Automotive Digital Instrument Cluster to Generate Revenue Worth $6.6 Billion by 2023

- Published: April 2018

Valued at $2.0 billion in 2017, the global automotive digital instrument cluster market is projected to surpass $6.6 billion in 2023, witnessing 21.8% CAGR during 2018–2023. On the basis of type, the organic light emitting diode (OLED) category is expected to grow at the faster rate during the forecast period.

OLED screen-based digital instrument clusters cater to a niche segment and accounted for a small share in global sales, in 2017, even in advanced economies. These displays have been majorly installed in luxury cars, due to their relatively high cost. Also, more luxury car manufacturers during the forecast period are expected to opt for OLED screens, due to high contrast feature as compared to other screens.

Advent of Driverless Cars Providing Opportunities for Market Players

Though driverless cars are at a nascent stage, automobile manufacturers and technology companies are working on this transportation system for the future. This is expected to facilitate fully automatic functioning of the vehicles. With the advent of autonomous vehicles, the sales of digital instrument clusters are expected to accelerate as these help to handle large volumes of data created by such vehicles.

Following are the expected launches of driverless cars in the market:

- Audi is expected to launch a self-driving car by 2020.

- BMW expects to launch its autonomous car, iNext, by 2021.

- Delphi and MobilEye plan to introduce self-driving system by the end of 2019.

- NuTonomy plans to introduce self-driving taxi services in Singapore in 2018.

- Ford Motor Company and Lyft Inc. plan to jointly develop and deploy driverless cars by 2021.

- Volkswagen expects to introduce its first self-driving car in the market by the end of 2019.

- Jaguar Land Rover plans to provide fully autonomous cars by 2024.

Growing In-Vehicle Safety Features Demand

Governments in various countries across the globe are implementing regulations regarding vehicle safety and security. Original Equipment Manufacturers (OEMs) across the automobile value chain acknowledge the importance of in-vehicle smart display applications. Automotive digital instrument cluster vendors regularly upgrade their offerings to meet the growing consumer demand for enhanced display applications. These vendors have also increased their research and development (R&D) investment to develop advanced display technologies that will meet the expanding connected car features. Industry trends indicate that by 2030, the majority of the cars will have vehicle-to-vehicle connectivity and vehicle-to-infrastructure connectivity, which will ensure better road and passenger safety, and reduced congestion on roads. Furthermore, the development of interactive human-machine interface (HMI) systems integrated with smart features is also expected to propel the growth of the automotive digital instrument cluster market.

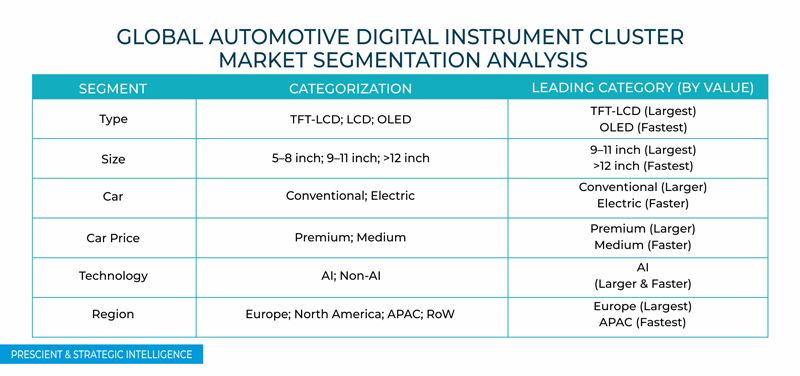

Segmentation Analysis of Automotive Digital Instrument Cluster Market

The premium cars category dominated the automotive digital instrument cluster market during the historical period. Driven by falling prices of automotive digital instrument clusters, their adoption in the medium category will grow faster during the forecast period. For instance, Audi is now incorporating the clusters in its medium category cars, such as Audi A3 and Audi A4.

Based on technology, artificial intelligence (AI)-based digital instrument clusters have been accounting for larger share in the automotive digital instrument cluster market in 2017. This is majorly due to growing penetration of AI-based features in premium cars, such as head-up displays and smart parking.

Geographical Analysis of Automotive Digital Instrument Cluster Market

Globally, Europe held the largest share in the automotive digital instrument cluster market in 2017. The sales of automotive digital instrument clusters are dependent on the sales of clusters-installed electric and premium cars. Europe accounts for the largest share of premium car sales in the world, benefiting the automotive digital instrument cluster sales in the region. Furthermore, the APAC market is expected to witness the fastest growth during the forecast period. This is because region is the largest electric car market, which further increases the sales of digital instrument clusters.

Competitive Landscape of Automotive Digital Instrument Cluster Market

The global automotive digital instrument cluster market is operated by international players, such as Visteon Corporation and Continental AG. Besides, other players include Robert Bosch GmbH, Magneti Marelli S.p.A., Delphi Automotive PLC, DENSO Corporation, Yazaki Corporation, and Nippon Seiki Co. Ltd. Furthermore, some of the major key suppliers include Panasonic Corporation, NVIDIA Corporation, and Intel Corporation.

In recent years, market players have been involved in several strategic measures, such as partnerships. For instance, in January 2018, Luxoft, a global IT service provider, and Intel Corporation codeveloped a solution for a new automotive reference platform (ARP), designed to power the digital cockpit of next-generation vehicles. The Intel ARP is a modular development and prototyping platform for infotainment and advanced driver assistance systems (ADAS). The design for vehicle’s instrument cluster, cockpit occupant monitoring, head-up display (HUD), and driver-assistance systems are now integrated on the ARP.

Market Segmentation by Display Type

- Liquid Crystal Display (LCD)

- Organic Light Emitting Diode (OLED)

- Thin-Film Transistor LCD (TFT-LCD)

Market Segmentation by Display Size

- 5-8 inch

- 9-11 inch

- More than 12 inches (>12 inch)

Market Segmentation by Car

- Conventional

- Electric

- Hybrid Electric Vehicle (HEV)

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

Market Segmentation by Car Price

- Premium

- Medium

Market Segmentation by Technology

- Artificial intelligence (AI)

- Non-AI

Market Segmentation by Geography

- Europe Automotive Digital Instrument Cluster Market

- By display type

- By display size

- By car

- By car price

- By technology

- By country – Germany, France, U.K., Italy, and Rest of Europe

- North America Automotive Digital Instrument Cluster Market

- By display type

- By display size

- By car

- By car price

- By technology

- By country – U.S. and Canada

- Asia-Pacific Automotive Digital Instrument Cluster Market

- By display type

- By display size

- By car

- By car price

- By technology

- By country – Japan, China, South Korea, India, and Rest of Asia-Pacific

- Rest of the World (RoW) Automotive Digital Instrument Cluster Market

- By display type

- By display size

- By car

- By car price

- By technology

- By country – Brazil, Russia, and others