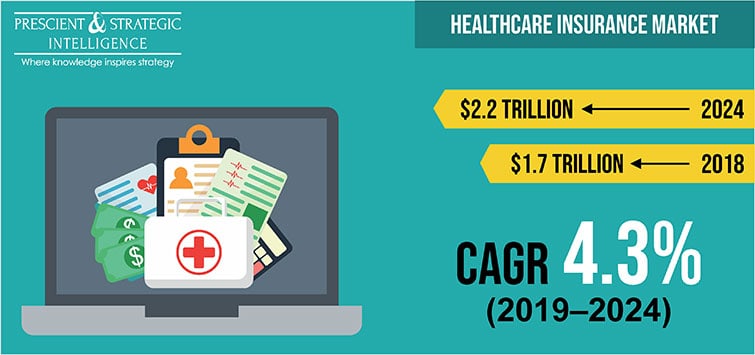

Healthcare Insurance Market Size to Reach $2.2 Trillion by 2024

- Published: March 2019

Healthcare insurance market is expected to generate a revenue of $2.2 trillion by 2024, advancing at a CAGR of 4.3% during the forecast period, the market is driven by rising prevalence of chronic diseases, growing geriatric population, increasing healthcare expenditure, and high medical costs, globally.

Insights into Market Segments

Term and lifetime are the two types of coverage available in the healthcare insurance market. Term coverage category is estimated to dominate the market, contributing 76.5% share to the overall market in 2018. This can be attributed to several advantages associated with this category, such as low cost of premiums, receipt of a lump sum amount at the end of the term, and increasing awareness about the benefits of health insurance among the global population.

The service provider segment is categorized into public and private service providers. Public service provider is the leading category in the healthcare insurance market. The category is estimated to generate revenue of around $0.9 trillion in 2018 and is expected to reach $1.2 trillion by 2024, progressing at a CAGR of 4.1%. However, private service provider category is predicted to witness faster growth in the market, advancing at a CAGR of 4.7% during the forecast period.

Geographically, North America leads the healthcare insurance market, and is expected to progress at a CAGR of 3.7% during the forecast period. This can be attributed to well-structured healthcare and insurance system, mandatory health insurance from employers, and increasing number of chronic diseases cases in the region.

Healthcare Insurance Market in Asia-Pacific (APAC)

Globally, the healthcare insurance market is expected to witness the fastest growth in APAC, progressing at a CAGR of 5.7% during the period 2019–2024. The APAC market is projected to generate approximately $0.5 trillion revenue by 2024. This growth is mainly led by expanding healthcare industry, increasing healthcare awareness, and surging prevalence of chronic ailments in the region. Increasing medical tourism industry is also supporting the growth of the market in APAC.

Further, overall dynamics of healthcare industry is changing in the region, mainly on account of improving healthcare expenditure and infrastructure in APAC countries. With these changes, healthcare insurance plans are gaining popularity among the Asian population. Besides, conferences, seminars, and training sessions are being actively organized related to this industry in the region. For instance, in November 2018, Insurinnovator Connect conducted a conference on health insurance in Hong Kong. The conference witnessed the presence of esteemed healthcare insurance market players, specifically players of the APAC region. The conference focused on the growing healthcare insurance industry in the region, and innovations and advancements in this sector.

Browse report overview with 122 tables and 76 figures spread through 185 pages and detailed TOC on "Healthcare Insurance Market by Coverage Type (Term, Lifetime), by Insurance Type (Medical, Disease, Income Protection), by Service Provider (Public, Private), by Insurance Network (Exclusive Provider Organization, Preferred Provider Organization, Point of Service, Health Maintenance Organization), by Insured Type (Adults, Senior Citizens, Minors), by Distribution Channel (Agents/Brokers, Direct Marketing, Bancassurance), by Geography (U.S., Canada, Germany, France, U.K., Italy Spain, Russia, Switzerland, Sweden, Belgium, Poland, Norway, China, India, Japan, Australia, Singapore, Malaysia, Brazil, Mexico, Argentina, Chile, Colombia, U.A.E., Israel, South Africa, Saudi Arabia) – Global Market Size, Share, Development, Growth, and Demand Forecast, 2014–2024" at:https://www.psmarketresearch.com/market-analysis/healthcare-insurance-market

Similarly, in 2019, IBC Asia (S) Pte Ltd., a Singapore-based conference, exhibition, and training company, plans to organize its 13th annual healthcare insurance conference in Singapore. Key highlights of this conference will include innovation and services in the Asian market, digital transformation of the industry, and insights on growing healthcare insurance market. Such conferences and seminars create awareness about the benefits and features of healthcare insurance products, which in turn, are expected to boost the market growth.

Healthcare Insurance Market Competitive Landscape

Globally, the healthcare insurance market is witnessing rapid evolution with a substantial increase in the number of product launches and expansion. For instance, in January 2019, Aviva plc launched a new approach for its midmarket clients so as to expand its corporate level services and customer level underwriting. This approach is advocated by technological advancements, and helps in expanding the network of specialists. Similarly, in financial year 2017–2018, Apollo Munich Health Insurance Company, headquartered in India, launched a new product called health wallet. Funds deposited in this wallet can be used by consumers for outpatient department (OPD) expenses, non-payable items under the insurance policy, and renewing the plan (up to 50% of the amount).

Also, in January 2019, Aviva plc expanded its digital general practitioner (GP) services to small medium enterprises (SMEs) and individual policy holders. This was followed after its entry into corporate insurance products. The policy holders can get remote diagnosis of health issues on the app and obtain advices on simple medical enquiries. Thus, companies are expanding their product portfolio, which can be a strong opportunity to expand their customers reach.

Some of the key players operating in the global healthcare insurance market are Allianz Group, Anthem Inc., Centene Corporation, Kaiser Permanente, Cigna Corporation, Gulf Insurance Group, International Medical Group Inc., Zurich Insurance Group, and Aetna Inc.

HEALTHCARE INSURANCE MARKET SEGMENTATION

Market Segmentation by Coverage Type

- Term

- Lifetime

Market Segmentation by Insurance Type

- Medical

- Disease

- Income Protection

Market Segmentation by Service Provider

- Public

- Private

Market Segmentation by Insurance Network

- Exclusive Provider Organization (EPO)

- Preferred Provider Organization (PPO)

- Point of Service (POS)

- Home Maintenance Organization (HMO)

Market Segmentation by Insured Type

- Adults

- Senior Citizens

- Minors

Market Segmentation by Distribution Channel

- Agents/Brokers

- Bancassurance

- Direct Marketing

Market Segmentation by Geography

-

North America Healthcare Insurance Market

- By coverage type

- By insurance type

- By service provider

- By insurance network

- By insured type

- By distribution channel

- By country – U.S. and Canada

-

Europe Healthcare Insurance Market

- By coverage type

- By insurance type

- By service provider

- By insurance network

- By insured type

- By distribution channel

- By country – Germany, France, U.K., Italy, Spain, Russia, Switzerland, Sweden, Belgium, Poland, Norway, and Rest of Europe

-

Asia-Pacific (APAC) Healthcare Insurance Market

- By coverage type

- By insurance type

- By service provider

- By insurance network

- By insured type

- By distribution channel

- By country – China, India, Japan, Australia, Singapore, Malaysia, and Rest of APAC

-

Latin America (LATAM) Healthcare Insurance Market

- By coverage type

- By insurance type

- By service provider

- By insurance network

- By insured type

- By distribution channel

- By country – Brazil, Mexico, Argentina, Chile, Colombia, and Rest of LATAM

-

Middle East and Africa (MEA) Healthcare Insurance Market

- By coverage type

- By insurance type

- By service provider

- By insurance network

- By insured type

- By distribution channel

- By country – U.A.E., Israel, South Africa, Saudi Arabia, and Rest of MEA.