Indian Electric Vehicle Component Market To Grow at 22.1% CAGR during 2020–2030

- Published: May 2020

India is presently witnessing a rapid rise in the adoption of electric vehicles (EVs). Additionally, a decline is being seen in the price of various components, which is making EVs more affordable for people. Both these factors are projected to propel the Indian electric vehicle component market at a 22.1% CAGR during 2020–2030 (forecast period); the market generated $536.1 million in revenue in 2019.

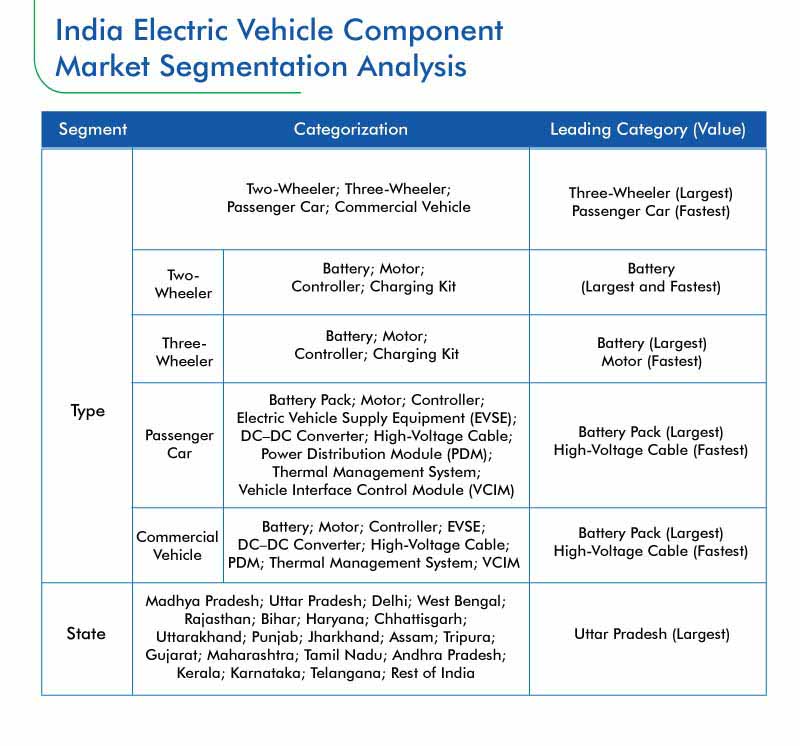

Indian Electric Vehicle Component Market Segmentation

During the forecast period, the passenger car category is predicted to witness the fastest growth in the Indian electric vehicle component market, as numerous transport companies, as well as the government, are taking initiatives to increase the number of electric cars in shared mobility fleets.

For two-wheelers, brushless direct current (BLDC) motor was the highest-revenue-generating classification in the Indian electric vehicle component market during the historical period (2014–2019), as such motors are more cost-effective compared to others of similar power ratings.

Till 2030, Tripura would grow the fastest in the Indian electric vehicle component market for three-wheelers. This is attributed to the increasing number of e-rickshaws in operation in the state, which is further leading to the rising demand for various components from original equipment manufacturers (OEM) as well as aftermarket companies.

Partnerships Are the Most Important Strategic Measures in the Market

Indian electric vehicle component market players are entering into partnerships, to make the most of the opportunities being provided by the rising EV sales in the country.

For instance, in February 2019, Contemporary Amperex Technology Co. Ltd. began collaborating with Honda Motor Company Ltd. for EV batteries, primarily lithium-ion (Li-ion) variants. Under the agreement, the former company will provide Honda with Li-ion EV batteries, with a cumulative storage capacity of 56 gigawatt-hours (GWh) by 2027. Additionally, Contemporary Amperex Technology will set up an office near the research unit of Honda in Tochigi Prefecture, outside Tokyo.

Browse report overview with detailed TOC on "Indian Electric Vehicle Component Market Research Report: Two-Wheeler (Scooters, Motorcycle), Three-Wheeler (E-Rickshaw, E-Auto, Retrofitted Rickshaw), Passenger Car, Commercial Vehicle – Industry Analysis and Growth Forecast to 2030" at:https://www.psmarketresearch.com/market-analysis/indian-electric-vehicle-component-market

In the same vein, in November 2018, Mahindra Electric Mobility Limited and +ME Technologies entered into a partnership for the construction of a manufacturing facility near Bengaluru. The unit, being constructed with a $14.65 million (INR 100 crore) investment by Mahindra, would produce battery packs, motor assembly, and power electronics.

Amara Raja Batteries Ltd., Exide Industries Ltd., Okaya Power Pvt. Ltd., Eastman Auto & Power Ltd., Panasonic Corp., Sparco Batteries Pvt. Ltd., Contemporary Amperex Technology Co. Ltd., Robert Bosch GmbH, DENSO CORP., and CY International are the key players in the Indian electric vehicle component market.