APAC Automotive Tire Market to Generate Revenue Worth $109,007.4 Million by 2024

- Published: September 2019

The APAC automotive tire market was valued at $61,523.4 million in 2018 and is expected to reach $109,007.4 million by 2024, witnessing a CAGR of 10.0% during 2019–2024. Categorized on vehicle type, passenger cars held the largest volume share in 2018.

Furthermore, commercial vehicles are expected to witness notable growth in their sales on account of their growing usage in logistics and construction activities. This, in turn, would propel the demand for tires for light, medium, and heavy commercial vehicles, and hence boost the APAC automotive tire market.

Growing Popularity of Next-Generation, High-Performance Tires is a Key Trend Witnessed in the Market

Growing popularity of next-generation, high-performance tires is the key trend observed in the APAC automotive tire market. The fuel-efficient and low-noise high-performance tires have been mainly used in luxury passenger cars; and in recent years, they have made inroads in crossover utility vehicle and premium sport utility vehicle segments. The mainstream adoption of these tires is encouraging tire makers, across the world, to invest in new technologies for the development of ultra-high-performance tires to increase speed and overall performance of tires. Many manufacturers are developing these tires by employing patented technologies, specialized silica compounds and polymers, and unique tread designs to meet changing consumer demands and achieve desired performance. In addition, with increasing tire demand, several tire manufacturers are offering next-generation, high-performance tires with ride comfort, all-season or multi-season driving capacities, and less tread wear.

Growth in the Automotive Industry Derives the APAC Automotive Tire Market

APAC holds the largest share in the global automotive industry, due to the presence of several global vehicle and automobile manufacturers. Thus, the future of the APAC automotive tire market looks promising in the region, especially with reduction in tariff, introduction of technologically advanced vehicles such as autonomous and electric vehicles, changing preferences of young consumers, increasing compliance in product manufacturing, and growing demand for tires in developing countries. Furthermore, there are prominent growth opportunities in the light commercial vehicles category, owing to the growing production of these vehicles in order to meet the demand of customers. Additionally, due to existence of a large customer base, introduction of open investment policy, accessibility of a highly skilled and cheap workforce, and state and local government incentives for the adoption of vehicles, the automotive industry in the region continues to maintain its dominance, thus supporting the growth of the APAC automotive tire market.

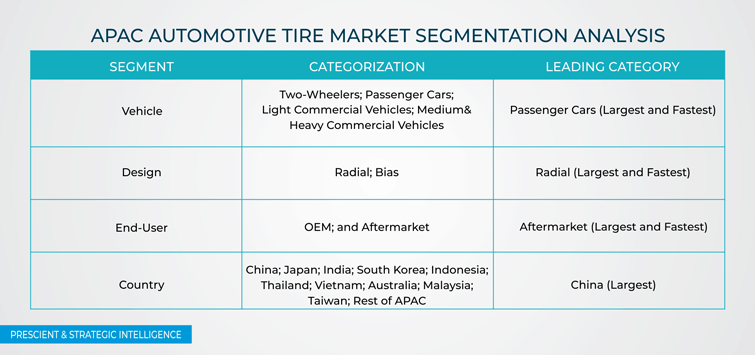

Segmentation Analysis of the APAC Automotive Tire Market

- The passenger cars category dominated the APAC automotive tire market in 2018, owing to the large customer base of passenger cars and high replacement rate of tires equipped in these vehicles. The category is further projected to continue dominating the market during the forecast period, witnessing a CAGR of nearly 10%. Whereas, the medium & heavy commercial vehicles category is expected to attain a notable growth during the forecast period, owing to the increasing production and sales of these vehicles in ASEAN countries.

- The radial tire category is projected to grow significantly during the forecast period in the APAC automotive tire market. This is attributed to the fact that the radial tires last longer than bias tires due to their construction, which is mainly characterized by crisscrossed steel belts and perpendicular polyester plies. In addition, larger utilization of the radial tires in passenger cars contributed to the high demand for these tires in the region.

- The aftermarket is larger end use category in 2018 and is expected to dominate the APAC automotive tire market during the forecast period. This can be primarily ascribed to the fact that a tire is replaced after every 50,000–80,000 km of usage, which is much higher than the replacement rate of the vehicle itself. This factor further boosts the demand for tires in the aftermarket.

Geographical Analysis of the APAC Automotive Tire Market

China led the APAC automotive tire market during the historical period, with more than 40% sales volume in 2018. The country is a center of vehicle manufacturing and has the largest customer base of passenger cars in the world. According to the China Association of Automobile Manufacturers, the country is forecasting to manufacture 30 million units of passenger cars by 2020 and 35 million units by 2025. Thus, the development in the automobile market is also making China a key producer of automobile components, including tires, in the region.

Other countries, such as India, Japan, South Korea, and Indonesia, also hold considerable share in the APAC automotive tire market. Due to increasing gross domestic product (GDP), per capita income, and purchasing power a customer, the automobile customer base is increasing in these countries, which is further accelerating the market growth in the region.

Browse report overview with detailed TOC on "Asia-Pacific (APAC) Automotive Tire Research Report: By Vehicle (Two-Wheelers, Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles), Design (Radial, Bias), End-User (OEM, Aftermarket), Regional Outlook (China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia, Malaysia, Taiwan) – Industry Trends, Growth Prospect and Demand Forecast to 2024" at:https://www.psmarketresearch.com/market-analysis/apac-automotive-tire-market

Competitive Landscape of the APAC Automotive Tire Market

The APAC automotive tire market is consolidated in nature, with the existence of established manufacturers such as The Goodyear Tire & Rubber Company, Continental AG, Pirelli & C. S.p.A., Cooper Tire & Rubber Company, Michelin Asia-Pacific Pte. Ltd., Yokohama Rubber Co. Ltd., Bridgestone Asia Pacific Pte. Ltd., Hankook Technology Group Co. Ltd., Apollo Tyres Ltd., Nokian Renkaat Oyj, and Sumitomo Rubber Industries Ltd.

Collaborations and acquisitions and facility expansions are key strategies adopted by the players to increase their foothold in the APAC automotive tire market. For instance, in August 2018, Continental AG announced its plans to acquire the Kmart Tyre and Auto Service (KTAS) chain for approximately $244 million. With 258 branches and more than 1,200 employees, KTAS is one of the largest tire and auto service chains in Australia. The acquisition is part of the company’s Vision 2025, which targets systematic expansion of its tire division across the world.