Automotive OEM Coatings Market to Generate Revenue Worth $13,661.4 Million by 2024

- Published: November 2019

In 2018, the global automotive OEM coatings market was valued at $10,997.4 million, and it is expected to reach $13,661.4 million by 2024, witnessing a CAGR of 4.2% during the forecast period (2019–2024). On the basis of technology, solvent-borne coatings held the largest volume share, and the market category is also expected to demonstrate a promising growth during the forecast period.

In terms of volume, water-borne coatings for automobiles are likely to demonstrate the fastest market growth during the study period. This can be attributed to the low volatile organic compounds (VOCs) in these coatings owing to its water-based nature.

Development of Powder Coatings

Powder coatings meet several environmental standards as well as regulations levied by governments across the globe, owing to which its preference is increasing. In addition, the application of powder coatings on vehicles provides uniform thickness along with no paint sludge during application. With the recent development of these coatings, vehicle manufacturers are rapidly shifting from liquid coatings to powder coatings. For instance, plants owned by Bayerische Motoren Werke AG (BMW) in Europe are shifting towards powder coatings for the clearcoat process.

Growth Potential of Automotive Industry in Developing Nations

Developing nations in the Southeast Asian region such as India, Thailand, and Indonesia have witnessed a rapid pace in the technological development in the automobile sector. One of the effects have been compounding automobile production in these countries. The rapid surge in demand for two-wheeler and four-wheeler vehicles is attributable to the increase in consumer spending and associated improvement in road connectivity and infrastructure. With such associated factors, the automotive industry holds immense potential of growth in these countries, owing to which the market demand for automotive OEM coatings is expected to increase in the coming years.

Moreover, strategic alliances between automobile manufacturers are expected to further propel the market growth in the coming times. For instance, in April 2017, a Memorandum of Understanding (MoU) was signed between Volkswagen AG and Tata Motors Limited for development of automotive vehicles and components to serve the Indian market along with other countries.

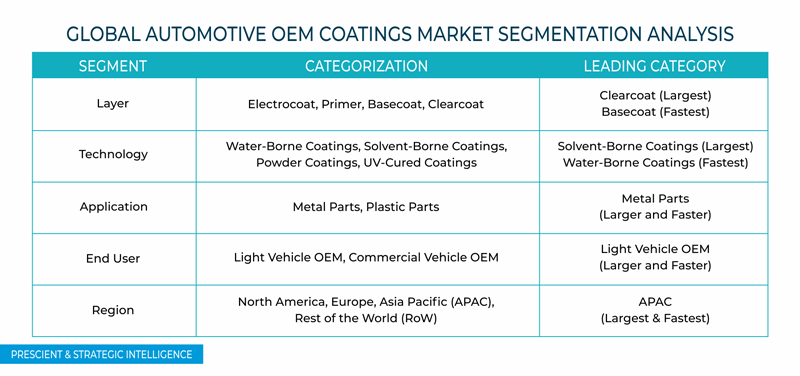

Segmentation Analysis of Automotive OEM Coatings Market

- On the basis of layer, clearcoat is expected to hold the largest volume share in 2024, while basecoat is projected to demonstrate the fastest CAGR during the forecast period. The application of clearcoat coatings on automobile vehicles offers protection from ultra-violet rays, owing to which a thicker coating of clearcoat is applied. This in turn created a high-volume demand for clearcoat coatings in automobile applications.

- Based on technology, solvent-borne coatings held the largest volume share in 2018 in the automotive OEM coatings market, and the trend is likely to continue during the forecast period. However, with the increase in environmental concerns and stringent regulations regarding emission of VOCs, the volumetric demand for water-borne automotive coatings is projected to witness the fastest growth during the forecast period.

- On the basis of application, metal parts accounted for a larger volumetric market share owing to high-volume composition of metal-based automotive parts and components.

- Based on end user, commercial vehicle OEM held the larger volumetric share in 2018, and the trend is likely to continue during the forecast period. The market category is also projected to witness the fastest CAGR during the study period. This is attributable to the large-scale production of commercial vehicles for trade purposes as well as passenger conveyance.

Geographical Analysis of Automotive OEM Coatings Market

Geographically, Asia Pacific market held the largest share, both by value and volume, in the global automotive OEM coatings market. The market in the APAC region and is expected to demonstrate the fastest CAGR of 3.7% by volume and 4.9% in terms of value during the forecast period. This fast pace growth is attributed to the increasing automotive production in countries such as China, India, Indonesia, and several others, which in turn is creating a demand for automotive coatings at automobile production sites. In addition, as of 2019, China is world’s second largest two-wheeler manufacturer and largest passenger car and commercial vehicle manufacturer. The two-wheeler sales in China stood at 15.5 million units, which is expected to witness a rise with the increasing adoption of electric vehicles and lightweight vehicles, and in due course generate demand for OEM coatings.

Browse report overview with detailed TOC on "Automotive OEM Coatings Market Research Report: By Layer (Electrocoat, Primer, Basecoat, Clearcoat), Technology (Water-Borne Coatings, Solvent-Borne Coatings, Powder Coatings, UV-Cured Coatings), Application ( Metal Parts, Plastic Parts), End User ( Light Vehicle OEM, Commercial Vehicle OEM), Geographical Outlook (U.S., Canada, Germany, Spain, France, U.K., China, Japan, India, Mexico, Brazil, Turkey) – Global Opportunity Analysis and Demand Forecast to 2024" at:https://www.psmarketresearch.com/market-analysis/automotive-oem-coatings-market

Competitive Landscape of Automotive OEM Coatings Market

The global market for automotive OEM coatings is consolidated in nature with a share of over 65% being captured by seven leading players in the market in 2018. Key players in the OEM coatings for automotive industry include PPG Industries Inc., BASF SE, Axalta Coating Systems Ltd., Nippon Paint Holdings Co. Ltd., Kansai Paint Co. Ltd., The Sherwin-Williams Company, and Akzo Nobel N.V.

Several automotive coating manufacturers are heading for geographical expansions, product launches, strategic alliances, and mergers in order to expand their market coverage. For instance, in April 2019, PPG Industries Inc. completed the acquisition of Germany based Hemmerlrath Lackfabrik GmbH, an automotive OEM coatings manufacturer. With this, PPG Industries Inc. aims to increase its market share in the European automotive OEM coatings market. Other leading players in the market include Merck Group, CHT Group, and HMG Paints Limited.

Market Segmentation by Layer

- Electrocoat

- Primer

- Basecoat

- Clearcoat

Market Segmentation by Technology

- Water-borne Coatings

- Solvent-borne Coatings

- Powder Coatings

- UV-cured Coatings

Market Segmentation by Application

- Metal Parts

- Plastic Parts

Market Segmentation by End User

- Light Vehicle OEM

- Commercial Vehicle OEM

Market Segmentation by Geography

-

North America Automotive OEM Coatings market

- By layer

- By technology

- By application

- By end user

- By country – U.S. and Canada

-

Europe Automotive OEM Coatings market

- By layer

- By technology

- By application

- By end user

- By country – Germany, Spain, France, U.K., and Rest of Europe

-

Asia-Pacific (APAC) Automotive OEM Coatings market

- By layer

- By technology

- By application

- By end user

- By country –China, Japan, India, and Rest of APAC

-

Rest of the World (RoW) Automotive OEM Coatings market

- By layer

- By technology

- By application

- By end user

- By country –Mexico, Brazil, Turkey, and Others