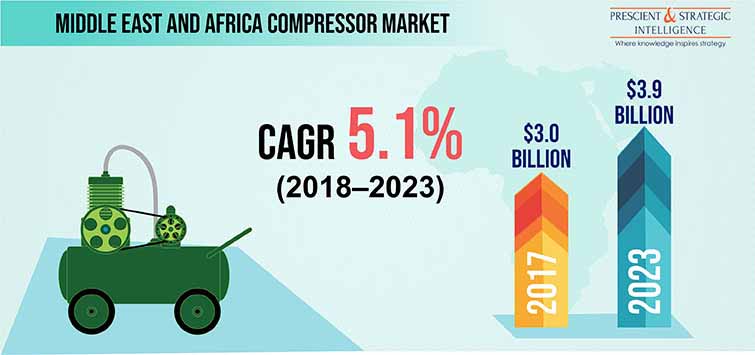

Middle East and Africa Compressor Market to Reach $3.9 Billion by 2023

- Published: February 2019

The Middle East and Africa (MEA) compressor market is forecasted to cross 3.9 Billion by 2023, according to P&S Intelligence.

During the historical period, MEA compressor market recorded decline of 0.2%, with major decline witnessed during 2014-2015, predominantly due to falling oil prices, which affected most of the industries during this period. However, the demand for compressors in MEA is expected to increase in the forecast period with expected economic recovery in the region in 2019. Moreover, the packaging industry in Middle East is expected to grow swiftly, pushing the demand for compressors in the forecast period.

Insights into market segments

Based on type, Middle East and Africa compressor market has been segmented into positive displacement and dynamic compressors. Positive displacement compressor category held larger market share in terms of value in 2017, owing to its widespread application in automotive industry. North Africa market is one of the largest automotive markets in the MEA region; OEMs are increasingly setting-up automotive manufacturing in countries including Algeria, Egypt, Morocco, and Tunisia due to rising disposable income, rapid urbanization, and continuous improvement in infrastructure. This is proving to be a major factor behind its growth in the region.

On the basis of positive displacement, the Middle East and Africa compressor market has been categorized into rotary and reciprocating. Rotary compressors held a major revenue share in 2017. Rotary compressors are used in a range of applications including power generation and industrial production. Major countries such as Saudi Arabia, U.A.E., and Iran are setting-up policies to reduce their dependency on crude oil and gas production and boost power and industrial infrastructure development.

Oil-flooded compressors were the most popular category on the basis of lubrication type in Middle East and Africa compressor market in 2017. This is due to advantages offered by these compressors over oil-free compressors, such as low maintenance cost, and low requirement of external cooling. Apart from this, one of the most important factors behind its adoption is the inherent hermetic seal that it provides, which makes it suitable for high pressure applications.

Based on pressure, the Middle East and Africa compressor market has been divided into medium-pressure, high-pressure, low-pressure, hyper-pressure and ultra-low-pressure. Medium pressure compressor category held largest market share in 2017, due to its applications in HVAC-R and automotive industries.

Among application, food and beverage application category is expected to offer lucrative opportunities for compressor market players due to rising government regulations regarding food safety and food packaging. Moreover, with increasing population coupled with high disposable income, the growing demand for packaged food is also expected to propel the demand for compressors.

Browse report overview with 241 tables and 105 figures spread through 265 pages and detailed TOC on "Middle East and Africa (MEA) Compressor Market by Type (Positive Displacement [Reciprocating {In-Line, V-Shaped, Tandem Piston, Single-Acting, Double-Acting, Diaphragm}, Rotary {Screw, Vane, Lobe & Scroll}, Dynamic [Centrifugal, Axial Flow]), by Lubrication Type (Oil-Flooded, Oil-Free), by Portability (Stationary, Portable), by Pressure Type (Medium-Pressure, High-Pressure, Low-Pressure, Hyper-Pressure, Ultra-Low-Pressure), by Application (Oil and Gas, Automotive, HVAC-R, Chemical & Cement, Industrial Manufacturing, Power, Construction, Food & Beverage, Textile), by Country (Saudi Arabia, U.A.E., Turkey, South Africa, Sudan) – Global Market Size, Share, Development, Growth and Demand Forecast, 2013–2023" at:https://www.psmarketresearch.com/market-analysis/middle-east-and-africa-compressor-market

Saudi Arabia to be the fastest growing market during the forecast period

Saudi Arabia accounted for major share in Middle East and Africa compressor market in 2017, and is expected to reach a value of $988.6 billion by 2023. The country is the largest oil producer with a total share of around 30% in MEA region. Compressor market in Saudi Arabia is expected to witness demand from other sectors as well including automotive, food and beverage, and chemical and cement.

New opportunities in these sectors can be attributed to Saudi Government’s initiative to reduce dependency on oil. Saudi government is investing in non-oil sectors and promoting automotive companies to start manufacturing in the country, which is expected to surge the demand for compressors in the country in the coming year.

Growing construction market in MEA region to push market growth

Construction industry is expected to record CAGR of 7.2%, during 2018-2023. Compressors are used in the construction industry to supply air-operated machinery used at construction site. The growing number of construction projects in MEA region is a major factor influencing the growth of compressor market. The Saudi Vision 2030 is a plan to reduce dependency on oil and increase investments in other public service sectors such as education, health, infrastructure, and tourism. Under this vision, ‘Neom’ project which comprises of 26,500 sq. km area is under-construction and is expected to be completed by 2025, with an investment of $500 million.

Apart from this, IAAF World Athletic Championship is scheduled to be held in Doha, Qatar in 2019. Also, 2022 FIFA World Cup is scheduled to take place in Qatar, wherein Al-Wakrah football stadium is one of the construction projects that is being carried out in Doha, Qatar worth $575 million. Thus, rising number of construction projects would promote the growth of compressor market in the region.

Growing food and beverage industry to provide ample of growth opportunities

The food and beverage industry, one of the emerging industries in the MEA region is expected to offer ample of growth opportunities in Middle East and Africa compressor market. It is expected to record a CAGR of 6% during the forecast period of 2018-2024. Compressed air plays a vital role in food and beverage applications including product handling, fluid pumps, packaging, food filling machines, and air cleaning of containers.

Product handling includes moving of products at high speed in the production process. Fluid pumps involve movement of liquid products in the filling and production process. In packaging, vacuum is generated in the process through compressed air. It is done to protect food from contaminants during shipment and storage.

Middle East and Africa compressor market competitive landscape

MEA compressor is a highly competitive market, with primary competitive parameters being price, brand loyalty, quality, and technical competence in the market. Siemens AG and Atlas Copco Group led the MEA compressor market in 2017. The companies offer industrial grade compressors for industries such as oil and gas, petrochemical, and other manufacturing industries. Furthermore, companies such as Ingersoll Rand PLC, Gardner Denver Inc, Flowserve Corporation are focused on expanding their regional presence in order to cater all the major countries in the region.

Some the key players in the Middle East and Africa compressor market include General Electric Company, IDEX Corporation, Flowserve Corporation, Colfax Corporation, Burckhardt Compression Holding AG, Man SE, Gardner Denver Holdings Inc., Kaeser Kompressoren SE, Ingersoll-Rand plc, Mitsubishi Heavy Industries Ltd., Accudyne Industries LLC, Atlas Copco AB, Kobe Steel, Ltd., ANEST IWATA Corporation, Zhe Jiang Hongwuhuan Machinery Co., Ltd, MAHLE GmbH, Sanden Holdings Corporation, Valeo SA, Hanon Systems, and Toyota Industries Corporation.

Middle East and Africa compressor Market Segmentation

Market Segmentation by Type

-

Positive Displacement

-

Reciprocating

- In-line

- “V” shaped

- Tandem piston

- Single-acting

- Double-acting

- Diaphragm

-

Rotary

- Screw

- Vane

- Lobe and scroll

-

Reciprocating

-

Dynamic

- Centrifugal

- Axial flow

Market Segmentation by Lubrication Type

- Oil-flooded

- Oil-free

Market Segmentation by Portability

- Stationary

- Portable

Market Segmentation by Pressure

- Medium-Pressure

- High-Pressure

- Low-Pressure

- Hyper-Pressure

- Ultra-Low-Pressure

Market Segmentation by Application

- Oil and Gas

- Automotive

- Heating, Ventilation, Air Conditioning and Refrigeration (HVAC-R)

- Chemical and Cement

- Industrial Manufacturing

- Power

- Construction

- Food and Beverage

- Textile

- Others (includes Healthcare, Research, and Agriculture)

Market Segmentation by Country

-

Saudi Arabia Compressor Market

- By type

- By lubrication type

- By portability

- By pressure

- By application

-

U.A.E. Compressor Market

- By type

- By lubrication type

- By portability

- By pressure

- By application

-

Turkey Compressor Market

- By type

- By lubrication type

- By portability

- By pressure

- By application

-

South Africa Compressor Market

- By type

- By lubrication type

- By portability

- By pressure

- By application

-

Sudan Compressor Market

- By type

- By lubrication type

- By portability

- By pressure

- By application

-

Rest of MEA Compressor Market

- By type

- By lubrication type

- By portability

- By pressure

- By application