Report Code: 11620 | Available Format: PDF | Pages: 265

Middle East and Africa (MEA) Compressor Market by Type (Positive Displacement [Reciprocating {In-Line, V-Shaped, Tandem Piston, Single-Acting, Double-Acting, Diaphragm}, Rotary {Screw, Vane, Lobe & Scroll}, Dynamic [Centrifugal, Axial Flow]), by Lubrication Type (Oil-Flooded, Oil-Free), by Portability (Stationary, Portable), by Pressure Type (Medium-Pressure, High-Pressure, Low-Pressure, Hyper-Pressure, Ultra-Low-Pressure), by Application (Oil and Gas, Automotive, HVAC-R, Chemical & Cement, Industrial Manufacturing, Power, Construction, Food & Beverage, Textile), by Country (Saudi Arabia, U.A.E., Turkey, South Africa, Sudan) - Market Size, Share, Development, Growth and Demand Forecast, 2013-2023

- Report Code: 11620

- Available Format: PDF

- Pages: 265

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Middle East and Africa Compressor Market Overview

Middle East and Africa compressor market was valued at $3.0 billion in 2017 and is anticipated to record a compound annual growth rate (CAGR) of 5.1%, during the forecast period. Automotive industry is expected to provide ample of opportunities in the forecast period, especially in Africa region, as automobile manufacturers are setting-up production hub in the region.

Companies such as Volkswagen AG, Renault SA, Peugeot SA, Hyundai Motor Co., and Toyota Motor Corp are investing in North Africa region to cater to rising local and regional demand. Apart from this, during the forecast period, food and beverage industry is forecasted to be the potential market for compressor due to government push for healthy diet resulting in modifications as well as setting-up of new food processing plants.

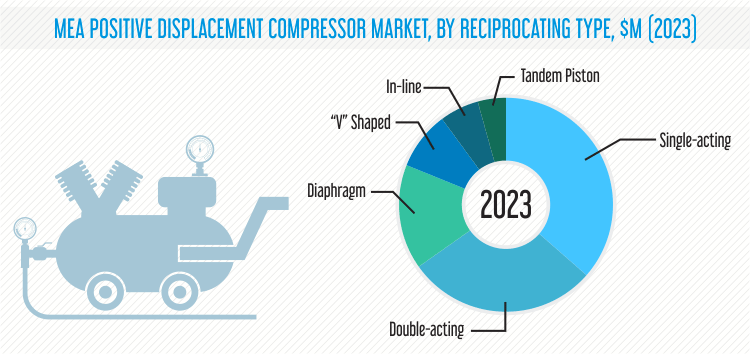

Based on type, Middle East and Africa compressor market has been segmented into positive displacement and dynamic compressors. The demand for positive displacement compressors expected to rise significantly in the forecast period, owing to rise in in automotive and HVAC-R industries in MEA region.

Under the positive displacement category, rotary compressors held major revenue share in 2017, and is expected to stay in the lead during the forecast period, predominately due to increasing investments in power and industrial infrastructure development. This is based on the region’s reducing dependency on oil and gas sector and aim at transformation of petroleum-based economy to a manufacturing one.

In terms of dynamic compressors, centrifugal compressor category held highest revenue share in 2017, as majority of centrifugal compressors are used in the oil and gas industry. Projects like Jazan Export Refinery in Saudi Arabia, which started in 2014 and is nearly 70% complete (as of 2017); Duqm Refinery in Oman, to be completed by 2021; Ras Al-Khair Maritime Yard in Saudi Arabia, to be completed by 2022; North Field Expansion in Qatar, to be completed by 2023; Ruwais Refinery in U.A.E., to be completed by 2022; are expected to provide ample opportunities for centrifugal compressors in the forecast period.

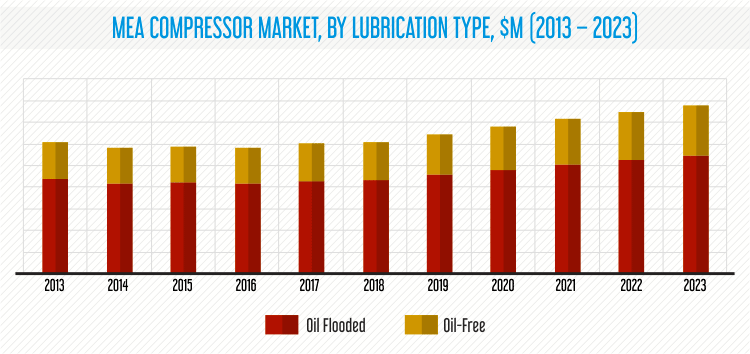

On the basis of lubrication type, Middle East and Africa compressor market is categorized into oil-flooded and oil-free. Oil-flooded compressors is the most adopted type compressor in the market, due to advantages offered by these compressors over the oil-free compressors, which include low maintenance cost and low requirement of external cooling.

In terms of portability, stationary compressors category accounted for larger revenue share in 2017, attributed to its major presence in application industries such as oil and gas, automotive, HVAC-R, power, chemical and cement, and food and beverage. These applications rarely require the use of portable compressors, while the construction is the prime sector where the majority of applications require portable compressors.

Among applications, oil and gas application category held highest revenue share in the Middle East and Africa compressor market, predominately due to increasing global energy demand. Fluctuations in compressor sales is directly linked to the fluctuations in oil prices. In 2014, the fall in oil prices and a corresponding decline in demand for compressors was recorded in 2015. However, on the path to recovery coupled with rising number of projects and corresponding investments, demand for compressors increased during 2016-2017.

Saudi Arabia accounted for major share in Middle East and Africa compressor market in 2017, and would further contribute to the growth of compressor market. Saudi Arabia is the largest oil producing country with a total share of around 30% in MEA region. The market recorded highest demand for compressor from oil and gas application industry. Apart from this, compressor market in Saudi Arabia is expected to witness demand from other sectors as well, predominantly automotive, food and beverage, and chemical and cement.

Middle East and Africa Compressor Market Dynamics

Trends

The use of rotary compressors is one of the emerging trends in Middle East and Africa compressor market. It is due to the application of rotary compressors in industries including mining, construction, and oil and gas. The crude oil production in the Middle East region accounted for over 30% share in 2017, globally. These compressors are used in oil and gas industry to supply high-powered compressed air in the production of crude oil, which in turn is contributing to the development of compressor market in MEA region.

Drivers

Compressors are widely used in oil and gas industry, to carry out activities including oil extraction, refinement, and transportation process. The growing number of oil and gas refineries in the region and investments is a major factor propelling the growth of compressors. Compressors are used in transportation and liquefication of gas from one location to another. In Middle East and Africa compressor market, oil and gas application industry is predicted to grow at positive CAGR during the forecast period 2018-2023.

Opportunities

The rising number of gas exploration projects in the region is likely to create opportunity in Middle East and Africa compressor market in the coming years. Companies dealing in energy and chemical sectors are emphasizing on joint venture in UAE region in order to fulfil the requirement of gas. For instance, in August 2018, Air Products & Chemicals Inc., ACWA Power, and Saudi Arabian Oil Co. signed a term sheet to form power/gasification located in Saudi Arabia at Jazan Economic City (JEC) worth $8 billion, in terms of joint venture (JV). Air Products and Chemicals Inc. and ACWA Power purchased the power block, gasification assets, and the associated utilities from Saudi Arabian Oil Co.; it is currently under-construction and scheduled to be transferred upon successful completion in 2019.

Middle East and Africa Compressor Market - Competitive Landscape

MEA compressor is a highly competitive market, with primary competitive parameters being price, brand loyalty, quality, and technical competence in the market. Siemens AG led the Middle East and Africa compressor market in 2017. Ever since the acquisition of Dresser Rand Group, an industrial compressor manufacturer, in 2012, the company recorded significant growth in the compressor market. The company offers industrial grade compressors for industries such as oil and gas, petrochemical, and other manufacturing industries.

Furthermore, companies such as Atlas Copco Group, Ingersoll Rand PLC, Gardner Denver Inc, and Flowserve Corporation are focused on expanding their regional presence in order to cater all the major countries in the region. For instance, Gardner Denver Inc, established manufacturing plant in Dubai, U.A.E., which is expected to reduce the delivery time.

Some the key players in the Middle East and Africa compressor market include General Electric Company, IDEX Corporation, Flowserve Corporation, Colfax Corporation, Burckhardt Compression Holding AG, Man SE, Gardner Denver Holdings Inc., Kaeser Kompressoren SE, Ingersoll-Rand plc, Mitsubishi Heavy Industries Ltd., Accudyne Industries LLC, Atlas Copco AB, Kobe Steel, Ltd., ANEST IWATA Corporation, Zhe Jiang Hongwuhuan Machinery Co., Ltd, MAHLE GmbH, Sanden Holdings Corporation, Valeo SA, Hanon Systems, and Toyota Industries Corporation.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws