Automotive Sensors Market to Generate Revenue Worth $58,215.3 Million by 2030

- Published: March 2020

The global automotive sensors market generated the revenue of $25,723.8 million in 2019. Furthermore, the market is projected to advance with a CAGR of 7.4%, during the forecast period (2020–2030), and generate $58,215.3 million revenue in 2030. The powertrain sensors application category in terms of volume dominated the market in 2019.

However, the ADAS application category is expected to generate the fastest growth in the automotive sensors market during the forecast period. At present, these sensors find their major application in level 1, 2, and 3 autonomous vehicles, and with the introduction of level 4 and 5 autonomous vehicles in 2023 and 2025, respectively, the demand for these sensors is expected to spur up significantly.

Technological advancement Is a Major Trend in the Market

One of the key trends witnessed in the automotive sensors market is the ongoing technological advancements. For instance, the concept of sensor fusion has gained much popularity in the automobiles. Sensor fusions are intended to combine the best information available from each of their systems installed in the vehicles. Moreover, the increasing installation of electronic devices in the vehicles has fueled the need for various automobile sensors for engine management systems; heating, ventilation, and air conditioning (HVAC) systems; and other application areas.

Increasing Adoption of ADAS Sensors Is Driving the Growth of the Market

The increasing demand for advanced driver-assistance system (ADAS) sensors is a major driver for the growth of the automotive sensors market. With the growing adoption of autonomous vehicles of different levels, these sensors are becoming more and more crucial for the vehicles. Autonomous vehicles have several functions, such as speech recognition, eye tracking, driver monitoring, virtual assistance, gesture recognition, and natural language interface, which are highly dependent on advanced automotive sensors. Further, the development of the ADAS, which includes camera-based machine vision systems, driver condition evaluation systems, sensor fusion engine control units (ECUs), and radar-based detection units, creates higher demand for ADAS sensors in the market.

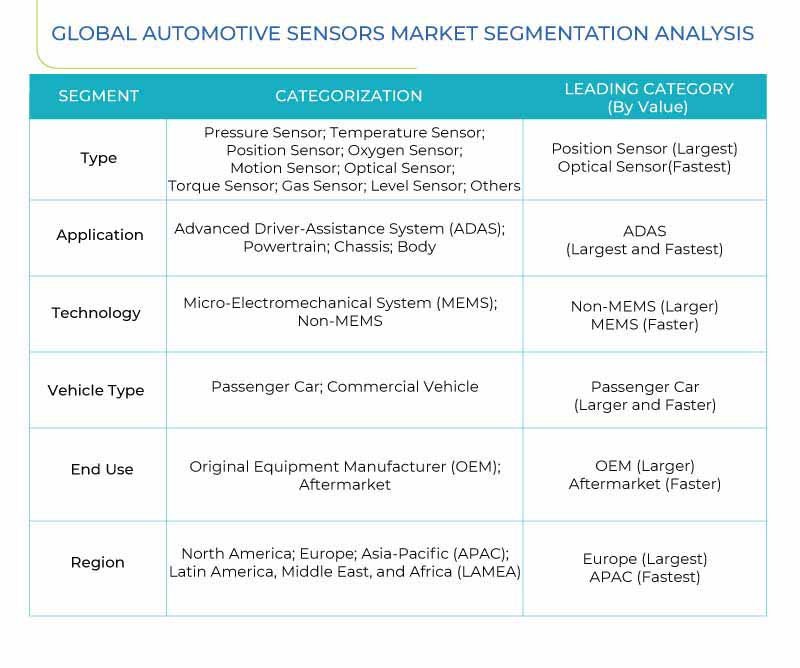

Segmentation Analysis of Automotive Sensors Market

- The fastest growth is expected to be exhibited by the optical sensors in the automotive sensors market during the forecast period. This can be attributed to the fact that with the growing adoption of autonomous vehicles in the near future, the application area of these sensors will expand significantly.

- The powertrain application category held the largest volume share, in the automotive sensors market, in 2019. This is attributed to the greater usage of powertrain sensors in the engine, transmission, and alternator of the conventional internal combustion engine (ICE) vehicles.

- The automotive sensors market is expected to witness faster growth in the micro-electromechanical system (MEMS) category during the forecast period. This can be due to its smaller size, lower cost, and high efficiency.

- Passenger car was the larger category in the automotive sensors market in 2017. Under this, faster growth is expected to be witnessed in the alternative fuel car subcategory with the extensive penetration rate of electric cars in major automobile producing countries across the world.

- The aftermarket category is expected to grow fastest during the forecast period in the automotive sensors market. The introduction of numerous legislations in different countries across the world pertaining to emission control and safety feature incorporation is expected to boost up the demand for the sensors in the aftermarket.

Geographical Analysis of Automotive Sensors Market

Asia-Pacific (APAC), led by China, was the most dominant region in terms of volume in the automotive sensors market. Moreover, the region is expected to witness the fastest growth as well during the forecast period. The dominance of China is buoyed by its high production capacity as well as its continuous implementation of automotive innovations in terms of electric and autonomous vehicles. These vehicles require advanced and greater number of automotive sensors in the vehicles, which is a major driver for the market.

Competitive Landscape of Automotive Sensors Market

The global automotive sensors market is moderately fragmented in nature, with the top six players accounting around 60.0% of the total market share in 2019. Among the major players, Robert Bosch GmbH led the market in 2019. Moreover, the historical trend exhibits that the company consistently remained the market leader between 2015 and 2019, with significant fluctuations in share over the mentioned period.

Browse report overview with detailed TOC on "Automotive Sensors Market Research Report: By Type (Pressure Sensor, Temperature Sensor, Position Sensor, Oxygen Sensor, Motion Sensor, Optical Sensor, Torque Sensor, Gas Sensor, Level Sensor), Application (ADAS, Powertrain, Chassis, Body), Technology (MEMS, Non-MEMS), Vehicle Type (Passenger Car, Commercial Vehicle), End Use (OEM, Aftermarket) – Global Industry Share, Size, Growth and Demand Forecast to 2030" at:https://www.psmarketresearch.com/market-analysis/automotive-sensors-market

In December 2019, Continental AG introduced a contact sensor system that is able to pick up the sound signal of low-speed impacts and detect scratches and damages on the vehicle. The new sensor would improve the safety in automated parking, thereby assisting in the development in self-driving vehicles. Furthermore, in April 2019, NXP Semiconductors N.V. entered into a strategic collaboration with HawkEye Technology Co. Ltd. to develop autonomous vehicle in the Chinese market. Under the partnership, HawkEye Technology Co., Ltd. would offer its deep expertise in 77 GHz radar sensor to NXP Semiconductors N.V., in order to develop 77 GHz radar solutions for the Chinese automotive market.

Some other players operating in the market are DENSO CORP., Valeo SA, Panasonic Corp., OmniVision Technologies Inc., ON Semiconductor Corp., Sensata Technologies Holding plc, TE Connectivity Ltd., NXP Semiconductors N.V., Analog Devices Inc., Continental AG, Delphi Technologies PLC, Infineon Technologies AG, Melexis NV, and Allegro MicroSystems LLC.