China Electric Bus Market to Generate Sales of 176.4 Thousand Units by 2025

- Published: June 2018

The electric bus sales in China stood at 104.3 thousand units in 2017, and are predicted to reach 176.4 thousand units by 2025, witnessing a CAGR of 8.6% between 2018 and 2025.

The pure electric buses category dominated the Chinese electric bus market in 2018 and is expected to continue leading the market during the forecast period. It is mainly driven by the continuously reducing prices of lithium-ion (Li-ion) batteries, leading to the reduction in the upfront cost of pure electric buses. Additionally, the manufacturers of these buses have received huge subsidies from the government for their production, thereby leading to their large share in the market.

Consolidation in the Market After Revision of the Subsidy Schemes is a Major Trend

Consolidation in the Chinese electric bus market, after the revision in subsidy schemes in 2017, is the major trend in the industry. Players relying on subsidies given by the Chinese government for the production of electric buses are finding it difficult to comply with the revised norms. Small manufacturers are currently finding it difficult to operate under the new subsidy norms, leading to a consolidation in the market.

Falling Battery Prices along with Improving Operational Efficiency is a Major Growth Driver of the Market

The falling battery costs, along with the improving operational efficiency, is acting as a major growth driver for the Chinese electric bus market. According to industry experts, the average price of Li-ion battery cells for large orders declined from around $540/kWh in 2012 to around $240/kWh, in 2016. As the battery accounts for around 40% of the electric bus manufacturing cost, the declining battery prices would help bus companies keep the bus prices low, in turn, leading to the growth of the market.

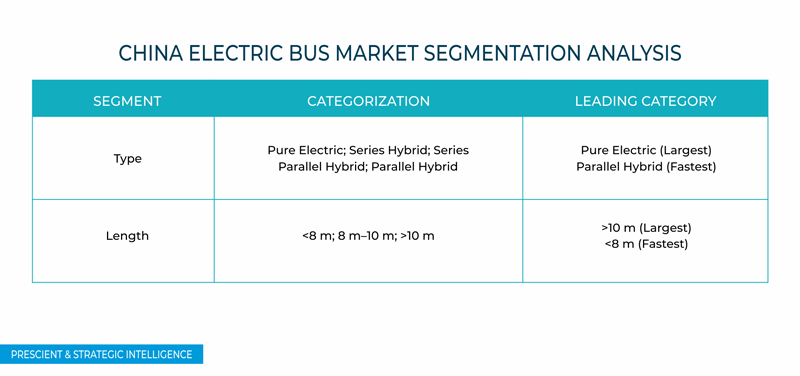

Segmentation Analysis of China Electric Bus Market

The pure electric bus (BEV) category is expected to dominate in the Chinese electric bus market during the forecast period, mainly due to the continuously falling prices of the Li-ion batteries used in these buses and higher preference for these buses by transport operators due to higher subsidies.

Electric buses of <8m length are expected to witness fastest growth in the Chinese electric bus market during the forecast period, mainly due to the rising demand for these buses from end users such as corporates and schools.

Competitive Landscape of China Electric Bus Market

The Chinese electric bus market has been shifting toward consolidation due to the revision in the subsidy schemes by the government. In 2017, majority of the market share was held by Zhengzhou Yutong Group Co. Ltd., BYD Co. Ltd., and Zhongtong Bus & Holding Co. Ltd.

In August 2017, Ankai Bus secured an order to supply 400 city buses, worth $104.3 million, to Hefei Public Transport Group. In the same month, the company also delivered 400 city buses worth $81.3 million, including 160 clean-energy powered buses and 240 electric buses.

Some of the other players operating in the Chinese electric bus market are Dongfeng Motor Corp., Liaoning Huanghai Automobile Import & Export Co. Ltd., King Long United Automotive Industry Co. Ltd., and Anhui Ankai Automobile Co. Ltd.

CHINA ELECTRIC BUS MARKET SEGMENTATION

By Type

- Battery Electric Bus (BEV)

- Plug-in Hybrid Electric Bus (PHEV)

- Hybrid Electric Bus (HEV)

By Hybrid Powertrain

- Parallel Hybrid

- Series Parallel Hybrid

- Series Hybrid

By Length

- >10m

- 8m-10m

- <8m

By Battery

- LFP

- NMC

- Others

By Customer

- Public

- Private