Alumina Market to Generate Revenue Worth $54,907.3 Million by 2024

- Published: September 2019

The global alumina market was valued at $61,093.4 million in 2018 and is forecast to demonstrate a CAGR of 2.2% during the forecast period (2019–2024). In 2018, the global alumina prices jumped around to $470 per ton which are expected to rebalance in the coming future and assist the market to reach $54,907.3 million by 2024. The demand for metallurgical-grade alumina for the production of aluminum, owing to the high demand for the base metal in the automotive, construction, packaging, electrical and electronics, and consumer durables industries has been identified as the major demand generating area in the market.

The global primary aluminum production rose from 52.2 million tonnes in 2013 to 60.1 million tonnes in 2017. This, along with smelting capacity additions, low labor and other associated costs, and macroeconomic growth across the APAC region, is providing traction to the demand for aluminum and alumina.

Increasing alumina production in Asia-Pacific is a key trend in the global alumina market

In recent years, the share of the APAC region in the global alumina production has increased at a rapid pace. Furthermore, the alumina supply chain is increasingly showing signs of interconnection across the region with the growing bauxite mining in APAC countries to cater to the growing production of alumina and a similar trend of forward integration with the growing aluminum production volume.

In contrast, countries in the North American and South American regions have reported steep drops in the compound’s production, owing to lower product prices, fall in the demand for final products, and tight refinery margins. Furthermore, processors in the North American region are increasingly focusing on secondary aluminum (aluminum recovered from scrap, casted products, and wrought aluminum processing) production and deferring primary aluminum production, thereby lowering their traditional dependency on alumina for producing aluminum.

Increasing demand for high-specialty alumina in refractories is expected to drive demand for alumina

The global uptick in industrialization and commercialization, with the advent of the 21st century, has led to rapid developments in the construction sector. Furthermore, the demand for aluminum, steel, cement, and metal alloys has increased and is expected to continue on the path in the future. This, along with the overhauling of the existing steel manufacturing technologies, is expected to translate into a higher demand for chemical-grade alumina for refractory products in the future.

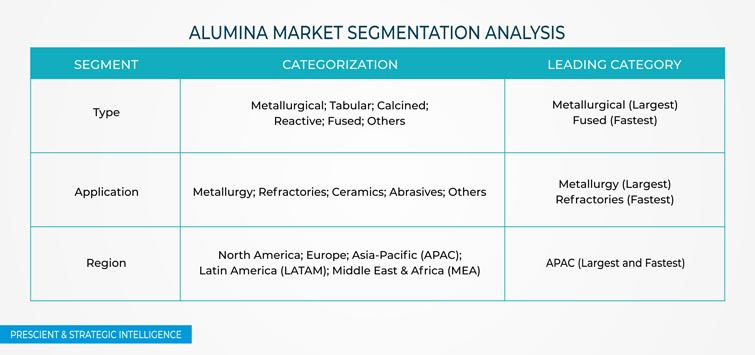

Segmentation Analysis of Alumina Market

Traditionally, the demand for metallurgical alumina was the highest among all types of alumina across the globe, primarily owing to the high-volume production of aluminum. In recent years, the new applications of fused alumina in abrasives for metal polishing and lapping are predicted to result in the fastest growth of this type in the global alumina market.

Based on application, the demand for alumina in refractories is expected to grow with the highest CAGR during the forecast period. Alumina’s ability to provide heat, corrosion, and wear resistance and dimensional stability as a refractory material is expected to result in an increasing demand for the compound to develop high-quality and advanced products.

Geographical Analysis of Alumina Market

In 2018, APAC accounted for the largest size of over 85,000 kilotons in the global alumina market. The regional market is driven by the high alumina manufacturing capacity of China, India, and Indonesia, which together, as per the data released by the British Geological Survey in its publication, titled World Mineral Production 2013–2017, accounted for over 58.0% of the global alumina production in 2017. This is chiefly due to the concentrated aluminum production capacities in China, India, Indonesia, Malaysia, and Australia, which draw a high-volume demand for alumina. The region accounted for over 64.0% of the worldwide aluminum production in 2017.

China generated the highest demand for the compound in the APAC alumina market in 2018. In the recent future, the demand for alumina in the country is expected to witness slow growth owing to a slowdown in the construction sector, government policies aimed at regulating emissions, tight alumina refining margins, and international trade policies. Yet, the country is forecast to continue generating a high-volume demand for metallurgical alumina and witness an increasing demand for the chemical variant as well.

Browse report overview with detailed TOC on "Alumina Market Research Report: By Type (Metallurgical, Tabular, Calcined, Reactive, Fused), Application (Metallurgy, Refractories, Ceramics, Abrasives), Geographical Outlook (U.S., Canada, Russia, Germany, France, Norway, China, Australia, India, Malaysia, Brazil, Argentina, U.A.E, Bahrain, Saudi Arabia, Qatar, South Africa) – Global Industry Analysis and Forecast to 2024" at:https://www.psmarketresearch.com/market-analysis/alumina-market

Competitive Landscape of Alumina Market

The global alumina market is fragmented, with Chinese market players for large market shares on the backdrop of high production capacities. The Aluminum Corporation of China Limited accounted for the largest market share, of over 10.0% of the global market and over 21.0% of the Chinese manufacturing capacity. Alcoa Corporation was the second largest global alumina producer and the largest producer in the Western world. Alcoa Corporation alone produced 8,100 kilotons of alumina in 2018, and along with its joint venture, AWAC, accounted for a production of 12,900 kilotons. Apart from Alcoa Corporation, several other market players are engaged in joint ventures for production flexibilities, cost optimization, and catering to clients in several locations.

A probable positive growth trend for aluminum production in the U.S., India, Malaysia, and several other countries is expected to encourage market players to increase their production by reopening closed plants or setting up new facilities. The future alumina market in regions like MEA, APAC, and North America is expected to witness a promising CAGR, which, as a result, will generate lucrative opportunities for global operators over the coming years.

In January 2019, Vedanta Limited, a metals and mining company based in India, announced plans to invest $250–$300 million in order to ramp up its Lanjigarh alumina refinery in Odisha. The refinery expansion is expected to lessen Vedanta's dependence on imported alumina and reduce its aluminum production costs.

Some other important players operating in the alumina market are Hindalco Industries Limited, United Company RUSAL PLC, Rio Tinto PLC, National Aluminium Company Limited, Norsk Hydro ASA, South32 Limited, Almatis BV, CVG Bauxilum CA, and Alumina Limited.

Market Segmentation by Type

- Metallurgical

- Tabular

-

Calcined

- Low-soda alumina

- Medium-soda alumina

- Normal-soda alumina

- Reactive

- Fused

- Others

Market Segmentation by Application

- Metallurgy

-

Refractories

-

Tabular

- Steel

- Glass

- Cement

- Power

- Others

-

Calcined

- Steel

- Glass

- Cement

- Power

- Others

-

Reactive

- Steel

- Glass

- Cement

- Power

- Others

-

Fused

- Steel

- Glass

- Cement

- Power

- Others

-

Tabular

-

Ceramics

-

Traditional

- Calcined

- Others

-

Advanced

- Tabular

- Calcined

- Reactive

- Fused

- Others

-

Traditional

-

Abrasives

- Tabular

- Calcined

- Reactive

- Fused

- Others

- Others

Market Segmentation by Region

-

North America Alumina Market

- By type

- By application

- By country – U.S. and Canada

-

Europe Alumina Market

- By type

- By application

- By country – Russia, Germany, France, Norway, and Rest of Europe

-

Asia-Pacific (APAC) Alumina Market

- By type

- By application

- By country – China, Australia, India, Malaysia, and Rest of APAC

-

Latin America (LATAM) Alumina Market

- By type

- By application

- By country – Brazil, Argentina, and Rest of LATAM

-

Middle East and Africa (MEA) Alumina Market

- By type

- By application

- By country – U.A.E, Bahrain, Saudi Arabia, Qatar, South Africa, and Rest of MEA