to hygiene, adoption of Western culture, increasing affordability, and growing population.

Fundamentals Governing Sodium Sulphate Market

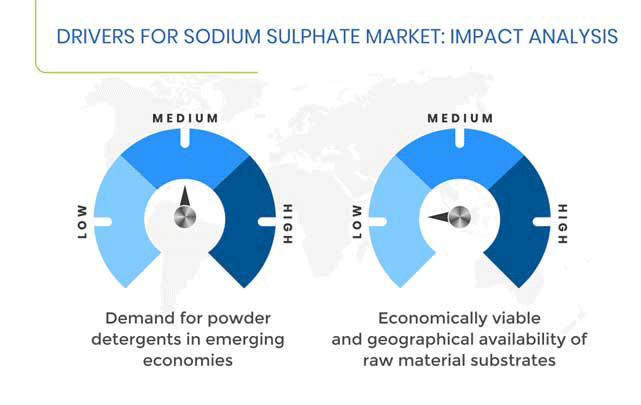

The growth of the sodium sulphate market is driven by the demand for powdered detergents in emerging countries in APAC, Africa, and Latin America (LATAM), such as China, India, Brazil, Colombia, Chile, Vietnam, Indonesia, the Philippines, and Thailand. This has created a high-volume demand for the salt, for product formulations, in recent years. This is mainly attributed to the easy movement of powders; the also substrates act as a filler in detergents. Besides, the increasing adoption of the products, is due to macroeconomic growth and shift from hand to machine-based washing of clothes, would drive the demand for sodium sulphate in soap & detergent formulations, at a volumetric CAGR of 2.8% during 2019–2024.

The rising demand for glass in construction projects, on account of the recovery in the sector in developed countries and investments across developing countries, is expected to drive the sodium sulphate market during the foreseeable future. The growing construction industry is fueling the demand for glass, particularly in modern buildings, where it is excessively used in exteriors, instead of the conventional bricks and cement. Sodium sulphate is used in glass manufacturing as a fining agent, which helps in removing small air bubbles from molten glass. With the growing consumer preference for artificial façades, the market is expected to progress during the forecast period.

Sodium Sulphate Market Segmentation Analysis

The soaps & detergents category generated the highest demand for the salt, on the basis of application, accounting for more than 30.0% value share, in 2018. This can be mainly attributed to its properties, which enable detergent powder to flow freely. It is used as a filler in detergent powder that enables the adjustment of the concentration of the active matter in the powder, as required.

Geographical Analysis of Sodium Sulphate Market

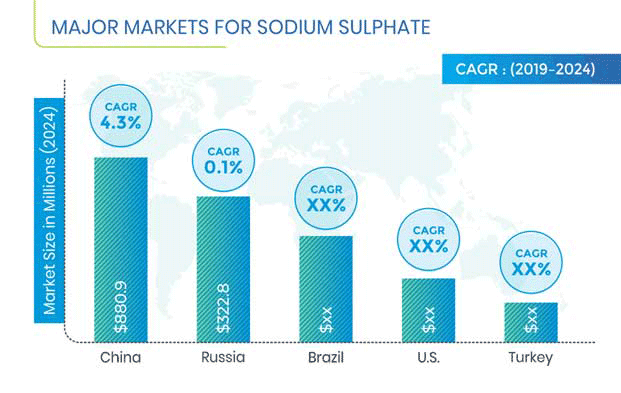

Globally, APAC was the largest sodium sulphate market, in terms of value, in 2018, and it is expected to maintain the trend during the forecast period. This can be majorly attributed to the high consumption of the product in China for various applications, majorly soaps & detergents and textiles. Additionally, the Chinese personal care sector has gained rapid pace, owing to which there has been an increasing demand for sodium sulphate, as a raw material, for the production of shampoos, soap bars, body washes, and several other personal care and hygiene products. Considering the future industry scenario, China is expected to lead the APAC sodium sulphate market, generating revenue worth $880.9 million in 2024.

Competitive Landscape of Sodium Sulphate Market

The sodium sulphate market is concentrated, characterized by the presence of small players, which together account for over 57.0% share of the market. MINERA DE SANTA MARTA S.A., Xinli Chemical, JSC Kuchuksulphate, Jiangsu Yinzhu Chemical Group Co. Ltd., China Lumena New Materials Corp., Sichuan Hongya Qingyijiang Sodium Sulphate Co. Ltd., Grupo Industrial Crimidesa, and Nafine New Material Co. Ltd. are the important players operating in the market.

Recent Strategic Developments of Major Sodium Sulphate Market Players

In recent years, the major players in the sodium sulphate market have taken several strategic measures, such as product launches, geographical expansions, and mergers & acquisitions, to gain a competitive edge in the industry. For instance, in November 2018, Beautiful Mind Capital (BMC), an independent private equity form, announced the acquisition of Cordenka from Chequers Capital, for an enterprise value of $268 million. Chequers Capital will transfer all its assets, which include its Obernburg site, which has a capacity to produce 40,000 metric tons of anhydrous sodium sulphate, at its.

Moreover, in October 2018, In January 2019, Albemarle Corporation announced the commencement of construction at its lithium hydroxide (LiOH) conversion site in Kemerton, Western Australia. The plant will process spodumene ore (containing 6% lithium oxide), in order to produce lithium hydroxide, and sodium sulphate as a by-product. The volume of sodium sulphate is expected to be in the tune of 200,000 tons annually.

Market Size Breakdown by Segment

The sodium sulphate market report offers comprehensive market segmentation analysis along with market estimates for the period 2014–2024.

Based on Application

- Soaps & Detergents

- Pulp & Paper

- Textiles

- Glass

Geographical Analysis

-

North America

- U.S.

- Canada

-

Europe

- Germany

- Spain

- Russia

- Turkey

- U.K.

- Poland

-

Asia-Pacific (APAC)

- China

- Japan

- Indonesia

- South Korea

-

Latin America (LATAM)

- Brazil

- Mexico

- Chile

- Colombia

-

Middle East & Africa (MEA)

- Iran

- Egypt

- Saudi Arabia

- Algeria

- Morocco

Key Questions Addressed

- What is the current scenario of the sodium sulphate market?

- What are the historical and present sizes of the categories within the market segments and their future potential?

- What are the major catalysts for the market and their expected impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws