Automotive Tire Market to Generate Revenue Worth $237.2 Billion by 2024

- Published: September 2019

The global automotive tire market registered revenue of $155.3 billion in 2018, which is expected to reach $237.2 billion by 2024, growing with a CAGR of 7.7% during 2019–2024. In terms of vehicles, the passenger cars category held the largest share in the market during the historical period.

However, the fastest growth in the automotive tire market is projected to be observed by the medium & heavy commercial vehicles category, during the forecast period. This is attributed to the rising demand for these vehicles in the manufacturing industries across the world. For instance, as per the American Trucking Associations (ATA), the U.S. truck transportation volume grew by 4.2% in 2018, owing to the rebound of the manufacturing industry, along with rising economy, in the U.S.

Rising Popularity of Next-Generation, High Performance Tires is an Existing Trend Witnessed in the Market

The growing demand for next-generation, high performance tires is a popular trend being witnessed in the automotive tire market, across the world. The mainstream adoption of these tires is encouraging tire makers across the world to invest in new technologies for the development of ultra-high-performance tires to increase the speed and overall performance of the tires. Many manufacturers are developing these tires by employing patented technologies, specialized silica compounds and polymers, and unique tread designs to meet changing consumer demands and achieve desired performance. Moreover, with the increasing demand for automotive tires, various tire manufacturers are producing high-performance tires with season driving abilities, rider comfort, and less tread wear. Thus, the introduction for next-generation, high-performance tires is one of the key trends being seen in the market.

Improved Lifespan of Vehicles is Propelling the Growth of the Market

Due to enormous technological developments in the recent past, the usual lifecycle of the vehicles had significantly increased from 10.5 years in 2010 to 12 years in 2018. Different factors, such as rising competition among automobile manufacturers and increasing government regulations, have resulted in the development of vehicles’ durability and dependability over the years. Moreover, in recent years, it is seen that customers are buying additional units of small crossover vehicles and are also possessing their older vehicles for longer span than before. This changing consumer behavior is predicted to further increase the number of tire replacements required within a vehicle’s lifespan. Further, with the more mileage being provided by vehicles, the probabilities of depreciation of tires have amplified significantly, which cause the need for replacing the tires more often. Thus, the rising overall life of the vehicles is driving the growth of the automotive tire market.

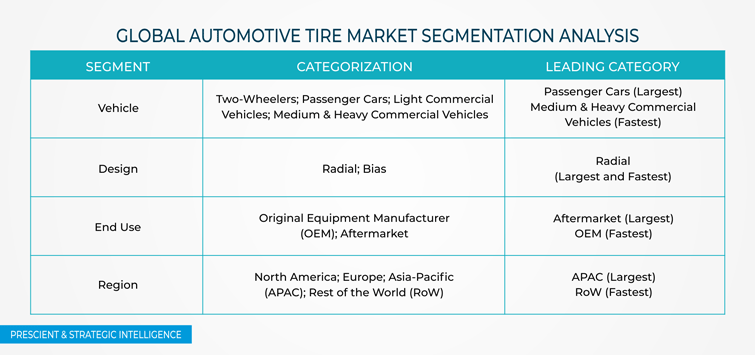

Segmentation Analysis of Automotive Tire Market

- The passenger cars category held the largest share in the automotive tire market in 2018, and is expected to continue being the largest category during the forecast period. This can be primarily ascribed to the rising sales of these vehicles in the growing economies, globally, coupled with increasing disposable income of consumers.

- The Radial tires category dominated the automotive tire market in 2018, and is projected to showcase faster growth during the forecast period. This is attributed to the fact that radial tires are more durable than bias tires, due to their unique construction, which consists of perpendicularly placed polyester plies along with crisscrossed steel belts. Moreover, radial tires are widely used in passenger cars as they offer more comfortable riding experience than its counterpart, which results in increasing demand of these tires.

- In the automotive tire market, greater usage of tires is observed in the aftermarket. This is because with the improves lifespan of the vehicles, there is an increase in the number of replacements of the tires, which is causing higher demand for tires in the aftermarket.

Geographical Analysis of Automotive Tire Market

Geographically, APAC is expected to continue being the largest market for automotive tires in the coming years. The region comprised over 55% volume share of the market in 2018. The market in the region is primarily driven by increasing automobile production, rising gross domestic product (GDP), and increasing disposable income of people in emerging economies, such as China and India. Further, the North American market is also growing rapidly on account of the growing number of heavy investments (domestic and international) by several manufacturers in recent years.

Competitive Landscape of Automotive Tire Market

The global automotive tire market was consolidated in nature, with four major players holding around 45% of the tire sales, globally, in 2018. The market was led by Compagnie Générale des Établissements Michelin, which was followed Bridgestone Corporation, The Goodyear Tire & Rubber Company, and Continental AG. The dominance of Compagnie Générale des Établissements Michelin in the world is mainly due to heavy investments by the company, as well as the growing presence of large dealer network across the globe.

Browse report overview with detailed TOC on "Automotive Tire Market Research Report: By Vehicle (Two-Wheelers, Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles), Design (Radial, Bias), End-Use (OEM, Aftermarket), Geographical Outlook (U.S., Canada, Germany, France, Italty, Spain, U.K., Poland, Netherlands, Belgium, Switzerland, Austria, China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia, Malaysia, Taiwan, Brazil, Mexico) – Global Industry Analysis and Forecast to 2024" at:https://www.psmarketresearch.com/market-analysis/automotive-tire-market

In March 2019, Yokohama India announced its plans of expanding the tire manufacturing capacity of its Bahadurgarh unit in Jhajjar district of Haryana. The project will be implemented in two phases. Phase-I comprises expansion from 2,000 to 4,600 tires per year and Phase-II comprises expansion from 4,600 to 7,000 tires per year. Further, in February 2019, Bridgestone Americas Inc. announced that it would construct a new Firestone race tire manufacturing plant in Akron, Ohio, over the next four years. The plan to build a manufacturing plant in the city is a part of a five-year partnership extension between NTT IndyCar Series and Firestone (a brand of Bridgestone Americas Inc.). The partnership includes tire supplies by Firestone to NTT IndyCar Series. The company also stated that it would manufacture and sell more than 26,000 Firehawk race tires throughout the calendar year 2019.

Some other players, who held significant share in the automotive tire market in 2018, include Sumitomo Rubber Industries Limited, Pirelli & C. S.p.A., Hankook Tire Company Limited, and The Yokohama Rubber Company Limited.

Market Segmentation by Vehicle

- Two-Wheelers

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

Market Segmentation by Design

- Radial

- Bias

Market Segmentation by End Use

- Original Equipment Manufacturer (OEM)

- Aftermarket

Market Segmentation by Region

-

North America Automotive Tire Market

- By vehicle

- By design

- By end use

- By country – U.S. and Canada

-

Europe Automotive Tire Market

- By vehicle

- By design

- By end use

- By country – Germany, France, Italty, Spain, U.K., Poland, Netherlands, Belgium, Switzerland, Austria, and Rest of Europe

-

Asia-Pacific (APAC) Automotive Tire Market

- By vehicle

- By design

- By end use

- By country – China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia, Malaysia, Taiwan, and Rest of APAC

-

Rest of the World (RoW) Automotive Tire Market

- By vehicle

- By design

- By end use

- By country – Brazil, Mexico, and Others