Report Code: 11295 | Available Format: PDF | Pages: 81

China Electric Bus Market by Type (BEV, PHEV, HEV), by Hybrid Powertrain (Parallel Hybrid, Series Parallel Hybrid, Series Hybrid), by Length (>10m, 8m-10m, <8m), by Battery (LFP, NMC), by Customer (Public, Private) - Market Size, Share, Development, Growth, and Demand Forecast, 2013-2025

- Report Code: 11295

- Available Format: PDF

- Pages: 81

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

The electric bus sales in China were 104.3 thousand units in 2017 and are projected to reach 176.4 thousand units by 2025, witnessing a CAGR of 8.6% between 2018 and 2025.

.png)

Dynamics of China Electric Bus Market

The major trend being observed in the Chinese electric bus market is the market consolidation, after the revision in the subsidy schemes in 2017. Small players are currently finding it difficult to operate under the new subsidy norms. The demand for electric buses in China is now fulfilled by giant leading players, which have the requisite technological and financial power to perform in the changing market scenario. Small companies are expected to merge with these leading players, thereby consolidating the electric bus market in the country.

The Chinese electric bus market is highly dependent on government support, as these buses are majorly used in public transport, military, and other transit services. Most of the decisions of purchasing electric buses are made at the government level. The Chinese government has a strong commitment to increase the share of electric buses in the transportation system of the country. It is expected that the majority of conventional buses plying in China would be replaced by electric ones in the long run, thereby driving the growth of the market, during the forecast period.

In the earlier subsidy scheme valid till 2016, the ternary batteries or nickel, cobalt, and manganese (NCM)-based lithium-ion (Li-ion) batteries were excluded. Due to this, manufacturers used lithium–iron-phosphate (LFP) chemistries, such as LiFePO4, in the batteries. However, in January 2017, the government announced the inclusion of ternary batteries in the subsidy scheme, creating ample opportunities for the players in the Chinese electric bus market to deploy these in electric buses.

Structural Analysis of China Electric Bus Market

When segmented on the basis of vehicle type, pure electric buses (BEV) held the largest share in the Chinese electric bus market in 2017. It is mainly due to the huge subsidies on these buses provided by the Chinese government in the past.

Under the length segment, the Chinese market is expected to witness the fastest growth in the <8m bus length category, during the forecast period. This is driven by the high expected demand for these buses from end users, such as schools and corporates.

Competitive Landscape of China Electric Bus Market

The Chinese electric bus market is moderately consolidated, as the major share of the market is cumulatively possessed by three players, namely Zhengzhou Yutong Group Co. Ltd., BYD Co. Ltd., and Zhongtong Bus & Holding Co. Ltd. Some of the other major players operating in the market are Higer Bus Co. Ltd., King Long United Automotive Industry Co. Ltd., Dongfeng Motor Corp., Liaoning Huanghai Automobile Import & Export Co. Ltd., and Anhui Ankai Automobile Co. Ltd.

Recent Strategic Developments of Major Chinas Electric Bus Market Players

In recent years, the Chinese electric bus market players have received many client orders and introduced new electric buses with advanced systems and technologies. Additionally, few cities in the country have replaced either completely or a large proportion of their conventional bus fleet with electric buses, by placing orders with electric bus manufacturers, over a period of time. For instance, by December 2017, Shenzhen city had replaced its entire fleet of conventional buses with over 16,000 electric buses. The city has also built 510 charging stations, with 8,000 charging poles, for the smooth running of these buses.

Moreover, in January 2017, BYD Company delivered 500 buses to the north-eastern city of Tianjin. The city also opened a charging station with a charging capacity for 80 buses at a time and 448 buses a day. These buses, with a range of 200 km, were manufactured in collaboration with Tianjin Bus Group. With this delivery, Tianjin owned a total of 3,220 clean-energy buses, of which 1,346 were electric.

Key Questions Answered in the Report

- What is the current scenario of China electric bus market?

- What are the emerging technologies for the development of China electric bus market?

- What is the historical and the present size of the market segments and their future potential?

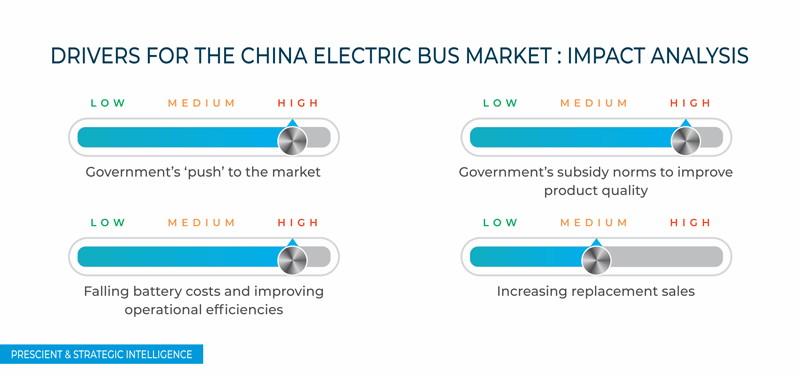

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the current technologies used in the electric buses in China?

- What are the evolving opportunities for the players in the market?

- What are the key strategies adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws