Report Code: 11728 | Available Format: PDF | Pages: 196

Asia-Pacific (APAC) Automotive Tire Market Research Report: By Vehicle (Two-Wheelers, Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles), Design (Radial, Bias), End-User (OEM, Aftermarket), Regional Outlook (China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia, Malaysia, Taiwan) - Industry Trends, Growth Prospect and Demand Forecast to 2024

- Report Code: 11728

- Available Format: PDF

- Pages: 196

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

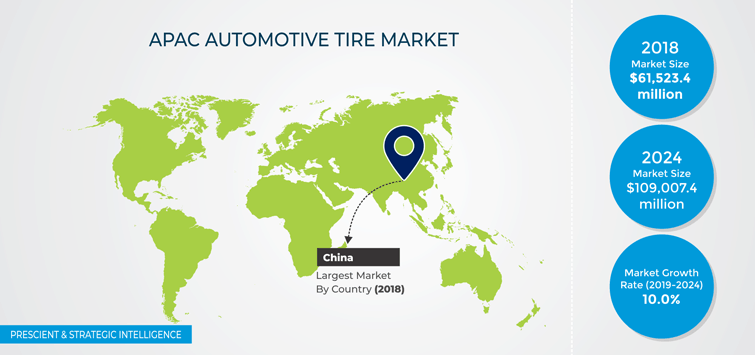

The APAC automotive tire market registered the sales of 1,080.5 million units in 2018, which is expected to reach 1,826.8 million units by 2024, witnessing a CAGR of 9.1% during 2019–2024.

Among countries in the region, China led the APAC automotive tire market during the historical period. Moreover, the country is expected to continue leading the market during the forecast period. This is due to the fact that China is a hub of automobile manufacturing and has the largest customer base of passenger cars in the world. Furthermore, as per the China Association of Automobile Manufacturers, the country is expecting to manufacture 30 million units by 2020 and 35 million units of passenger cars by 2025. Owing to the growing automobile industry, the country a major market for automotive components, including tires, in the region.

Factors Governing the APAC Automotive Tire Market

Key trend observed in the APAC automotive tire market is the growing popularity of next generation high-performance tires. The high-performance tires are increasingly gaining popularity among automakers and players in the aftermarket, owing to their properties such as low-noise and fuel-efficient. These tires have mainly been used in luxury passenger cars, premium sport utility vehicles, and crossover utility vehicles. Additionally, the development of ultra-high-performance tires has increased the overall speed and reliability of tires. An average high-performance tire can sustain a speed up to 270 km/h, whereas an ultra-high-performance tire can achieve a speed of 299 km/h. Besides, with the growing demand for tires, several tire manufacturers are offering next-generation high-performance tires with multi-season or all-season driving capabilities, ride comfort, and less tread wear. Thus, the development for next-generation high-performance tires is one of the key trends observed in the APAC automotive tire market.

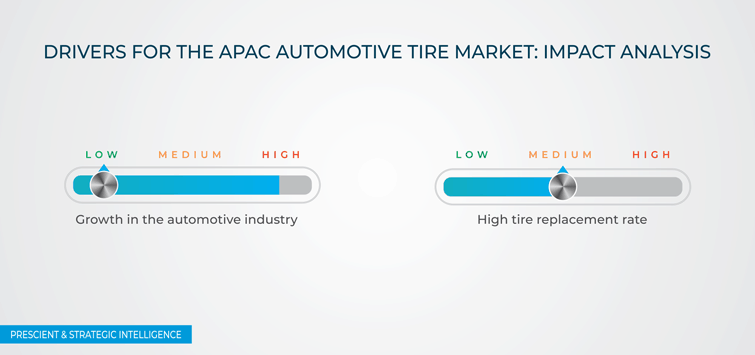

Growth in the automotive industry is the major factor boosting the APAC automotive tire market. APAC is the largest automobile manufacturer in the world and home to several global vehicle and automotive component manufacturers. In the market, the light commercial vehicle segment has most prominent growth opportunities, owing to the increased production of light commercial vehicles to meet the increasing demand. Moreover, stringent government regulations, increasing operational life of vehicles, and growing demand for green tires are furthering the scope for the automotive tire industry in the region.

Broadening scope of private labeling holds a huge growth potential for players in the APAC automotive tire market. In the automotive tire industry, private labeling primarily means production of tires by one company, followed by their sales under the brand of another company. Tire manufacturers are increasingly focusing on private labeling to meet the market demand for their products and optimize their bottom-line profits. A few OEMs also maximize their production capacity by adding private labeling to their operations, which is carried out under the supervision of experts with extensive experience in manufacturing. It helps them to focus on brand management while stressing little about issues pertaining to manufacturing operations.

Structural Analysis of the APAC Automotive Tire Market

On the basis of vehicle, the passenger cars category held the largest share in the APAC automotive tire market, accounting for more than 50% sales volume, in 2018. This is majorly due to high production and demand for passenger cars in comparison with other vehicles, coupled with high replacement tire rate in these vehicles.

In terms of design, the radial tires category is expected to grow at a faster rate during 2019–2024. Radial tires are more long-lasting than bias tires because of their construction, which is primarily characterized by perpendicular polyester plies and crisscrossed steel belts. Additionally, these tires are largely used in passenger cars, which further will contribute to the high demand for these tires in the APAC automotive tire market.

Among all end-use categories, the aftermarket category dominated the APAC automotive tire market in 2018. This is mainly attributed to the fact that a tire is replaced after every 50,000–80,000 km of usage, which is much higher than the replacement rate of the vehicle itself. This further supports the high demand for tires in the aftermarket.

Geographical Analysis of the APAC Automotive Tire Market

China held the largest volume share in the APAC automotive tire market in 2018. Furthermore, the country is projected to continue dominating the automotive tire industry in the region during the forecast period. China is home to the largest automotive industry in the world, which recorded production of over 27.8 million units of vehicles in 2018. The automotive industry is also considered one of the main pillars of the Chinese economy, with active government participation in market regulation.

Moreover, growth in the automotive industry has positively impacted the country’s ancillary markets in recent years. The Chinese automotive tire market valued more than $20 billion in 2018 and is further expected to advance at a CAGR of 11.1% during the forecast period. The country is also a major exporter of automotive tires in the world. In 2018, exports accounted for over 60% of the total tire production in China. Additionally, tire exports are expected to gain momentum with the growing focus on automotive manufacturing. Such factors will benefit the country to continue its domination in the market during the forecast period.

.png)

Competitive Landscape of the APAC Automotive Tire Market

The APAC automotive tire market is consolidated in nature, with the presence of established players such as Continental AG, The Goodyear Tire & Rubber Company, Cooper Tire & Rubber Company, Pirelli & C. S.p.A., Michelin Asia-Pacific Pte. Ltd., Bridgestone Asia Pacific Pte. Ltd., Yokohama Rubber Co. Ltd., Hankook Technology Group Co. Ltd., Nokian Renkaat Oyj, Apollo Tyres Ltd., and Sumitomo Rubber Industries Ltd.

Recent Strategic Developments of Major Automotive Tire Market Players in APAC

In recent years, major players in the APAC automotive tire market have taken several strategic measures, such as mergers and acquisitions, facility expansions, and product launches, to gain competitive edge in the industry. For instance, in June 2019, Compagnie Générale des Établissements Michelin increased its ownership stake in the Indonesian tire manufacturing company, P.T. Multistrada Arah Sarana TBK, to 99.6%. The deal provided Michelin a strategic edge over its competitors by increasing its annual tire production capacity beyond 180,000 metric tons and strengthening its presence in the fast-growing Indonesian market.

Furthermore, in March 2019, Yokohama India announced its plans to expand the tire manufacturing capacity of its Bahadurgarh unit in Jhajjar district of Haryana. The project will be implemented in two phases. Phase-I comprises expansion from 2,000 to 4,600 tires per year and phase-II comprises expansion from 4,600 to 7,000 tires per year.

Additionally, in August 2018, Hankook Technology Group Co. Ltd. introduced its second-generation electric vehicle tire, Kinergy AS EV, which features strengthened handling and noise-reducing capabilities for electric vehicles. The product was made available in South Korea in the same year, and the global launch is under review for 2019.

Key Questions Addressed/Answered in the Report

- What is the current scenario of the APAC automotive tire market?

- What are the emerging technologies for the development of automotive tires?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key geographies from the investment perspective?

- What are the key strategies adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws