Polytetrafluoroethylene (PTFE) Market to Generate Revenue Worth $2,953.6 Million by 2024

- Published: November 2019

The global polytetrafluoroethylene (PTFE) market stood at $2,197.8 million in 2018, and it is expected to reach $2,953.6 million in 2024, demonstrating a CAGR of 5.0% during the forecast period (2019–2024). A high-volume demand for the compound is expected to arise from the electrical and electronics industry, which would further drive the market.

The demand for polymer of tetrafluoroethylene in the electrical & electronics niche is expected to witness the fastest growth compared to all other applications, at a CAGR of 6.4%, in terms of volume, during the forecast period. This growth is attributed to the increasing demand for innovative products across several regions, which has expanded the manufacturing of electrical and electronic devices, which, in turn, is creating a huge demand for PTFE from the sector.

Use of PTFE in Medical Devices is the Key Market Trend

In the recent years, the increasing application of polytetrafluoroethylene in the medical sector has been a key trend in the market. It has replaced traditional plastics owing to its properties of low coefficient of friction, resistance to UV radiation, and chemical inertness. Such properties make it highly suitable for catheters, sutures, syringes, and bio-containment vessels. Additionally, the high chemical resistance of the compound makes it suitable for multi-lumen tubing that is required in minimally invasive procedures. In May 2019, Bal Seal Engineering Inc., a custom solutions and service provider for medical applications, announced its achievement of USP Class VI compliance for its SP-191 (filled PTFE) and SP-23 (polymer with PTFE base) seal materials.

Increasing Demand for PTFE from Electrical and Electronics Industry Driving the Market

The rapidly increasing demand from the electrical and electronics industry is one of the key factors driving the growth of the global market. It is required in cable ties, battery binders, brush holders, circuit breakers, connectors, barb insulators, and fabrication of semiconductor devices. With increasing population, the demand for electrical and electronic goods is likely to rise, specifically in the developing South Asian nations. This is predicted to increase the demand for PTFE owing to its requirement in several areas, such as wire and cable jacketing, separation of conductive surfaces in capacitors, and usage in high-voltage encapsulation devices for electrical components.

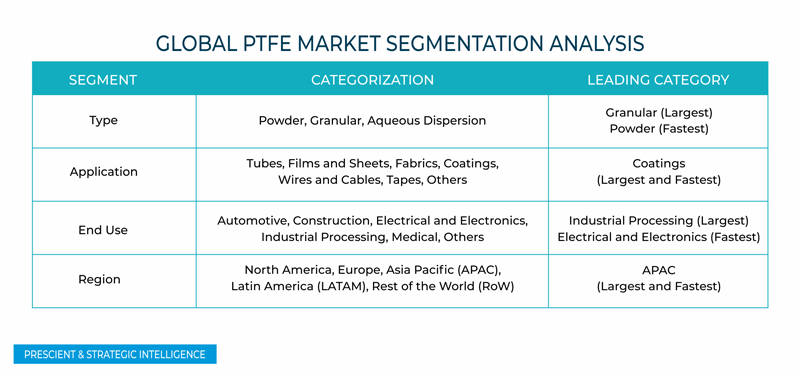

By type, granular segment is expected to dominate the market during the forecast period, owing to its suitability and large-scale usage in gaskets, seals, and rings for automotive and aerospace applications. Powdered type is expected to demonstrate the fastest growth owing to its application in electrical tapes and wire and cables, and coatings. Hence, with the rapid growth of the electrical and electronics industry, the market for powdered PTFE is expected to witness growth at a rapid pace.

By application, the coatings category is expected to dominate the global market as well as demonstrate the fastest growth during the forecast period. This is because coatings for the chemical compound are used in a wide array of industries, including nonstick cookware, electrical and electronics, and automotive, for prevention of minor scratches. In addition, the increasing demand for PTFE-coated valves, seals, and rings from the industrial processing sector is expected to further increase the demand.

By end use, the industrial processing sector is expected to lead the polytetrafluoroethylene market throughout the forecast period. The coating of the chemical on products, such as gaskets, linings, and piping, have the ability to improve the chemical and heat resistance, reduce friction and sticking, and enhance the electrical load bearing capacity of the base material, therefore are the material of choice in the chemical processing sector.

Geographical Analysis of PTFE Market

Geographically, Asia Pacific held the largest volume share, of 64.1%, in the global market in 2018, and it is also expected to demonstrate the fastest growth during the forecast period. Europe is expected to have the second largest share in the global market, while North America is expected to witness the second fastest growing demand for polymer of fluoroethylene during the forecast period. This can be attributed to the large-scale industrial processing activities in North America and growth of the automotive industry in Europe.

The increasing adoption of lightweight vehicles in countries such as Germany, France, the U.S. and the U.K. is expected to boost automotive production in the coming years, which, in turn, is likely to create a high demand for PTFE coatings.

China is expected to lead the market in APAC region, generating revenue of $1,594.0 million in 2024. This can be mainly attributed to the large number of electronics manufacturers in the country, which require such chemical coatings for wiring, semiconductors, and other parts. Some of the leading electronics manufacturing companies in the country are Lenovo Group Limited, Huawei Technologies Co. Ltd., Haier Group Corporation, and Xiaomi Corporation.

In RoW, Brazil dominated the market with the largest volume share, and it is expected to demonstrate the fastest growth during the forecast period as well. This is attributed to the escalating demand for PTFE coatings from the aerospace sector of the country. Moreover, the government is aiming at foreign investments in Brazil’s aviation sector. In addition, the demand for such coatings from Saudi Arabia’s chemical processing industry is expected to help the global market grow. In 2018, Saudi Aramco and SABIC announced their agreement for the development of an integrated industrial complex to convert crude oil to chemicals.

Competitive Landscape of PTFE Market

The global market is highly concentrated in nature due the presence of a small number of players. Some of the leading players in the market include 3M Company, Gujarat Fluoropolymers Ltd., AGC Inc., Daikin Industries Ltd., Solvay SA, Juhua Group Corporation, The Chemours Company, Zhonghao Chenguang Research Institute of Chemical Industry, and Shandong Dongyue Polymer Material Co. Ltd. A significant portion of the chemical manufacturing happens in the APAC region, primarily China.

Browse report overview with detailed TOC on "Polytetrafluoroethylene (PTFE) Market Research Report: By Type (Powder, Granules, Aqueous Dispersion), Application (Tubes, Films & Sheets, Fabrics, Coatings, Wires & Cables, Fuel Additives, Tapes), End User (Automotive, Construction, Electrical & Electronics, Industrial Processing, Medical), Geographical Outlook (U.S., Canada, Mexico, Germany, Italy, U.K., France, China, India, Japan, Brazil, South Africa, Iran, Australia) – Global Industry Trends and Forecast to 2024" at:https://www.psmarketresearch.com/market-analysis/ptfe-market

Mergers and acquisitions, product launches, and capacity expansions are being undertaken by PTFE market players in order to gain a larger share in the global market. Also, most of the large players operating in the market are backward integrated and also produce raw materials, such as fluorspar, chloroform, and R-22.

In 2017, Daikin Industries Ltd. acquired Heroflon S.p.A., an Italian manufacturer of fluoropolymer compounds. Heroflon’s product portfolio comprises fluoropolymer compounds and micro-powders of polytetrafluoroethylene.

Some other important players operating in the global market are Zhejiang Jusheng Fluorochemical Co. Ltd., HaloPolymer OJSC, Shamrock, and Shanghai 3F New Material Co. Ltd.

Market Segmentation by Type

- Powder

- Granules

- Aqueous Dispersion

Market Segmentation by Application

- Tubes

- Films & Sheets

- Fabrics

- Coatings

- Wires & Cables

- Fuel Additives

- Tapes

- Others

Market Segmentation by End User

- Automotive

- Construction

- Electrical & Electronics

- Industrial Processing

- Medical

- Others

Market Segmentation by Geography

-

North America PTFE Market

- By type

- By application

- By end user

- By country – U.S., Canada and Mexico

-

Europe PTFE Market

- By type

- By application

- By end user

- By country – Germany, Italy, U.K., France, and Rest of Europe

-

Asia-Pacific (APAC) PTFE market

- By type

- By application

- By end user

- By country – China, India, Japan, and Rest of APAC

-

Rest of World (RoW) PTFE Market

- By type

- By application

- By end user

- By country – Brazil, South Africa, Iran, Australia, and Others