Report Code: 11770 | Available Format: PDF | Pages: 149

Automotive OEM Coatings Market Research Report: By Layer (Electrocoat, Primer, Basecoat, Clearcoat), Technology (Water-Borne Coatings, Solvent-Borne Coatings, Powder Coatings, UV-Cured Coatings), Application ( Metal Parts, Plastic Parts), End User ( Light Vehicle OEM, Commercial Vehicle OEM), Geographical Outlook (U.S., Canada, Germany, Spain, France, U.K., China, Japan, India, Mexico, Brazil, Turkey) - Global Opportunity Analysis and Demand Forecast to 2024

- Report Code: 11770

- Available Format: PDF

- Pages: 149

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

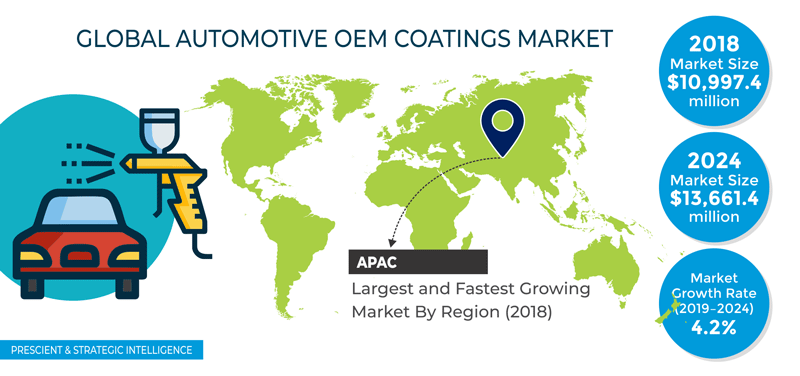

The automotive original equipment manufacturer (OEM) coatings market size is expected to grow from $10,997.4 million in 2018 to $13,661.4 million by 2024, exhibiting a CAGR of 4.2% during 2019–2024.

Asia-Pacific (APAC) is expected to witness the fastest growth in the coming years owing to the presence of leading automobile manufacturers in the region. The high-volume vehicle production in India, China, Japan, and Thailand creates a considerable demand for automotive OEM coatings in APAC.

Market Dynamics

The rising preference for powder coatings over liquid coatings is a prominent trend in the automotive OEM coatings industry. The shift can be owed to the lower content of volatile organic compounds (VOCs) in these coatings. For instance, the manufacturing units of Bayerische Motoren Werke AG (BMW) in Europe are switching to powder coatings for the clearcoat process. Moreover, powder clearcoats offer various benefits, such as film thickness and zero production of wastewater or paint sludge during their application.

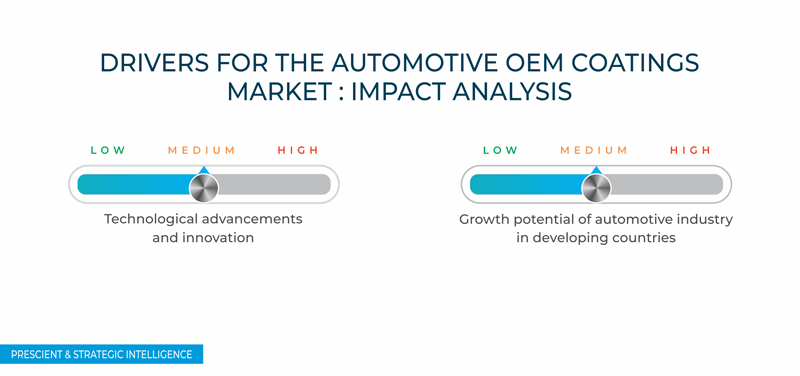

The technological innovations in such products being carried out in the APAC region are one of the primary growth drivers for the market. Coating manufacturers are focusing on the development of new technologies, products, and processes to meet the ever-changing demands of automakers. The end users in the automotive OEM coatings market are looking for coatings that offer greater functionality, reduced emissions, regulatory compliance, and low maintenance costs.

The surging investments to amplify vehicle production will create lucrative opportunities for the market players in the foreseeable future. For example, luxury automotive companies are expanding their base in the emerging economies of India, Indonesia, and Brazil to tap their middle-class and upper-middle-class populations. Additionally, the rise in the disposable income and macroeconomic growth in these nations have fueled the demand for automobiles and allied products, including coatings and accessories, in these developing economies.

Segmentation Analysis

The clearcoat category, within the layer segment, generated the highest demand in 2018 due to the advantages of clearcoats such as protection from the sun and ultraviolet (UV) rays. Owing to these features, a thicker coat of clearcoats needs to be applied as compared to those of other layers.

The solvent-borne coatings category, under the technology segment, accounted for the largest share during 2014–2018, and it is expected to hold an over 43.8% share in 2024, in terms of value. The water-borne coatings category will witness the fastest growth till 2024 due to the surging preference for water-borne coatings owing to the numerous environmental benefits offered by the former.

The metal parts category, within the application segment of the automotive OEM coatings market, will grow at the faster pace, as the majority of the automobile parts and components are made of metals. Due to this factor, metal parts need a larger volume of coatings as compared to plastic parts.

Geographical Analysis

APAC was the largest and fastest-growing market in the recent past, and it is projected to continue these trends in the future. This will be because of the presence of major automobile companies in the region.

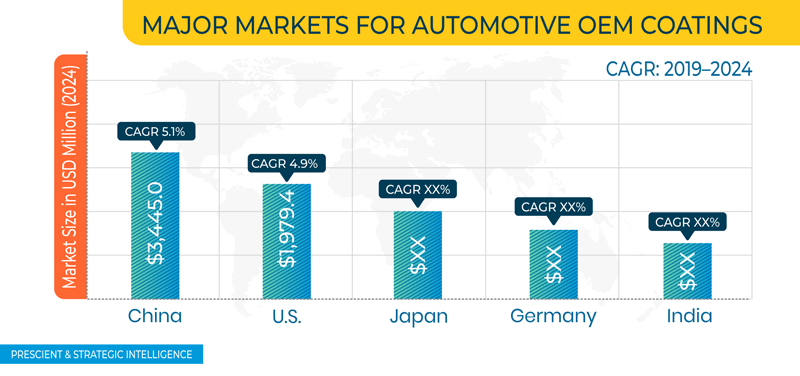

China is expected to dominate the APAC market for automotive OEM coatings, by generating revenue of around $3.4 billion, in 2024. This can be ascribed to the large-scale production of vehicles in the country. China has been the second-largest manufacturer of two-wheelers and largest producer of passenger cars and commercial vehicles in 2019. According to industry experts, 15.5 million two-wheelers have been sold in China in 2019 till now, and this number is expected to surge with the rising popularity of e-bikes in the coming years.

Competitive Landscape

The automotive OEM coatings market is consolidated in nature, characterized by the presence of established companies such as PPG Industries Inc., BASF SE, Axalta Coating Systems Ltd., Nippon Paint Holdings Co. Ltd., Kansai Paint Co. Ltd., The Sherwin-Williams Company, and Akzo Nobel N.V.

PPG Industries Inc. held the number rank one in the market with largest share in the global market owing to the broad portfolio of paints, coatings, and specialty materials.

Recent Strategic Developments of Major Automotive OEM Coatings Market Players

In recent years, major players in the automotive OEM coatings market have taken several strategic measures such as product launches, mergers & acquisitions, and facility expansions to gain a competitive edge in the industry. For instance, in April 2019, PPG Industries Inc., completed its acquisition of automotive OEM coatings manufacturer, Germany based Hemmerlrath Lackfabrik GmbH. Additionally, with this acquisition, the company aimed to increase its market share in the European automotive OEM coatings market.

Moreover, in March 2019, HMG Paints Ltd, the U.K. based paint manufacturer announced the launch of commercial vehicle topcoat, Acrythane 4G which is a high gloss and high solids acrylic polyurethane coating, and developed to meet and exceed the stringent requirements of the commercial vehicle market.

Key Questions Addressed

- What is the current scenario of the automotive OEM coatings market?

- What are the emerging technologies for the development of automotive OEM coatings?

- What is the historical and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key geographies from the investment perspective?

- What are the key strategies adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws